The Federal HIRE Act (Hiring Incentives to Restore Employment) is focused on accelerating the hiring of unemployed workers. It allows employers to take a tax credit for the Employer’s portion of FICA for all of the employees that qualify under this Act. There are also increased tax credits for employers that meet certain eligibility requirements. The employees must meet certain criteria before they qualify under this exemption. Make sure that you have researched the criteria to determine if a “New Hire” qualifies.

How is Payroll Processing affected in WinTeam

With the signing of the Federal HIRE Act, there have been many calls from clients asking what changes were going to be made in WinTeam to track qualified individuals. Since this is only a temporary law that is in effect, there will be no payroll processing changes made to the Payroll Engine. You will, however, be able to get to the information to obtain what amount of FICA credit you can take on your 941. These changes will are included with the Spring release.

The 6.2% Employer Social Security Tax exemption applies to individuals hired after February 3, 2010, but only for wages paid after March 18th and before January 1, 2011. You will want to be sure that you are not including any paychecks prior to March 18th in this process.

This tax credit is temporary and expires as of 1/01/2011. The 941 report will only consider check records with a check date less than this.

- Created Custom Setting for those companies who have qualified individuals that fall under the Federal HIRE Act.

This setting will drive some new functionality on the Employee W2 Report and the 941 Report.

| Section | Item | Value |

|---|---|---|

| PayHireAct | UseCustomField | “enter Custom field # between 1 and 26” |

- Since we need to be able to track the date an employer can start taking tax credit for the employer’s portion of FICA for qualified employees, you will define a custom field in the employee master file for this purpose. The custom field will need to be set up as a Field Type of Date. You can assign any description you want to this custom field (example: Fed Hire Act). Whatever description is indicated here will be the name of the new Category/Records item that will be available on the Employee W2 report.

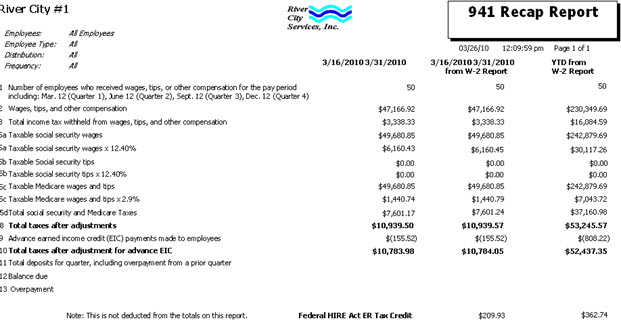

- With this Custom Setting in place, the 941 report will print a new line of information at the end of the report showing the total employer’s portion of FICA tax that can be taken as a credit.

- If there are employees with a date in this new custom field defined in the employee master file, that have paycheck activity within the criteria specified, the employer’s portion of FICA tax for those paychecks will be included in this credit total. Make sure you do not use a date prior to 3/18/2010 since only paychecks paid after this date are eligible for credit.

- This is the amount of credit you can take off of your 941 payment.

- Create a manual Adjusting Journal Entry booking the credit you are taking.

- You will need to do an Adjusting Journal Entry to credit back the employer’s portion of FICA tax expense and debit the liability account the amount should be relieved from.

- It is recommended that you set up a new Expense General Ledger number so that you have an easy way of tracking how much credit has been taken for this temporary Federal HIRE Act.

- When creating your journal entry each month, you will be debiting the Liability G/L number to “relieve” (should be the Liability General Ledger number set up with the FICA tax code), and crediting the Expense Account you want to post this amount to. It is probably best if a separate G/L number is set up for this purpose. Make sure that you add this new number to all of your P & L formats and any other applicable formats.

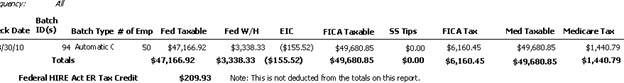

Here are examples of the 941 reports showing the change:

Output Type: Tax Liability

Output Type: Recap

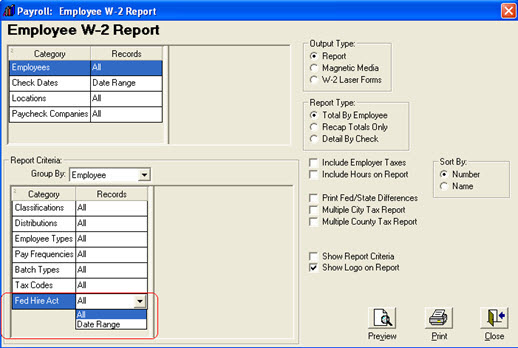

The Employee W2 report will have the new date field of this custom field as a new Category/Record item so that it can then be used for filtering. You can then validate the total credit amount that is printing on the 941 report.

