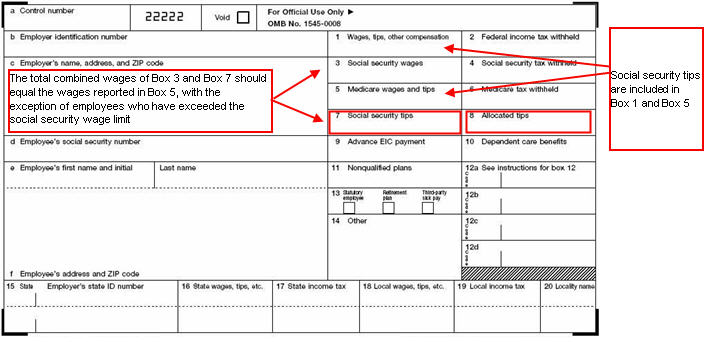

Employee wages received via gratuity (tips) must be included in Gross Wages (Box 1) and Medicare Wages (Box 5) on Employee W-2 forms.

Tips can also be used in the calculation of minimum wage. To accurately handle tips you must first create a new compensation code for tips, and then add wages from tips to the employee's other compensation before processing payroll.

Important: Uncollected Medicare and SS taxes on tips should be setup as Special W-2 codes and handled accordingly on the W-2 and magnetic media reporting. Allocated Tips are also handled as a Special W-2 code.

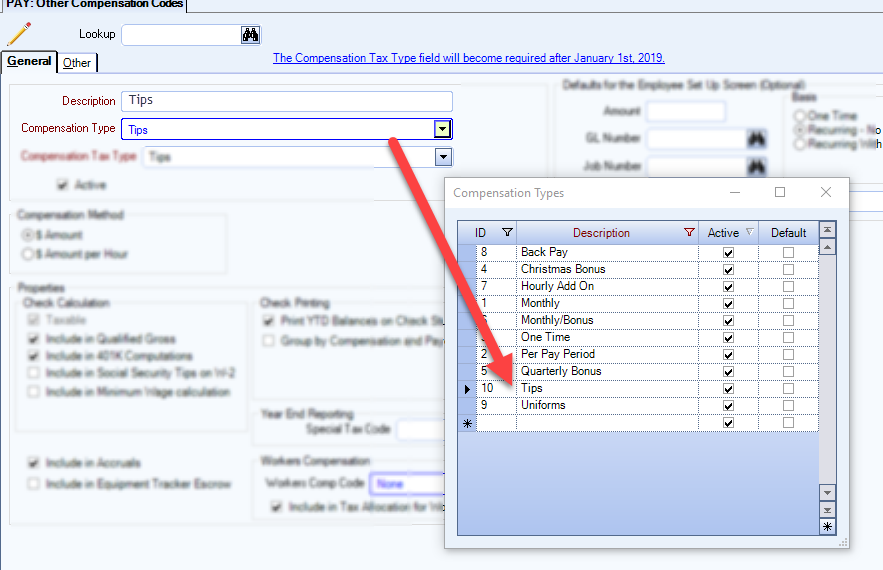

- Open the Other Compensation Codes window from the Payroll module.

- Type a unique description for the compensation code.

- Double-click the Compensation Type field to create a tips compensation type.

- Select Tips from the Compensation Tax Type field.

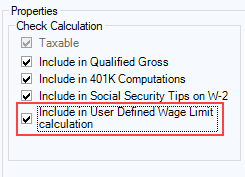

- (Optional) Select the Include in Social Security Tips on W-2 check box. When this is selected, the total wages from tips show in Box 7 (Social security tips) on the Employee W-2. This does not include Allocated Tips, which are shown in Box 8 on the W-2 form.

- (Optional) Select the Include in User Defined Wage Limit calculation check box. If you are using this option, you may want to review checks and filter for a minimum wage deficit amount to ensure your employees are meeting wage requirements.

Tip: The total combined wages of Box 3 and Box 7 should equal the wages reported in Box 5, with the exception of employees who have exceeded the social security wage limit.

