You can check whether employees are meeting federal, state, county, city, or custom minimum wage requirements from the Review Checks window after a payroll batch has been run.

To filter for minimum wage

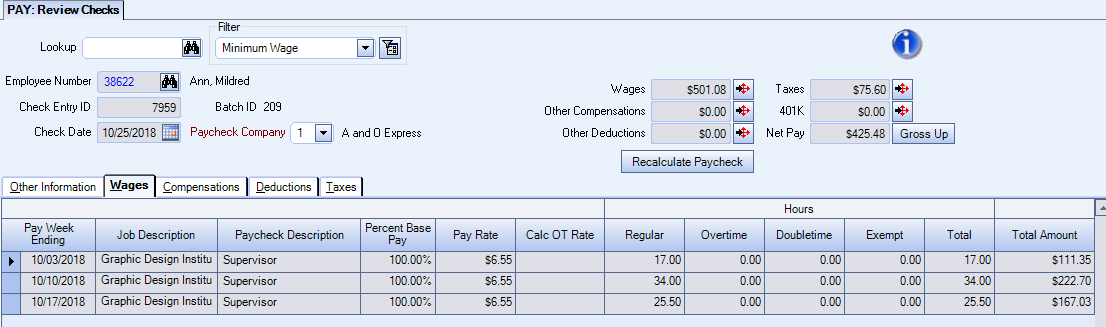

- After running a payroll batch, select Minimum Wage from the Filter list on the Review Checks window.

- Click the Apply Filter button.

The filter shows any employees who are earning below the minimum rate for any job they worked. See Setting Up Multiple Minimum Wage Rates for more information.

You can filter for employees who are not making a define rate based on Gross Wages / total hours, where gross wages are the total hourly wages plus any compensations (whose compensation code is selected to Include in User Defined Wage Limit calculation) and any deductions (whose deduction code is selected to Include in Gross Earnings). You may want to check any wage deficits for employees whose base salary is below minimum wage and earns wages through tips or who has deductions that may impact the minimum wage calculation.

- You can only filter for user defined wage deficits in the Payroll Review and Edit window that displays after completing a payroll batch.

- Compensations will not be included in wage calculations unless they are selected as Include in User Defined Wage Limit calculation in Other Compensation Codes.

- Deductions will not be included in minimum wage calculations unless they are selected as Include in Gross Earnings in Other Deduction Codes.

To filter for a deficit

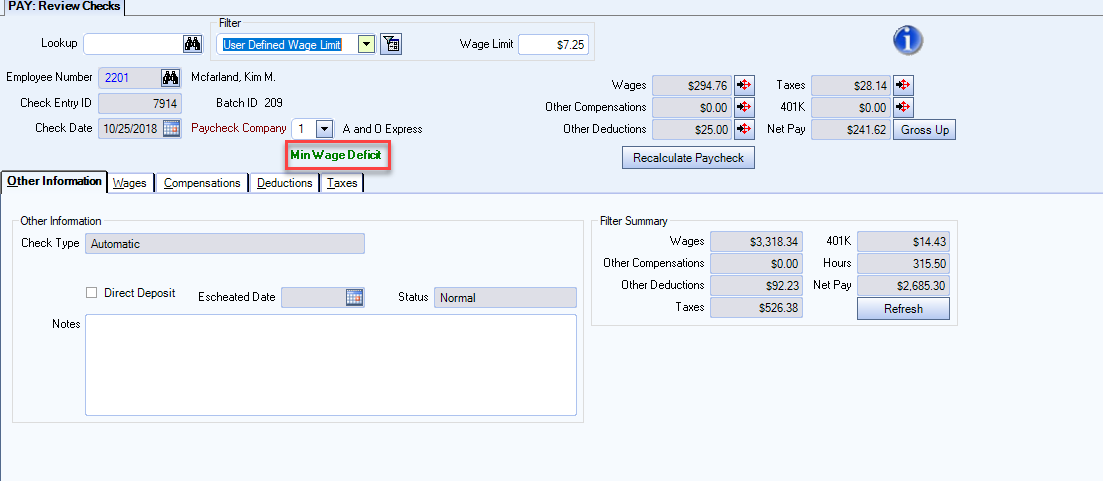

- After running a payroll batch, select User Defined Wage Limit from the Filter list on the Review Checks window. An additional Wage Limit field displays, with a default value of the federal minimum wage. Notice the green text Min Wage Deficit has no value next to it yet.

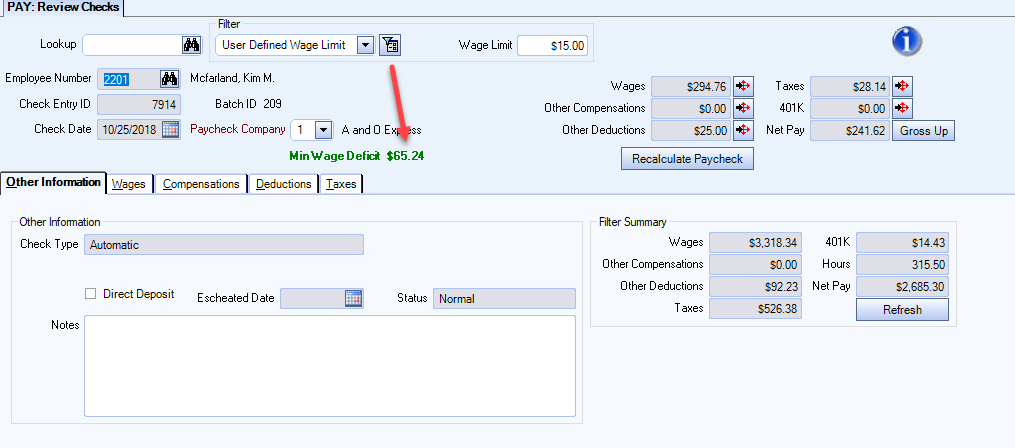

- Click the Apply Filter button to display the employee check records in the batch that do not meet the Wage Limit. The system will only look at checks that are marked Hourly.

- The Min Wage Deficit displays the total amount needed in order to meet the minimum hourly wage rate.