WinTeam provides the functionality to import tax adjustments from a csv file. This could be useful if you are just starting to use WinTeam and have many entries to make or need to import year end health care cost tax adjustments. However, it can be used at anytime. The Tax Adjustment import allows for multiple check dates for employees and also allows multiple companies to be uploaded in the same csv file.

- From the Payroll Menu, click Check Processing Wizard.

- Click Create a New Batch, and then click Next.

- Click Next on the Security Confirmation screen.

- Click Adjustments, and then click Next.

- Click Finish on the Notes page.

- On the Tax Adjustments Option, select Tax, and then click Proceed.

- The Tax Adjustments screen displays.

- Click the Import button.

- Locate the csv file you want to import.

- The system then begins to validate the integrity of the data. See Validation Checks below.

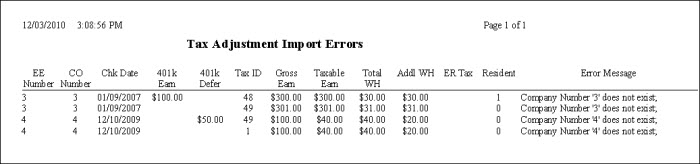

- If any validations fail, the import is canceled and an error report is shown.

- Upon a successful import, the Tax Adjustment screen displays. A record is shown for each line item that was imported. The Notes field will populate with the import details (Imported- user name, date, and file path.

Create a CSV file

Note: We recommend that you use the CSV Template for importing your adjustments, deleting the place holder information and inputting your own. It is important not to change the formatting of the document, as this will interfere with the importing process.

Required fields for Tax Adjustments

EmployeeNumber

CompanyNumber

CheckDate

K401Earnings

K401Deferred

TaxID – This will fill the Tax Jurisdiction column in the grid but the csv will remain TaxID.

GrossEarnings – comes from the Taxable Earnings table

TaxableEarnings – comes from the Taxable Amount

TotalWithheld – the withheld amount

AddlWH – AdditionalWithholding

EmployerTax

Resident

PSDTaxCode – used only for Pennsylvania PSD Codes

Validation Checks

WinTeam goes through a series of checks to validate the data from the csv file when importing tax adjustments. The following information is verified:

- Employee Number is a valid EMF employee

- The unique key is Employee, Company and Check Date. We verify that only one combination of the three exists. For any employee in the batch, you cannot have another entry for that same employee with either a different company or a different check date.

- Company Number is a valid WinTeam Company

- 401 K information can only be added to 1 record per Employee, Company and Check Date.

- Tax ID is a valid WinTeam Tax ID – This also includes marked as Available in Drop Downs

- Government Types of 70 and 75 cannot have a Withheld Amount or an Additional Withholding Amount

- If the Tax ID’s Calculation Method = 1 then user cannot enter an Employer Tax Amount

- Taxable Earnings must be numeric

- Taxable Amount must be numeric

- Withheld Amount must be numeric

- Additional Withholding Amount must be numeric

- Tax must be numeric

- 401 K Earnings must be numeric

- 401 K Deferred must be numeric

- Resident must be a 0 or 1 - Also during the import if the Tax ID’s government type is 30, 40 or 50 we use the value in the csv, if the government type is not 30, 40 or 50 then we default resident to 1.

Error Reports