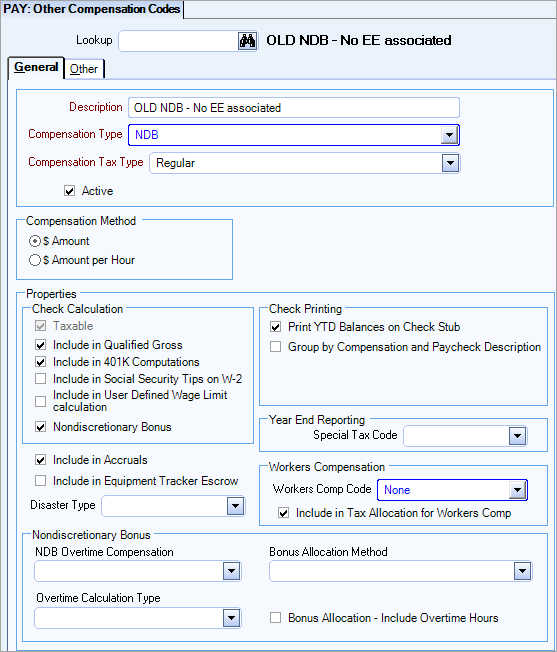

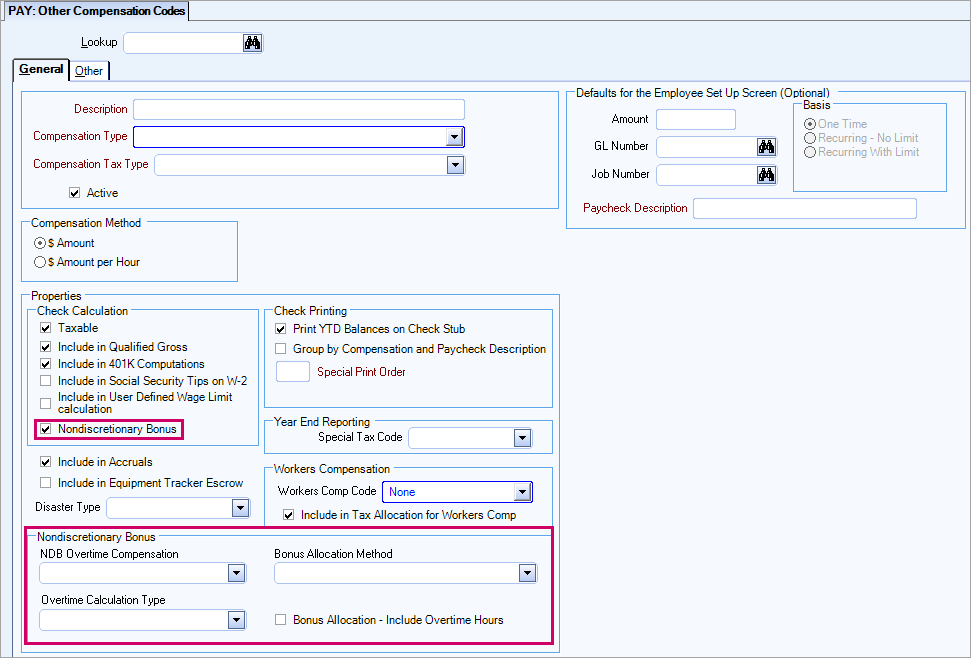

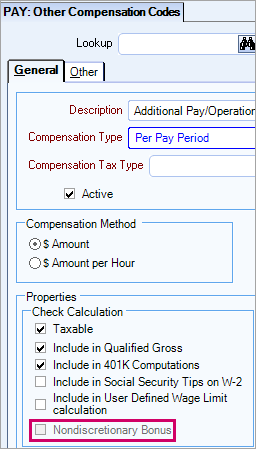

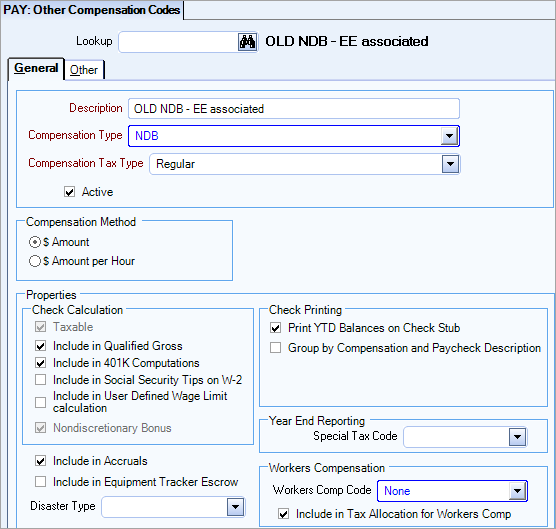

A check box labeled Nondiscretionary Bonus displays in the Check Calculation section of the Other Compensation Codes window. After you select this check box, a Nondiscretionary Bonus section displays at the bottom of the window.