If the date range is left as All, this report will not look at the custom field date when determining what check records should be included.

If a date range is entered, then only check records that apply for the tax credit will be included (based on the date range you enter).

The date range you enter should be the first date that applies for the Tax Credit (which would be 3/19/2010). The To Date should be the To: date of the Check Date Range. By entering your dates using these rules, the report will include only those check records that qualify for the tax credit. This is determined as follows:

- Only employee’s that have a qualifying date within the custom field date range will be considered.

- If #1 applies, then only those check records on or after the qualifying date will be included on the report.

You are running the Employee W2 report for check dates 04/01/2010 thru 4/30/2010. You would enter in the Custom Field date range:

From: 3/19/2010

To: 4/30/2010

You have an employee whose qualified date is 4/16/2010. This person had check records dated 4/15/2010 and 4/30/2010. The report is only going to include the 4/30/2010 check. It will not include the 4/15/2010 check since this was before the employee’s qualifying date.

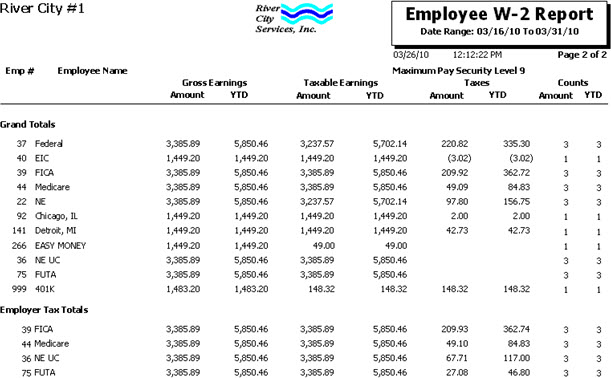

You can easily see the tax credit for FICA available to the employer within the Employer Tax Totals area. Whatever amount is printed for FICA under the Taxes Amount column will be the credit amount that you can take for that check date range. This should tie back to the same total shown on the 941 report as the tax credit.

Here’s an example showing the Employee W2 Report: Note that there are penny variances only because on the Employee W2 report we had changed some time ago to show the employer’s portion being the same as the Employee’s portion but on the 941 report we print the actual Employer portion that the system has stored (Employee/Employer amount combined less the Employee portion = the Employer’s portion on the 941 report).

Employee W2 Report Example

This report is being run to find all qualifying checks that were issued with a check date between 3/16/10 and 3/31/10. The date range that was entered for the special custom field assigned to track when someone is qualified was entered as From: 3/19/10 thru 3/31/10. Only those employee check records for individuals that had a qualifying date between this time period and had check records on or after the qualifying date will be included.

Once the Federal HIRE Act expires, you will simply remove the Custom Setting from your database which will then stop the printing of the credit information on the 941 report and will remove the date field from the Employee W2 report’s Category/Records filter criteria.

— The HIRE Retention Credit —

The Retention Credit provides employers with a General Business Credit of up to $1,000 for each qualified employee they retain for at least 52 consecutive weeks, whose wages do not significantly decrease during the last 26 weeks. The amount of the credit is the lesser of $1,000 or 6.2 percent of wages (as defined for income tax withholding purposes) paid by the employer to the retained qualified employee during the 52 consecutive week period. The qualified employee's wages for such employment during the last 26 weeks must equal at least 80% of wages for the first 26 weeks. This credit cannot be carried back to years beginning before March 18, 2010, but may be carried forward. The credit will be claimed on the employers income tax return.

The 941 Report displays a Include New Hire Retention Info check box if the PayHireAct Custom Setting is used. Select the check box to include this information on the report.

WinTeam will use the Hire Act (Custom Field designated in the Custom Setting) to calculate the credit. There is no data validation for Hire date in Employee Master File. The validation is driven from Custom Setting only.

The 941 Report will identify the qualified workers and verify wage requirements.

Employees who are employed (by the same employer) for a period of not less than 52 consecutive weeks and who meet the wage requirements are considered to be 'retained workers'. The credit is calculated and displayed only for retained workers. The total credits for all retained workers displays in the Total Year Credit. The Total Year Credit is then reported on IRS Form 3800.