Let's assume that you clean a client's office (Office Depot) for a monthly rate of $500.00, and they give you printing services in exchange for the cleaning services. This month your cost for printing services is $300.00. Set up the transaction as follows:

Preparation

- Set up a Customer in the Customer Master File. For this example, the customer is Office Depot.

- Set up a Job in the Job Master File. For this example, the Job is for your customer, Office Depot.

- Set up a Vendor in the Vendor Master File. For this example, the vendor is Office Depot.

- Set up a new General Ledger Number for Barter Transactions Clearing account. This would normally be set up as an Asset.

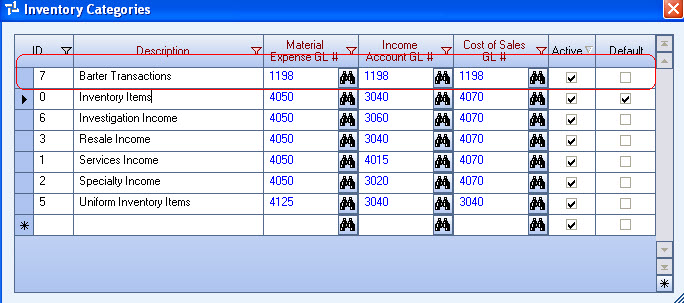

- Since a new Item number needs to be established for Vendors you are bartering with, you will first need to set up a new Inventory Category. Use the Barter Transactions Clearing G/L number you set up in step 4 for all of the G/L number fields of the Item Category.

- Now set up the Item number that you will use when crediting the Customer with amounts for Bartered services. Make sure to use the Category that you set up above.

To Set up the barter transaction

- Create an invoice in Accounts Receivable Recurring Invoices to bill Office Depot $500 for the monthly cleaning job.

The system debits the A/R, Trade account for $500.00 and credits the income account for $500.00. - Create an invoice in Accounts Payable for the Vendor (Office Depot) for $300.00 for printing services they provided.

The system debits the Printing Expense account for $300.00 and credits the A/P, Trade account for $300.00. - You’ve received your print services bill of $300.00 and now want to write off a portion of your client’s bill crediting what they owe you in Accounts Receivable. Create a credit memo, for that amount using the Item number you set up for Bartered Services. When this credit memo posts, it will debit the Barter Transactions Clearing account for $300.00 and credit the Account Receivable trade account.

- Create an Accounts Payable credit invoice for the Vendor using the Barter Transactions Clearing account general ledger number. When this credit posts into the General Ledger, it will credit the Barter Transactions Clearing account for $300.00 and debit the Accounts Payable trade account, thus clearing the balance in the Barter Transactions Clearing account.

- Apply the Credit Memo using Cash Posting and apply the credit memo from the customer balance posting against the invoice.

- Print a check with a zero amount in Accounts Payable. To print a check with a zero amount, you have to print at least one other check that doesn't have a zero amount.

In this example, there is still $200.00 due from this customer. This $200.00 will be used for future printing services.