New enhancements help you manage multiple minimum wage rates.

Minimum wage compliance can be complicated. The rates can differ between federal, state, county, city and even type of job. That’s why we’ve built new functionality in WinTeam that allows you to manage multiple minimum wage levels that differ from the federal rate. This helps you stay compliant, ensure employees are paid the correct rate and address payroll issues before you print checks.

You can also create a custom override rate to use when certain job sites have a special rate, like a union minimum. The enhancement also includes notifications and warnings throughout the system to ensure employees aren’t paid below the minimum rate throughout the scheduling and timekeeping process.

Want to start using this feature? Here's how

You can set up minimum wage rates by federal, state, county, city, or create a custom override rate.

Important: To use multiple minimum wages, you must use valid job addresses. For more information about address validation, see Payroll Tax Address Validation.

Set up multiple minimum wage rates

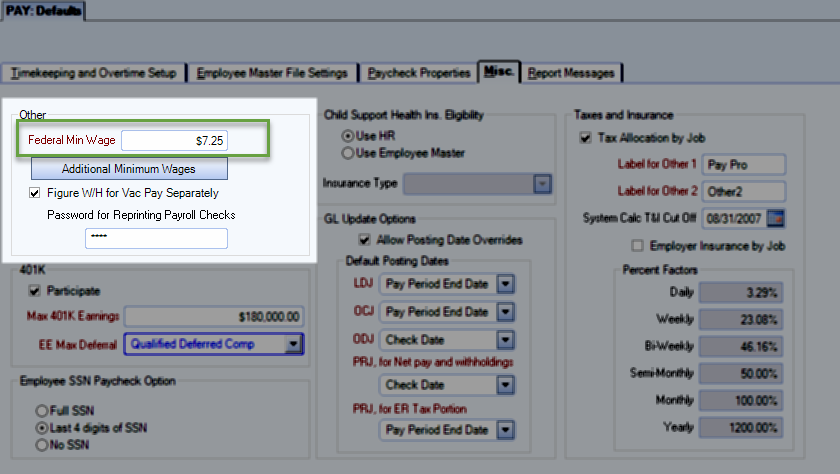

- Open the Payroll Defaults window from the Payroll module. Minimum wage information is on the Misc. tab.

- Enter the federal minimum wage. If no additional minimums are set, WinTeam will only check if pay rates meet this value.

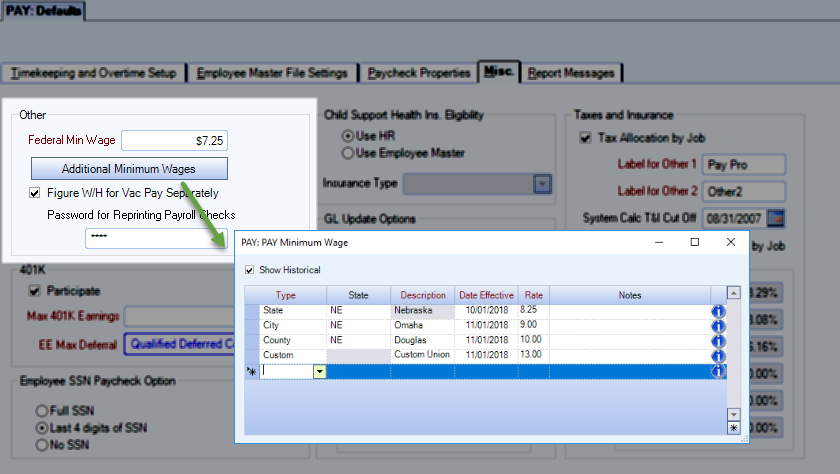

- Click the button to enter more minimums.

- Enter minimum wages for jurisdictions where you have active jobs. Rates can be future dated.

The Type of minimum wage determines the behavior of the State and Description columns.

