Payroll Other Deductions - Enhanced Functionality

Overview

If you are interested in starting the process of moving your deductions from Payroll Taxes to Payroll Other Deductions contact contact TEAM Client Services by phone at 800-500-4499 or by email at supportstaff@teamsoftware.com.

The Payroll Other Deductions window has been enhanced to support complex deductions. This enhancement allows you to set up all your deductions in one place, while providing the required tax and administrative restrictions. These changes include: a field called Deduction Tax Type, wage and deduction based limits, monthly limits, and an employer contribution option.

Some clients may have deductions set up in Payroll Taxes because of the calculation logic. With this functionality on the Payroll Other Deductions window, you can set up all of your deductions in this window and ensure a seamless transition with payroll tax automation.

There are two steps to using the enhanced functionality in the Payroll Other Deduction window.

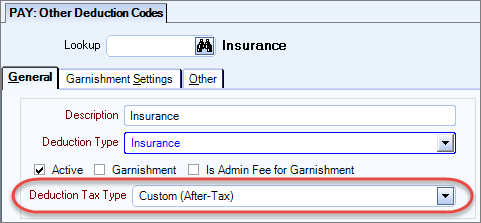

- Step A – Select the appropriate Deduction Tax Type for each of your existing deductions.

- Step B – Set up all your deductions in the Payroll Other Deductions window.

Key Functionality

Step A – Select the appropriate Deduction Tax Type

- Open the Payroll Other Deduction Codes window.

- Display all of your active other deductions.

- Click the binocular Lookup button to open the Lookup Deductions window.

- Click the Search button to display all of your deductions.

- Click the Select All button to pull up all of your active other deductions.

- Select the appropriate Deduction Tax Type option for each of your deductions.

Below is a list of the deduction tax types and general details. All of your deductions set up in the PayrollOther Deductions window need to have one of these options selected.

The system automatically determines the taxable wages based upon the Deduction Tax Type of your other deduction(s). Be sure to confirm all settings in this window when you select the Deduction Tax Type option.

This group of deductions are pre-tax and allow for deduction methods of $ Amount, $ Amount per Hour, Percent of Gross and Percent of Form W-2 "Box 1". The deduction method limitations are intended to ensure correct setup. Also, with this group of deduction tax types, all other properties are available except Section 125 Cafeteria Plan and Employer Contribution. The basis options available are One Time, Recurring – No Limit, and Recurring – Limit.

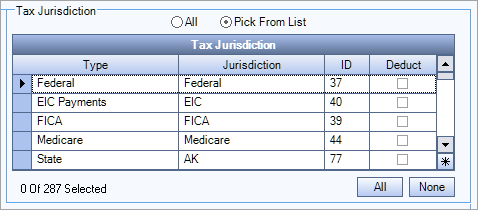

The Custom (Pre-tax) Deduction Tax Type has the same capabilities as the other pre-tax types, however, it should only be used under special circumstances when you want the ability to select the jurisdictions for which this deduction applies. Selecting this option will affect tax calculations and W2 earnings.

By default, all jurisdictions are selected, so you need to specifically select the Pick From List option and check the appropriate jurisdictions in the Tax Jurisdiction area.

This type has all the same capabilities as the other pre-tax types with two exceptions. The Section 125 Cafeteria Plan option is selected and cannot be cleared, and 401k Options are disabled as they should not be used with this deduction tax type. Note, that if 401k options were set on an existing deduction and this deduction tax type is applied, those settings will be cleared.

This group of deductions are after-tax and allow for deduction methods of $ Amount, Amount per Hour and Percent of Gross. Roth IRAs are set up as after-tax deductions and the Pre-tax check box cannot be selected. This limitation is intended to ensure correct set up. Also, with this group of Deduction Tax Types all other properties are available except Section 125 Cafeteria Plan, Include in Gross Earnings and Employer Contribution. The basis options available are One Time, Recurring – No Limit and Recurring – Limit available.

