You can set up minimum wage rates by federal, state, county, city, or create a custom override rate. Setting these rates can help you stay compliant with minimum rates and identify when employees are not meeting the minimum.

Important: To use multiple minimum wages, you must use valid job addresses. For more information about address validation, see Payroll Tax Address Validation.

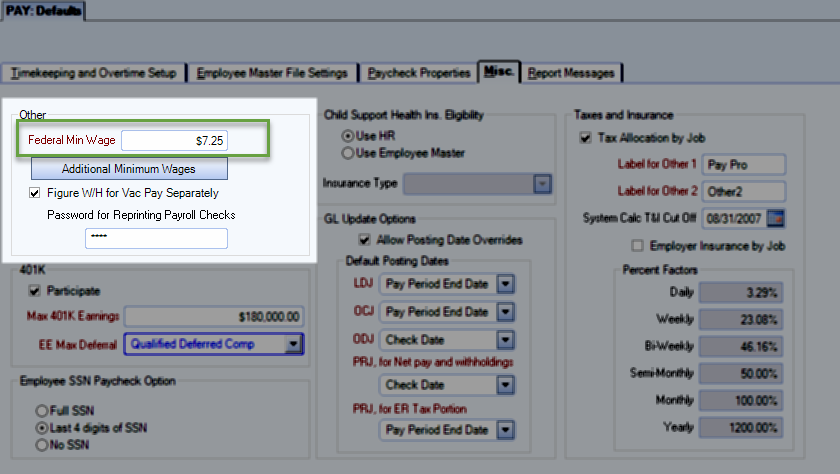

- Open the Payroll Defaults window from the Payroll module. Minimum wage information is on the Misc. tab.

- Enter the federal minimum wage. If no additional minimums are set, WinTeam will only check if pay rates meet this value.

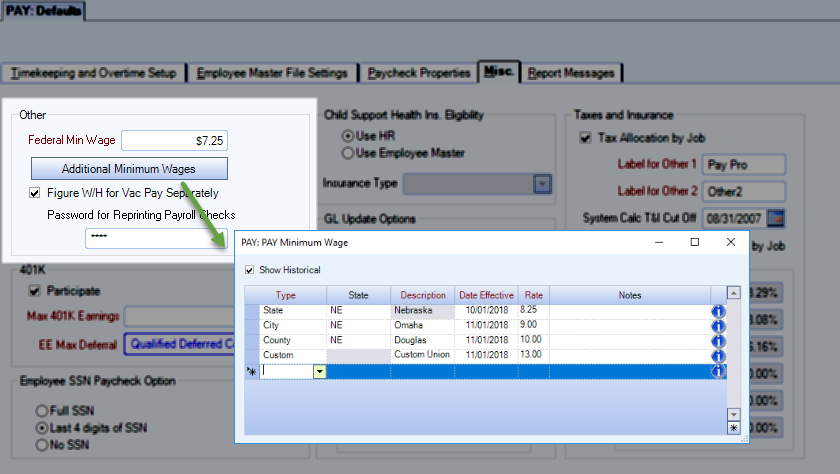

- Click the button to enter more minimums.

- Enter minimum wages for jurisdictions where you have active jobs. Rates can be future dated.

The Type of minimum wage determines the behavior of the State and Description columns.

| Type | State | Description |

|---|---|---|

| State | Dropdown list | Auto-filled with state (cannot be changed) |

| City | Dropdown list | Text form–The city must be spelled exactly the same here as it is for the job address |

| County | Dropdown list | Drop-down list |

| Custom | NA | Text form |