The Actual Payroll Taxes and Insurance amount is calculated during the Payroll Processing Update to General Ledger. This information is used primarily for Job Cost reports, but can also be incorporated into the Financial Statement.

At the time the Labor Distribution report is updated to the General Ledger, the system calculates the amount of Taxes and Insurance based on the total dollar amount of payroll for each job multiplied by the percentage rate of Payroll Taxes and Insurance.

| Job Number and Name | Total Labor | Taxes and Insurance Rates | Calculated Taxes and Insurance |

|---|---|---|---|

|

10002 |

$1,584.00 |

18.45% |

$292.00 |

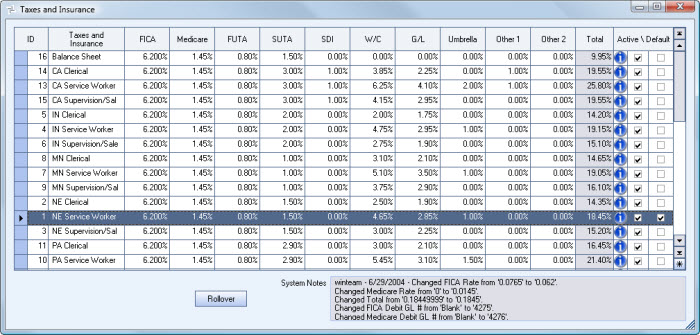

The Taxes and Insurance Rate is pulled from the Total column on the Taxes and Insurance screen.

To change the actual amount of payroll taxes and insurance calculated with each labor entry, see Changing the Actual Amount Payroll Taxes and Insurance.