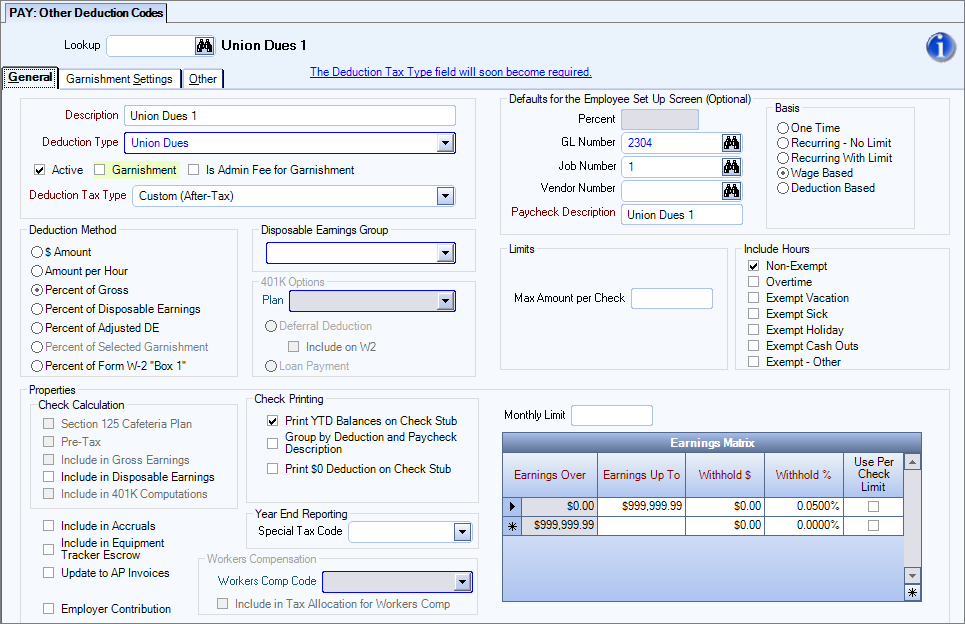

The Custom (After-Tax) Deduction Tax Type should be used when there is no effect on earnings or tax calculations. Examples of when you would use this Deduction Tax Type is for union dues or payroll savings. This type has similar functionality to the after-tax types, with the following changes.

- Include in 401k Computations (in properties), 401k Options and Workers Compensation settings are disabled.

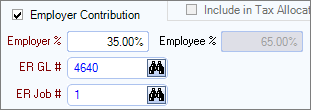

- Employer Contribution and Monthly Limit fields are enabled.

- When the Deduction Method is set to Percent of Gross, Basis options for Wage and Deduction Based options are available.

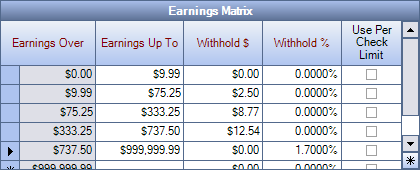

- When the Basis is set to Wage Based, the Earnings Matrix and Max Amount per Check fields are available.

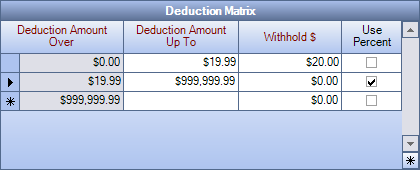

- When the Basis is set to Deduction Based, the Deduction Matrix and Use Monthly Gross Earnings fields are available.

Employer Contribution - This field offers the capability to set a percent of the deduction to be paid for by the employer. This value is the percentage of the Withhold $ deduction that is figured by the Deduction Matrix. When you select the Employer Contribution check box, the Employer Contribution %, ER GL # and the ER Job # fields display. Once you enter the Employer % value, the remaining percentage is automatically entered in the Employee % field.

Monthly Limit - This field limits the total monthly deduction to a specified amount. This value may be modified on the employee record once the deduction is added. If the original value on the Other Deduction window changes after being entered onto an employee record it will not update this change to the employee record.

Once this limit amount has been withheld for the month, no further deductions will be taken for that month. On the first paycheck of each month this limit resets.

Basis - Wage Based - Use this field to set up a deduction which after calculating the employees gross wages it uses a tier to calculate the deduction amount. The Earnings Matrix allows you to set the deduction parameters. You might want to set the Max Amount per Check and/or Monthly Limit fields for this type of deduction.

Max Amount per Check - This field limits the deduction amount that can be applied onto each paycheck. This value defaults to the Employee Master File - Other Compensations and Deductions window. If the original value on the Other Deduction window changes after being entered onto an employee record it will not update this change to the employee record.

Basis - Deduction Based - Use this field to set up a deduction which after the deduction amount is figured, you need to apply a tier to figure the withheld amount. The Deduction Matrix allows you to set up these tier parameters. You may set up as many lines as needed to create the tiers and limits necessary.

Also, you might want to set the Monthly Limit or select Use Monthly Gross Earnings for this type of deduction.

Use Monthly Gross Earnings - Select this check box to apply the deduction percentage to the current month to date taxable earnings when the deduction is calculated, or leave it cleared to have the calculation based only on the current check’s taxable earnings.

Garnishments

For garnishments you do not need to make any changes. When the Garnishment check box is selected, the Deduction Tax Type changes to the appropriate Garnishment Type.

Garnishments Admin Fees

For garnishment admin fees you do not need to make any changes. When the Is Admin Fee for Garnishment check box is selected, the Deduction Tax Type field is removed.

Step B – Set up all deductions in Payroll Other Deductions Codes window

If you have deductions set up in Payroll Taxes they need to be set up in the Payroll Other Deduction Codes window. This window has functionality which allows you to set up after-tax deductions and employer deductions.

- Open the Payroll Other Deduction Codes window.

- Select the appropriate Deduction Tax Type option for each of your deductions.

- Once you have set up your deductions in other deductions, use the Payroll Deduction Migration from Taxes window to replace the tax deduction on the Employee Master File with the new other deduction(s) you have set up.

Be sure to confirm all settings in this window after you select the Deduction Tax Type option. Option details are described in the above documentation.

Security

The PAY Other Deduction Codes window has its own Security Group, PAY Deductions. This window is also part of the PAY ALL Security Group.