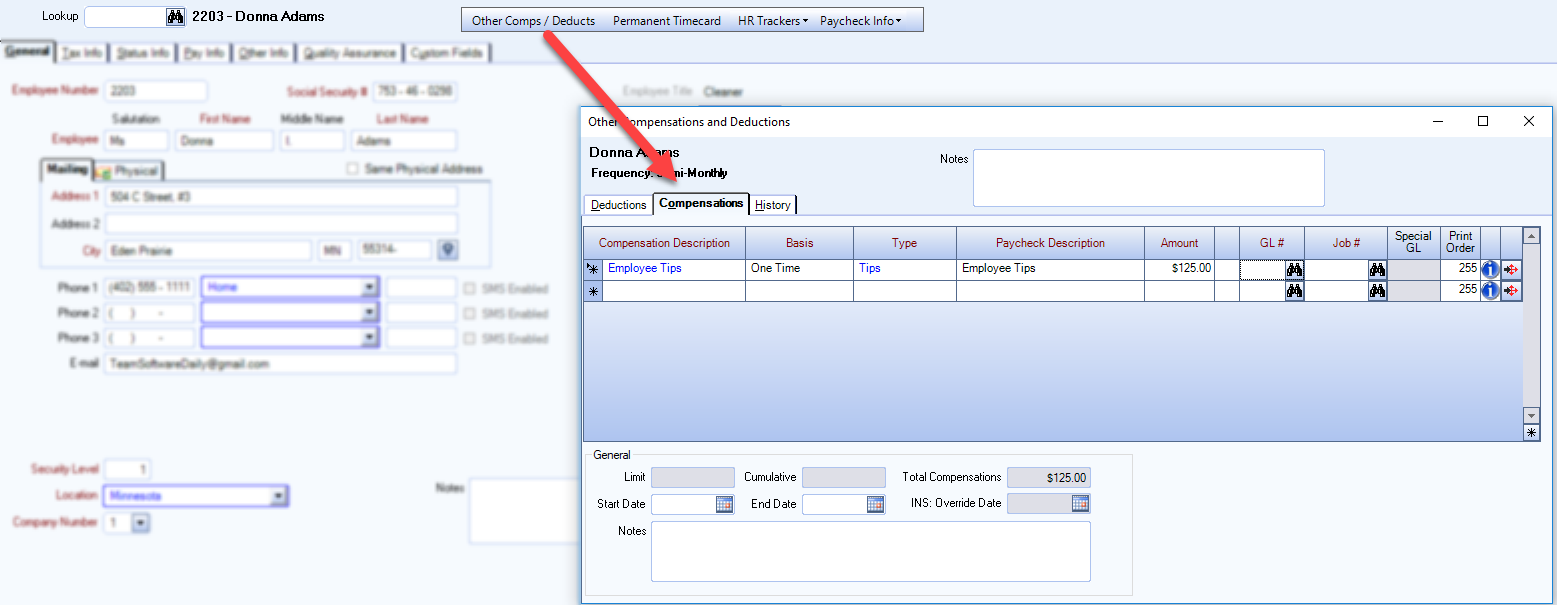

- Open the employee record from the Employee Master File window from the Payroll or Human Resources module.

- Click the Other Comps/Deducts button to open the Other Compensations and Deductions window for the employee.

- Insert the appropriate compensation information, using Tips as the type.

After processing Payroll, using the Payroll Review and Edit screen, you can filter for employees who are not making minimum wage based on Gross Wages / total hours. Gross Wages are total wages plus any Other Compensation paid whose Compensation Code is selected to be Include in Minimum Wage calculation.

Note: You can only filter for minimum wage deficits in the Payroll Review and Edit window that displays after completing a payroll batch.

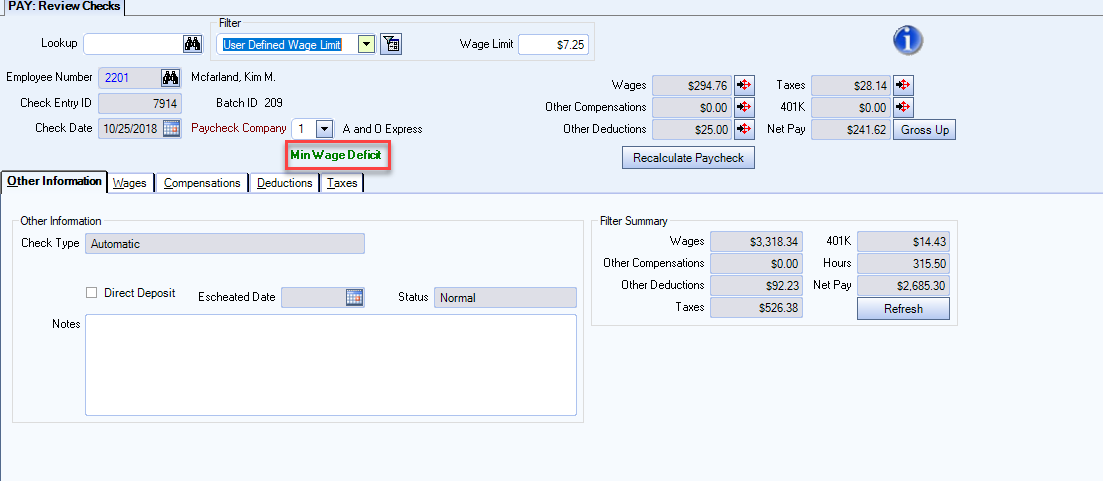

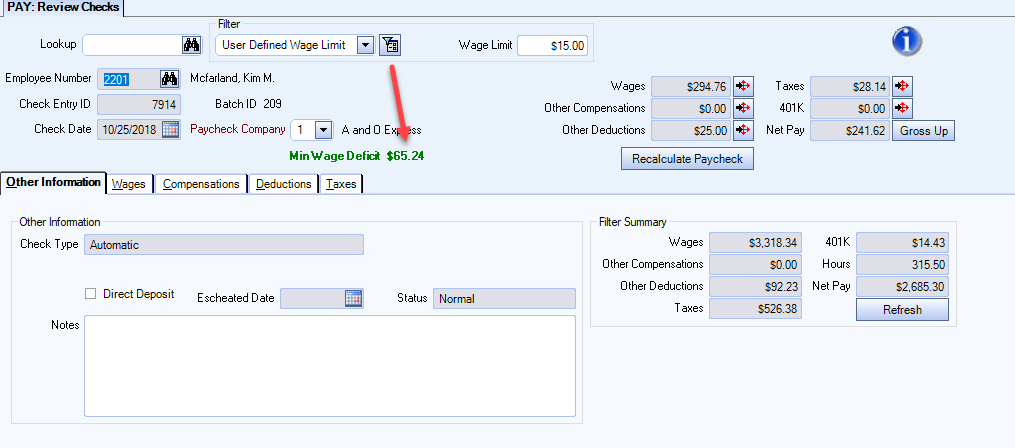

- After running a payroll batch, select User Defined Wage Limit from the Filter list on the Review Checks window. An additional Wage Limit field displays, with a default value of the federal minimum wage. Notice the green text Min Wage Deficit has no value next to it yet.

- Click the Apply Filter button to display the employee check records in the batch that do not meet the Wage Limit. The system will only look at checks that are marked Hourly.

- The Min Wage Deficit displays the total amount needed in order to meet the minimum hourly wage rate.