Use this document as an aid in understanding how Taxes and Insurance are calculated when using the Tax Allocation Program. We will assume you have the Enterprise version of WinTeam or have purchased the Tax Allocation Program. We will also assume you have set up WinTeam following the procedures in Allocating Payroll Taxes and Insurance. You may also want to review Understanding GL Entries for Tax Allocation.

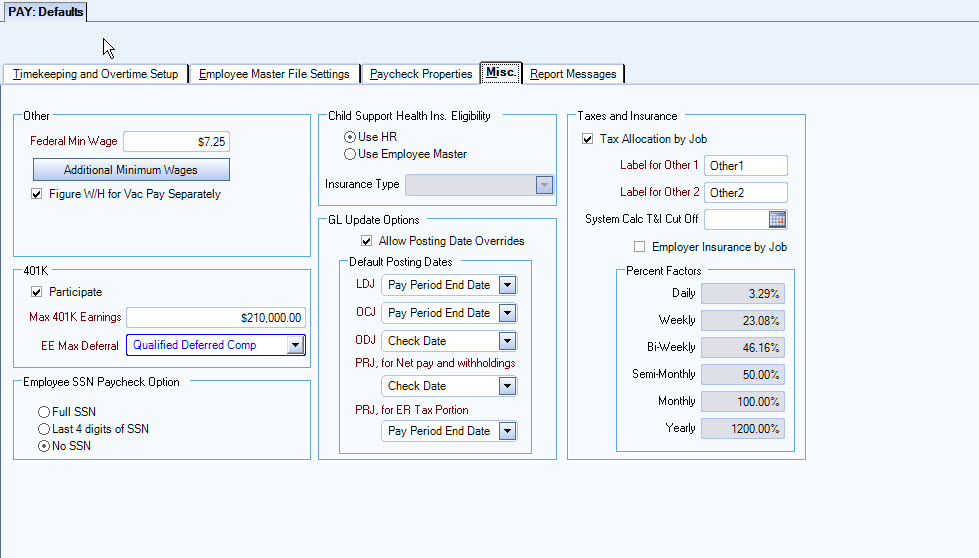

Our Payroll Defaults are set up similar to this:

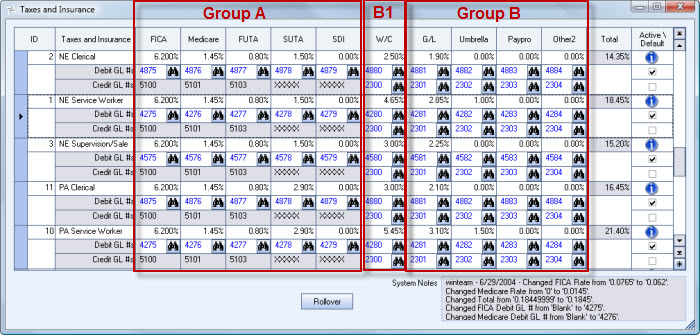

Our Taxes and Insurance are set up similar to this:

It is easiest to think of the Taxes and Insurance screen in terms of Group A and Group B.

Group A

Group A are those taxes that are already computed by the Payroll Processing. These include FICA, Medicare, FUTA, SUTA, and State Disability (SDI). The SDI includes any local taxes that has an employer portion.

Actuals for Group A are based on the rates stored in the Payroll Taxes table, not the rates in Taxes and Insurance screen.

Notice that the Credit GL #'s for Group A are disabled. The GL #'s for these fields are the same for all records and are pulled from the Payroll Taxes screen. We do not update the Liability for Group A when we allocate taxes in the Tax Allocation Journal (TAJ). Instead, it is the Expense G/L Number in the Tax setup area that is credited.

The Credit GL #'s for SUTA and SDI will show "XXXXX"'s since they could come from multiple states, and therefore, have several different GL Numbers.

Group B

Group B includes Workers Comp, General Liability, Umbrella insurance, and up to 2 Other items that are based on a percentage of labor (set up in PAY: Defaults).

Group B is further separated into B1–B1 is Workers Compensation. The system will subtract out the OT and Double time premium dollars.

Actuals for Group B and B1 are based on the rates in the Taxes and Insurance screen.

GL has a custom setting that allows you to exclude OT and Double time premium dollars

| Section | Item | Value |

|---|---|---|

| PayrollTAJ | GenLiabExcludePremDollars | Yes |

Umbrella Insurance will exclude OT and Double time premium dollars if the Employer Insurance by Job check box is selected in PAY: Defaults.

In our example, the item Paypro in Group B identifies a payroll processing fee. We defined the Label for Other 1 in Payroll Defaults.

In our example, the item Pay in Group B2 identifies a payroll processing fee. We defined the Label for Other 1 in Payroll Defaults.

Reallocating Group A

The Employer portion of these taxes and the Taxable Earnings were computed during payroll processing. Those taxes were given to one Job / GL Number for each tax type.

Let's assume the Taxable Earnings* are $700.00 and the Tax is $135.00 for one employee's check.

*Taxable Earnings are defined as earnings from the actual W2 record, which only includes earnings that are taxable. (i.e. Federal UC limit is $7000.00, therefore, only amounts up to $7000 are "Taxable Earnings"). This explains how your "taxable earnings" could be different from your "applicable earnings".

