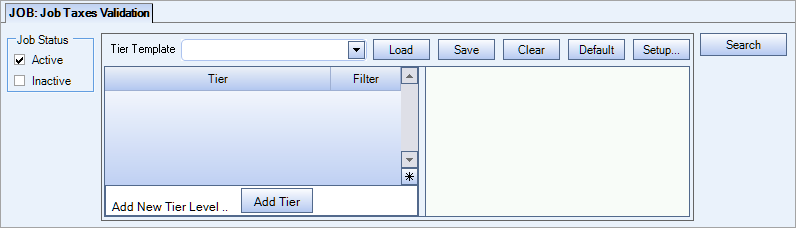

Job Taxes Validation

Overview

The Job Taxes Validation window is used to verify that all necessary tax codes used by the updated tax engine are mapped.

Note: Your jobs must have validated addresses to be included in the searching on this window.

Key Functionality

To use this window, select the appropriate Job Status(es), Tier Template and click the button.

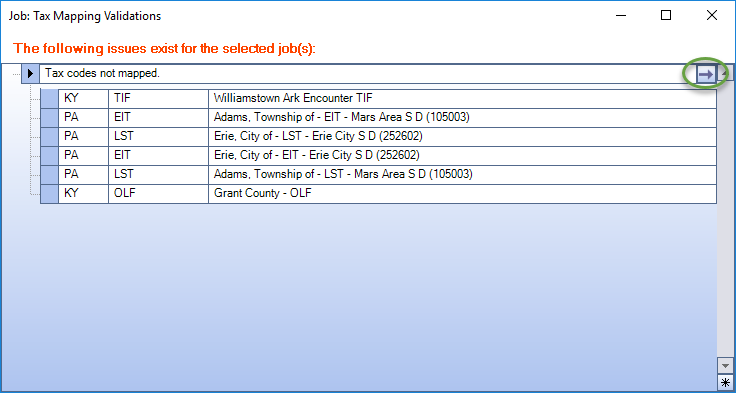

If all your job taxes are not mapped for the selected jobs, the Tax Mapping Validation window displays with a list of the unmapped taxes. Use the drill down button to open the Tax Mapping window.

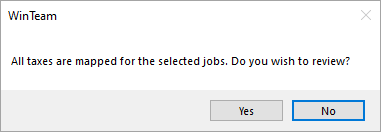

A message box displays to confirm all job taxes are mapped for the selected jobs.

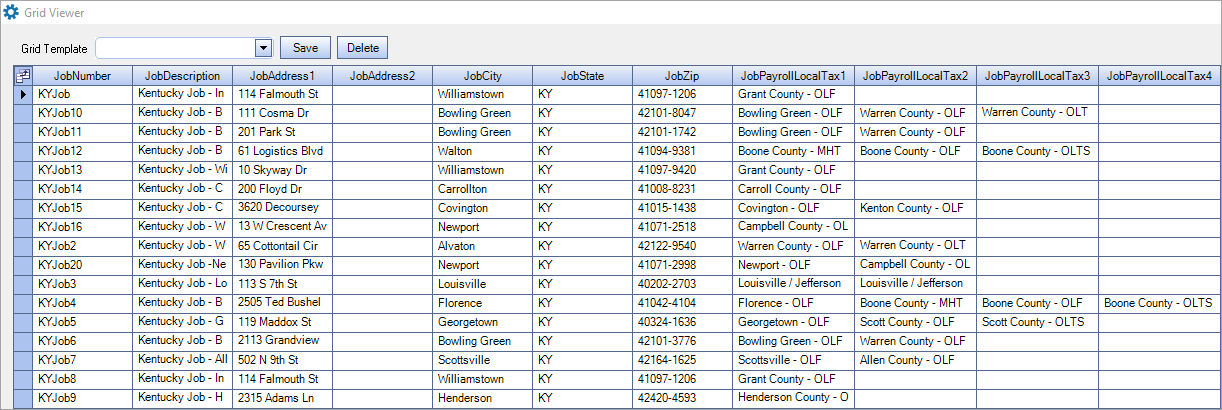

Click Yes in the confirmation message box to display a grid displays the contains the selected jobs and their applicable taxes. Only taxes that are automatically assigned are included in this grid. Taxes that must be manually assigned (e.g. JEDD, TIF, etc.) are not included.

Note: If you click No in the confirmation message box, the taxes are still mapped but the grid does not display automatically.

Continue to edit the Job Status and the Tier Template until all jobs have validated taxes.

Security

You need the security JOB Job Taxes Validation Screen added to your User Security profile and have started the payroll tax automation implementation to use the updated payroll tax engine to access the Job Taxes Validation window. This screen is in the JOB ALL security group.