Boone County, Kentucky has four relevant taxes.

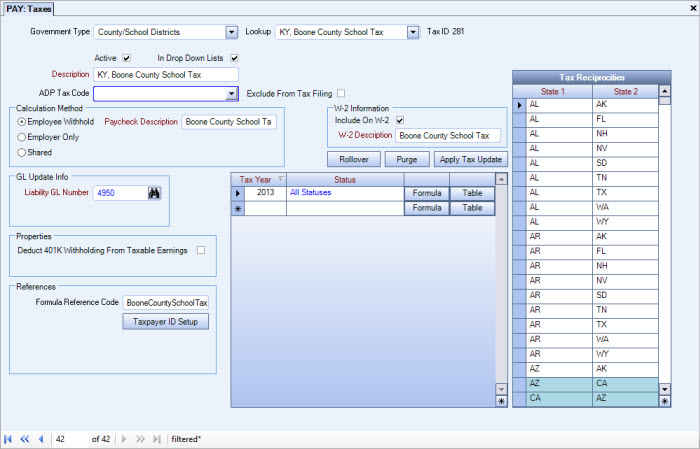

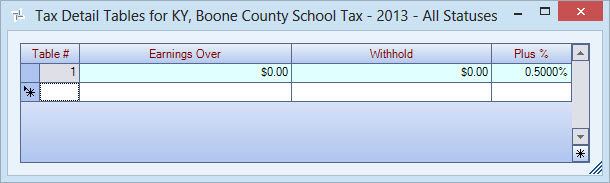

- Boone County bases its school tax on an employee's primary residence. The Boone County School Tax is added to the applicable Employee Master File records.

- Boone County Tax is relevant when an employee works at a Job location in Boone County. The Boone County Tax is set up in the Job Master File.

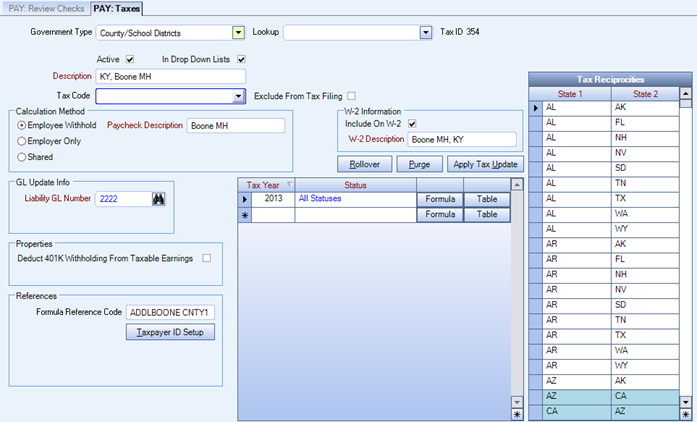

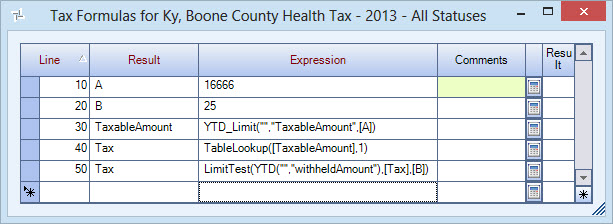

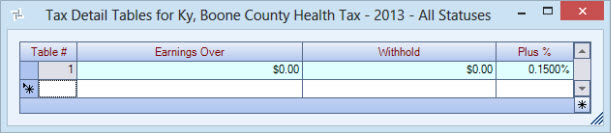

- Boone County Mental Health Tax is relevant when an employee works at a Job location in Boone County. The Boone County Mental Health Tax is set up in the Job Master File.

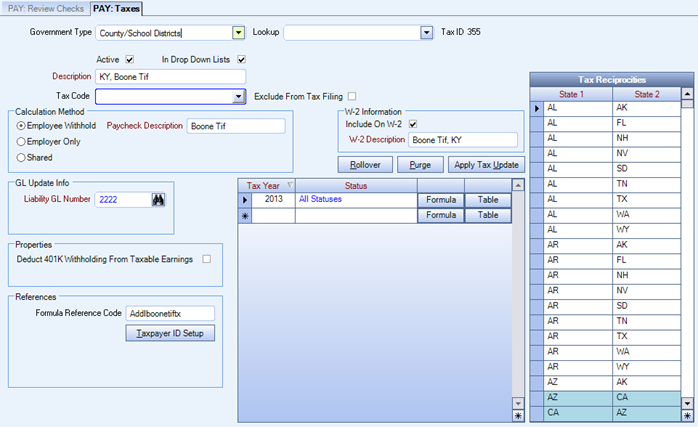

- Boone TIF Tax code is not used unless a Job is located within Boone County, Park South Richmond Development area. In this case, there could be three taxes applicable for the Job location. For these locations, the Job’s County Tax Code for Payroll should be set up with the KY, Boone TIF tax code, rather than with the regular Boone County tax code. When Payroll is processed, if the TIF tax is found, WinTeam automatically withholds the other two taxes for Boone County (Boone County Tax and Boone County Mental Health Tax), providing these codes are set up according to the steps outlined below.