The Employer Tax was computed by taking the Total Tax and subtracting the Employee portion.

First we determine the Applicable Earnings by Job for this check. This will determine which Jobs to reallocate the tax. This includes:

- All Wages

- Taxable Compensations

- Tax Deductible Deductions

To determine Applicable Earnings by Job, add the Wages and Taxable Compensations for each Job.

| Job | Wage/Comps |

|---|---|

| 100 | $500 |

| 101 | $400 |

| NONE | $600 |

| Total | $1500.00 |

Assume the Tax-Deductible Deductions are:

| Job | Deductions |

|---|---|

| 100 | $200 |

| 103 | $300 |

| NONE | $100 |

| Total | $600.00 |

First, subtract the Tax-Deductible Deductions for matching jobs. This gives us:

| Job | Amount |

|---|---|

| Job | Amount |

| 100 | $300 |

| 101 | $400 |

| NONE | $500 |

Now distribute the $300 for Job 103 (which does not match), proportionately across the 3 existing Comps / Wages Jobs

| Job | Amount | Ratio | Amount to Distribute |

|---|---|---|---|

| 100 | $300 | 300/1200 = 25% * $300 | $75 |

| 101 | $400 | 400/1200 = 33.33% * 300 | $100 |

| NONE | $500 | 500/1200 = 41.67% * 300 | $125 |

| Total | $1200 |

Subtracting the distribution amount for the non-matching Job leaves us with Applicable Earnings of:

| Job | Applicable Earnings |

|---|---|

| 100 | $225 ($300 - $75) |

| 101 | $300 ($400 - $100) |

| NONE | $375 ($500 - $125) |

Given the Applicable Earnings, we need to determine the Expense GL number to use for each Job.

- If the record in the Taxes and Insurance screen does have a GL Number entered, then use that.

- If the record in the Taxes and Insurance screen does NOT have a GL Number entered, then use the Expense GL Number in the Payroll Taxes screen.

| Job | Amount |

|---|---|

| 100 | $225 |

| 101 | $300 |

| NONE | $375 |

We now determine the allocation ratio by Job, by taking each Job’s Applicable Earnings, and dividing it into the total Applicable Earnings – all on a check-by-check basis:

| Job | Amount | Ratio |

|---|---|---|

| 100 | $225 | 225 / 900 = 25% |

| 101 | $300 | 300 / 900 = 33.3333% |

| NONE | $375 | 375 / 900 = 41.6666% |

| Total 900 / 900 = 99.9999% |

Now we take the Tax already computed by Pay Check Processing (the $135.00), and multiply each Job’s ratio to allocate the Tax amount back to each ‘Applicable Job’.

| Job | Amount | Ratio | Allocated Tax | PVR |

|---|---|---|---|---|

| 100 | $225 | 225/900 = 25% | $135 * 25% = $33.75 | 33.75 |

| 101 | $300 | 300/900 = 33.3333% | $135 * 33.3333%= $45.00 | 45.00 |

| 102 | $375 | 375/900 = 41.6666% | $135 * 41.6666%= $56.25 | 56.25 |

| $135 * 99.9999%= $135.00 | 135.00 |

If needed, we will give the ‘last’ job for each check +/- a few pennies, so that the Allocated Tax is always equal to the Computed Tax from Paycheck Processing. This will ‘fix’ any natural rounding errors. (See Penny Variance Rounding column – PVR).

We will do the same calculation for computing the ‘Allocated Taxable Earnings”.

| Job | Amount | Ratio | Allocated Taxable Earnings |

|---|---|---|---|

| 100 | $225 | 225/900 = 25% | $700* 25% = $175.00 |

| 101 | $300 | 300/900 = 33.3333% | $700* 33.3333%= $233.33 |

| 102 | $375 | 375/900 = 41.6666% | $700 * 41.6666%= $291.67 |

| 900/900 = 99.9999% | $700 * 99.9999%= $700.00 |

The Allocated Taxable Earnings will be stored during the update and can be used to:

- Help reconcile the Tax Amounts that were allocated

- Reprint a TAJ

The calculation of Allocated Tax and Allocated Taxable Earnings will be done for each check and for each Group A Tax Type (FICA, Medicare, FUTA, SUTA, State Disability/Local taxes).

To compute the total allocated Tax, the system will sum across all checks for each tax type, by Job and GL. This amount will update to the GL for the Expenses.

Reminder: Group A does not update the Liability Accounts from the Tax Tables.

Note: The Expenses will update by grouping across all tax types, By Job and GL, and then sum the Allocated Tax and Taxable Earnings.

Note: One entry in the GL might be for more than one Tax Type if the GL Number in the Taxes and Insurance screen is setup to use the same GL Number for different Tax Types.

Note: There will be a lot of entries to the GL, since the Job will be all the Labor Jobs, and not just balance sheet jobs.

Credit Side of Group A

The goal is to credit the lump sum Expense entry made during the PRJ.

The system builds the credit entries on a check-by-check basis, using the Expense GL Number stored in the Tax Tables, and the Tax Job Number for each Job’s Company.

The Credit entry should be the same as the PRJ entry.