Type State Description State Dropdown list Auto-filled with state (cannot be changed) City Dropdown list Text form–The city must be spelled exactly the same here as it is for the job address County Dropdown list Drop-down list Custom NA Text form

Here's how this feature works

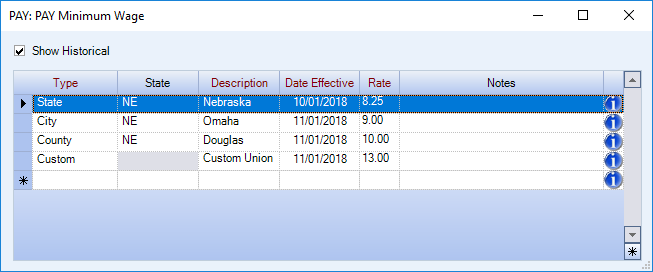

Minimum Wage window

The Minimum Wage window allows you to enter minimum wages by state, county, city or create a custom override rate. Rates at jobs with an address that matches the state, county (zip code), or city are compared to the rate associated with that jurisdiction. In cases where you have different rates for cities and counties in the same state, the rate that is the highest is used as the minimum.

Select Show Historical to view any rates that have been replaced with new values.

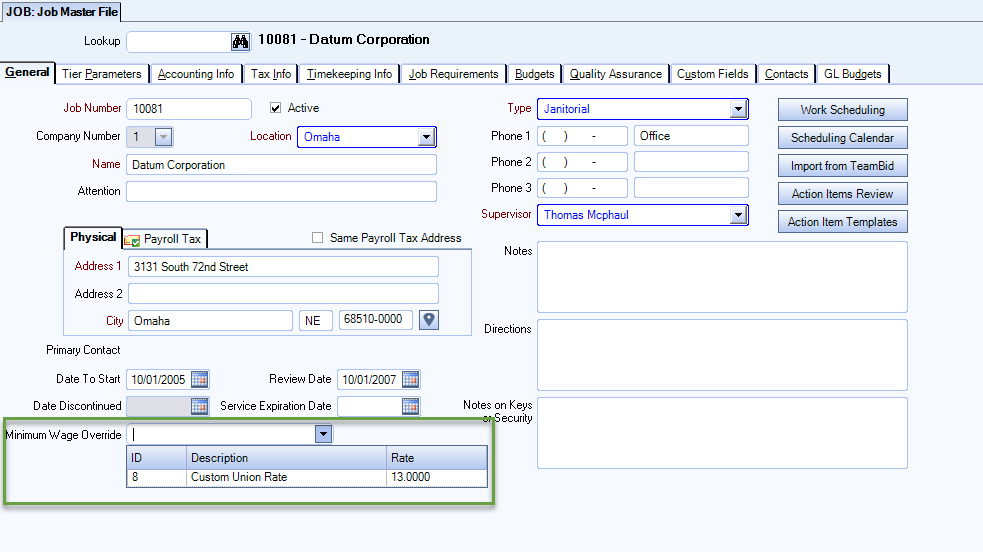

Minimum Wage Override

If you have a custom minimum wage type, you can apply it to a job in the Job Master File. This rate will override any federal, state, county, or city minimum wage rate.

Here's how you can leverage this feature

Warnings

Set up multiple minimum wages to be warned when an employee or job's hourly rate is changed below the minimum in the following areas of WinTeam:

- Personnel Schedules

- Timekeeping

- Employee Master File Pay Info tab

- Rates by Job

- Permanent Timecard

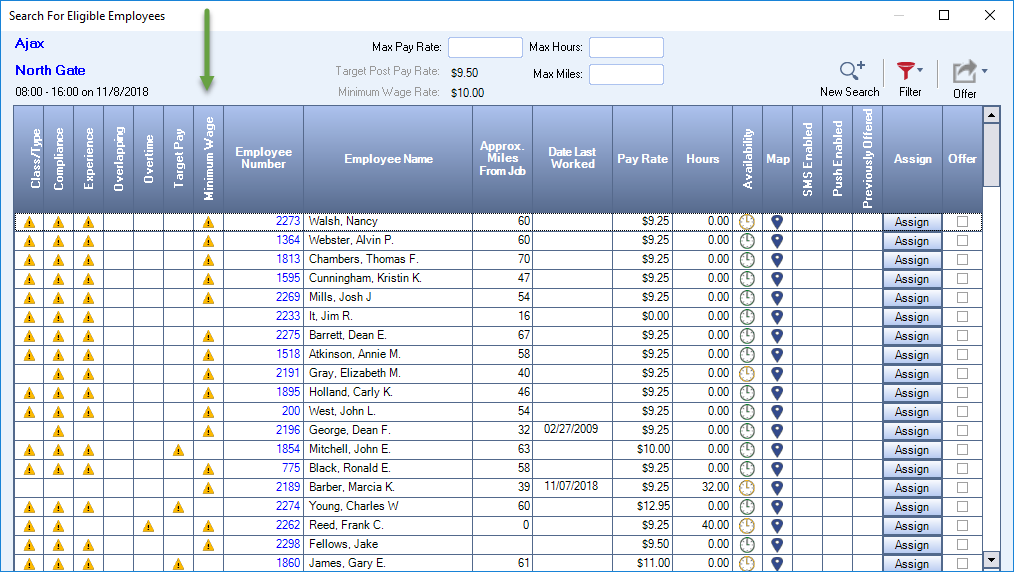

Personnel Scheduling and Timekeeping Exceptions

A Minimum Wage tab is available in both Personnel Scheduling and Timekeeping to identify employees that are not being paid the minimum rate.

Timekeeping shows the source of the pay rate, so that you can make adjustments in the applicable area.

Scheduling

When searching for an employee to schedule to an open shift, you can view any minimum wage exceptions.

Supervisors can see this exception in eHub and mobile.

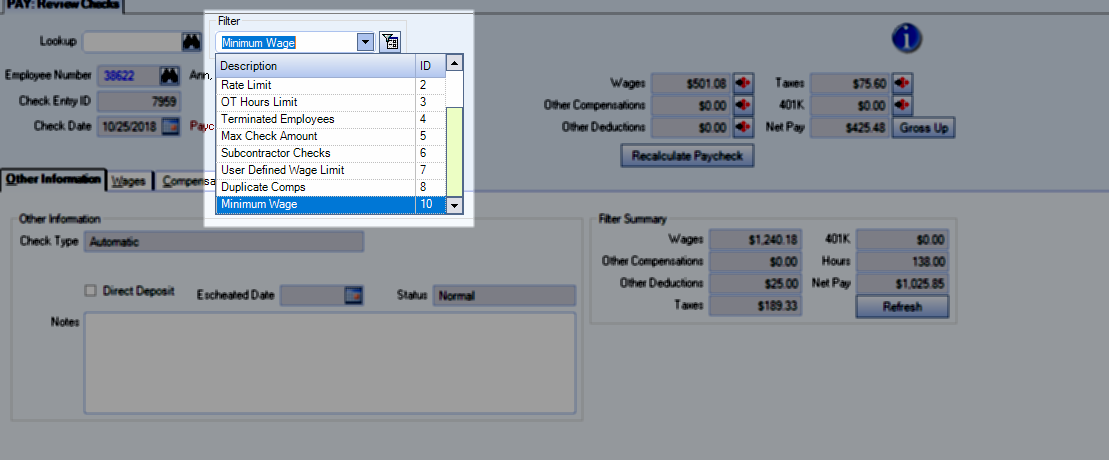

Payroll Review Filters

Minimum Wage

After running a payroll batch, you can filter the batch for any employees who are earning below the minimum rate for any job they worked.

User Defined Wage Limit

This filter allows you to set your own wage limit and see the employees who are not meeting that minimum based on their gross wages and hours works. The Min Wage Deficit value will be the total amount the employee needs added to their gross wages in order to meet the minimum. This filter is beneficial for when you have employees with other compensations that you want calculated as part of their minimum wage. See Checking Minimum Wage Compliance for more information.

Best Practices

Validate Job Addresses

Use the Job Address Validation feature to ensure you have valid addresses.

Fix Minimum Wage Compliance Issues

Use Timekeeping to discover the source of the pay rate issue and fix it so that the issue does not occur in the next pay cycle.