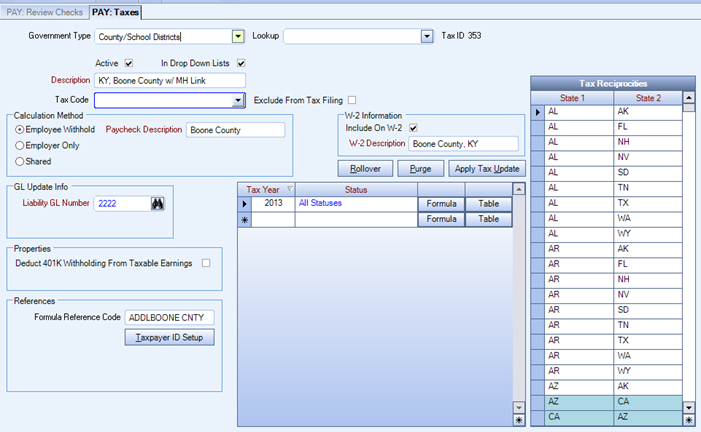

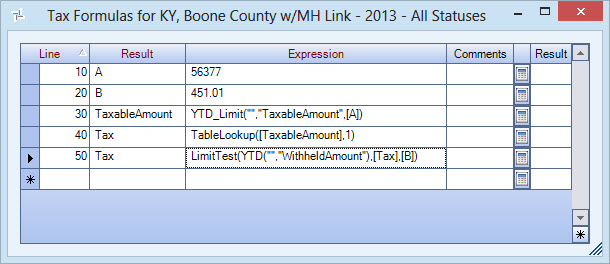

Boone County requires a deduction for a mental health when an employee works at a Job location in Boone County. Boone County and the Boone County Mental Health Tax have different withholding rates, and also different taxable limits. Because there is also a city tax involved (Florence), and a Job can only have one city and one county code set up for payroll taxes, a special link has been established for these two tax codes.

Provisions have been made in WinTeam to consider a second tax (for mental health) when a Job is set up in Boone County.

In order for WinTeam to recognize the additional tax as a ‘set’ of tax entities, it is important that this information be setup properly.

Note: The special link between the regular county and the county health tax functions only if the Job includes the KY, Boone County w/MH Link and the Tax Codes are setup properly.

Setting up tax codes for Boone County, Kentucky

- Set up the following tax codes.

- Add the County/School Districts Tax Code for KY, Boone County School Tax to the applicable Employee Master File records.

- Add the County/School Districts Tax Code for KY, Boone County w/MH Link to the applicable Job Master File records. By doing this, both the mental health tax and the county tax are withheld as two separate taxes.

- If the Job is located within the Park South Richmond Development area, add the County/School Districts Tax Code for KY, Boone TIF INSTEAD OF the Boone County w/MH Link tax code, since an additional tax for TIF will need to be withheld. The KY, Boone TIF code is set up to automatically withhold the Boone County tax and the Boone Mental Health tax.

The Boone County School Tax is a separate tax and is not linked to the Boone County Tax or the Boone County Mental Health Tax.

Boone County bases its School Tax on an employee's primary residence. The school district tax is withheld ONLY if the employee works at a job located in Boone County and only applies to the earnings earned within Boone County. If they work in other counties, the school tax does not apply to these other earnings. If they live in Boone County, but did not work at a location in Boone County, the school district tax is not withheld at all.

See below. The KY, Boone County School Tax code is then added to the applicable Employee Master File records.

The Formula Reference Code MUST BE set up as: BooneCountySchoolTax (no spaces).

The Boone County tax is relevant when an employee works at a Job location in Boone County. The KY, Boone County w/MH Link is then added to the Job Master File. This tax code also includes a link to a second tax for KY, Boone MH Tax (Mental Health tax code). Since there is only one county field in the Job Master File for Payroll, and there are two county codes, the formula reference code along with the formula information links both tax codes together in order to withhold both taxes.

The Formula Reference Code MUST BE set up as: AddlBoone Cnty.

The Boone County TIF Tax is relevant when an employee works at a Job Location that is located in Boone County, within the Park South Richmond District. If there is a Job located in this area, the Boone TIF Tax code is added to the Job Master File INSTEAD OF the Boone County w/ MH Link tax code. The Formula reference code links back to the normal Boone County tax code and therefore can withhold all three taxes (Boone County w/ MH Link, Boone Mental Health, and Boone TIF).

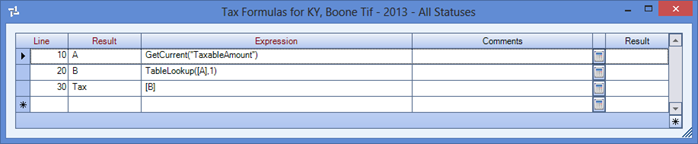

The Formula Reference Code MUST BE set up as: Addlboonetiftx.

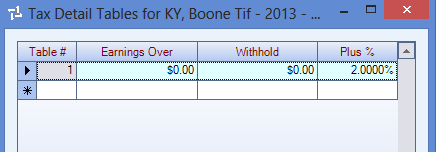

Note: The TIF tax rate is 2.00%. However, you receive credit for any Boone County or Boone County Mental Health tax that is withheld. The percentage of the TIF is reduced by the percentage of the other two taxes already being withheld. Once you reach a limit on one of the other two, then the TIF tax rate goes up based on what is still being withheld. Once both limits are reached (since both of the other two tax codes have limits), the full 2.00% for TIF tax will be withheld.

Example: If an employee is having the Boone County w/ MH Tax withheld (.8%) and also having the Mental Health tax withheld (.15%), instead of withholding 2.00% for the Tif tax, WinTeam will only withhold 1.05% (figured by taking 2.00% - .8% - .15% = 1.05%).

There is no earnings limit on the TIF tax, so withholding continues based on any employee earnings at a Job set up using the Payroll County Tax code of KY, Boone TIF.