Overview

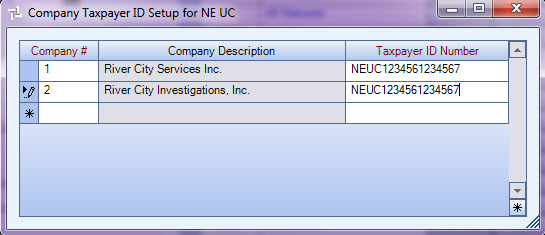

Applicable for multi-company databases only. Use the Company Taxpayer ID Setup screen to assign a Taxpayer ID Number to each company for the taxing jurisdiction. This information is very important because WinTeam prints this Taxpayer ID Number on tax reporting documents such as Unemployment Compensation transmissions, Employee W-2’s, and electronic reporting files.

Important: CALIFORNIA UC FORMAT: The Taxpayer ID for California is 8-digits plus a 3-digit branch code for a total of 11-digits. If your company is registered with the California Employment Development Department as a branch-coded employer, use the applicable branch code for each employee. If you are not a branch-coded employer, enter three zeros for the branch code—do not leave the branch code blank.

You can access the Company Tax Payer ID Setup screen from the Taxes screen in Payroll by clicking the Taxpayer ID Setup button for all Government Type tax codes except Federal, FICA, Medicare, and EIC tax types.