To confirm that WinTeam and ADP files are in balance, access the ADP Smart Compliance site to verify your file has been received and processed for the exact amounts you sent.

Note: Wait between 15 - 30 minutes after successfully transmitting the file before retrieving the ADP reports.

To reconcile the ADP Tax File and WinTeam, do the following:

- Log in to the ADP portal (https://smartcompliance.adp.com) using the username and password that was sent to you in an email from the ADP Tax Filing portal.

- The first time you access this website, you are asked to verify your password and then to create and verify a new password.

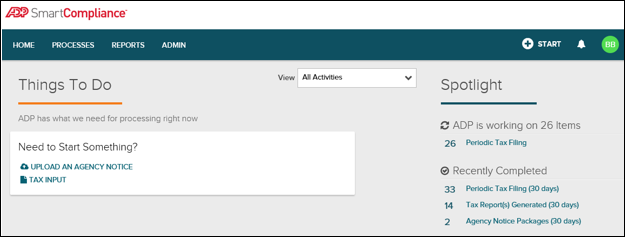

- After you create a new password, the following window displays:

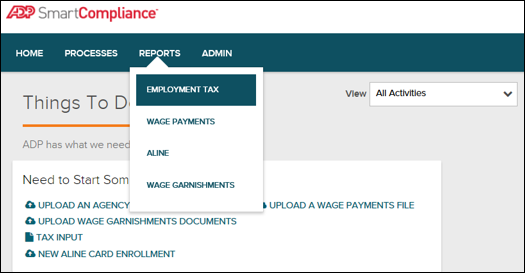

- On the Home page, hover over the Reports option and then select Employment Tax.

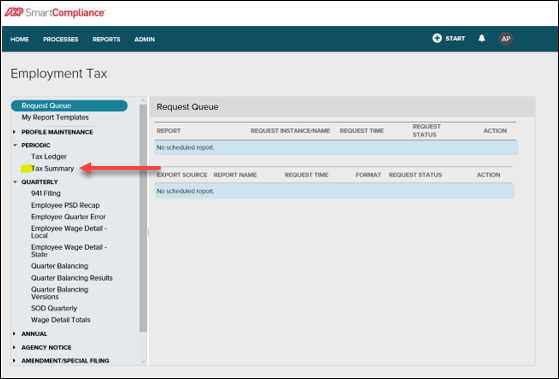

- On the Reports window, select the Periodic Tax Summary to see periodic files that have been remitted.

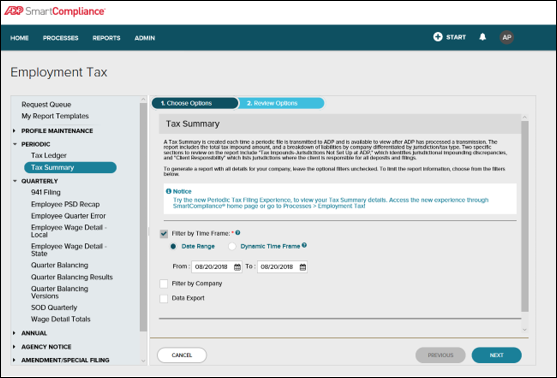

- Enter the Date Range as a filter.

- View the report that corresponds with the time you uploaded the file to ADP.

- Save or print this report.

- Compare the ADP Tax Summary Report to the ADP Tax Filing Report from WinTeam. The totals for each tax jurisdiction should match.

Tip: TEAM recommends you create a spreadsheet to compare the various tax jurisdiction totals on the WinTeam ADP Tax Filing Report to those found on the ADP Tax Summary Report. There should be no variance between your WinTeam ADP Tax Filing Report and the ADP Tax Summary Report. Any discrepancies should be reported to your TEAM ADP Tax Representative immediately.