Nondiscretionary Bonus Checkbox

The Nondiscretionary Bonus checkbox cannot be cleared for nondiscretionary bonus compensation codes that have already been used in the Employee Master File or the Pay Review Checks windows. The check box is disabled if it has already been used.

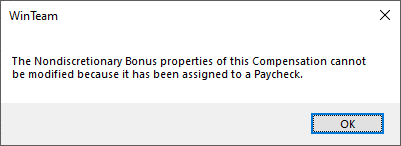

If you create a new nondiscretionary bonus compensation and add it to a check in the Review and Edit Checks window, and then you return to this window (still open) and clear the Nondiscretionary Bonus check box, a message box displays to remind you the nondiscretionary bonus properties of the compensation cannot be modified because it has been assigned to a paycheck.

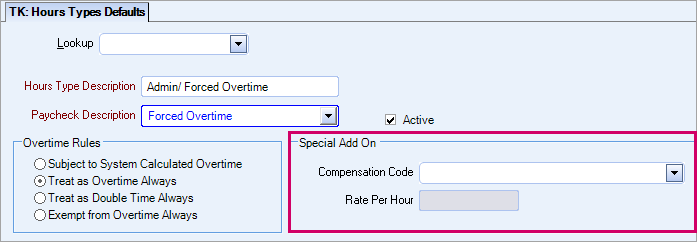

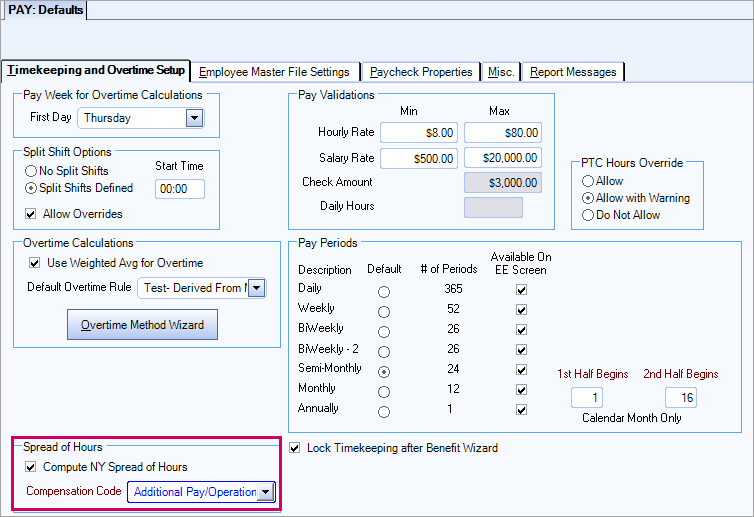

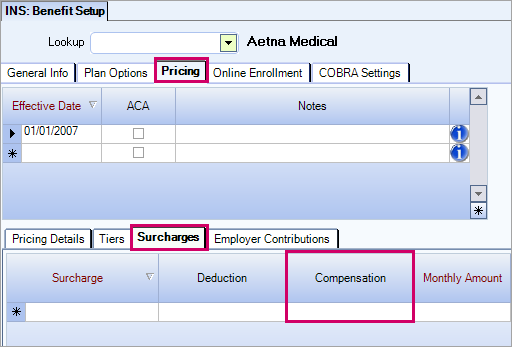

The Nondiscretionary Bonus checkbox is disabled for any compensation that is used in a Special Add On, Spread of Hours, or Surcharge. These compensations cannot be used as a nondiscretionary bonus compensation.

SYS Hours Types Defaults window, Special Add On section, Compensation Code field:

PAY Defaults window, Timekeeping and Overtime Setup tab, Spread of Hours section, Compensation Code field:

INS Benefit Setup window, Pricing tab, Surcharges sub-tab, Compensation column:

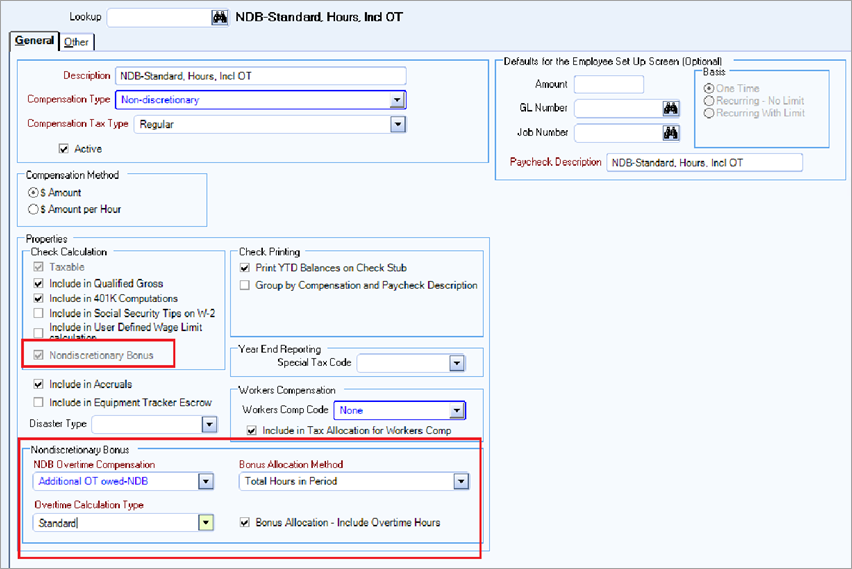

Nondiscretionary Bonus Section

The Nondiscretionary Bonus section contains the following options (the three drop-down fields in this section are required and the check box in this section is optional):

- NDB Overtime Compensation–This is the additional amount owed in compensation for the overtime as a result of the nondiscretionary bonus. Click the down arrow to select another compensation code from the list. Only compensation codes that are set up with a Compensation Method of $ Amount and a Basis of One Time can be used.

- Overtime Calculation Type–There is a unique method to calculate overtime owed in the state of California. Click the down arrow to select the standard formula or the California formula. Click the down arrow to select one of the two fixed options:

- ID 1 = Standard

- ID 2 = 150% OT; 200% DT (California) (150% Overtime and 200% Doubletime)

- Bonus Allocation Method–This field allows you to select how the bonus is allocated. The nondiscretionary bonus calculation is based on:

- The hours an employee worked and does not include the hours the employee did not work.

- Only paid timekeeping records are included in the calculation. Paid timekeeping records are those that were paid by a paycheck.

- Click the down arrow to select one of the two fixed options:

- ID 1 = Split Evenly by Week

- ID 2 = Total Hours in Period

- Sum the total hours worked (include overtime and doubletime hours if the Bonus Allocation: Include Overtime Hours checkbox is selected) for the bonus period, both by week and for the full period; for the partial weeks, determine which hours were in the bonus period.

- Divide the nondiscretionary bonus into equal parts for each calendar day of the service period and then assign amounts to each partial and/or full week in the bonus period (rounded to four decimal places). This is the additional weighted average rate.

- For each week, determine the percentage of hours worked that were in the bonus period.

- For each week, multiply the additional weighted average rate (from step 2) by the percentage allocated to this bonus period for the week.

- Determine the applicable rates for overtime, doubletime, sick, and meal and rest penalties (if any) (rounded to 3 decimal places).

- Multiply each rate by the applicable hours (rounded to 2 decimal places) and then sum the amounts to equal the total amount owed.

- Sum the total hours worked (include overtime and doubletime hours if the Bonus Allocation: Include Overtime Hours checkbox is selected) for the bonus period by week; for the partial weeks, determine which hours were in the bonus period.

- Divide the nondiscretionary bonus into equal parts for each calendar day of the service period and then assign amounts to each partial and/or full week in the bonus period (rounded to four decimal places).

- For each week, divide the weekly nondiscretionary bonus allocation (from step 2) by the hours worked that week. This is the additional weighted average rate for the week (rounded to three decimal places).

- Determine the applicable rates for overtime, doubletime, sick, and meal and rest penalties (if any) (rounded to 3 decimal places).

- Multiply each rate by the applicable hours (rounded to 2 decimal places) and then sum the amounts to equal the total amount owed.

- Bonus Allocation – Include Overtime Hours–Select this check box to include overtime and doubletime hours (in addition to regular hours) in the hours worked formula. When this check box is cleared, only regular hours are included in the formula (it is cleared by default).

Note: Compensations that are set up as nondiscretionary bonuses do not appear in this list because they cannot be used for the NDB Overtime Compensation.

| Bonus Allocation Method | Calculation Information |

|---|---|

| Split Evenly by Week |

How WinTeam calculates the additional amount owed: |

| Total Hours in Period |

How WinTeam calculates the additional amount owed: |

Note: This checkbox would typically be selected except in California where the rules are different, so this checkbox would typically be cleared for California.

A compensation code that was setup and assigned to an employee (in the Employee Master File) or used on a paycheck cannot be modified with the new values. You must create new compensation codes.

A compensation code that was setup can be modified to use the new values if it has not been assigned to an employee or used on a paycheck.

The compensation code has been assigned to an employee:

The compensation code has not been assigned to an employee: