Payroll Tax Automation FAQ

Pre-implementation

The updated tax engine insure(s) the taxes assigned to the employee based on the resident and work address and ensures the tax rates are updated for you each year.

Starting in 2019 we are scheduling clients into releases to insure we can provide adequate support during this process. TEAM will notify your company prior to starting this process.

Validate all Job and Employee Master File addresses, and migrate all other deductions from Payroll Taxes to Other Deductions. See this link for additional details.

During implementation

You will not need to setup new taxes, but you will need to map your existing taxes to the updated tax engine tax codes.

A tax refers to the existing WinTeam tax. A tax code is used by the updated tax engine and is assigned to the employees and jobs.

The Federal, State and some local taxes that were previously maintained by TEAM are automatically mapped for you in the Tax Mapping window.

Because of the complexity and various naming conventions that may be used there is no automated way to guarantee that the correct WinTeam tax would be mapped to the new tax codes. Many of the local names are similar which makes it difficult for the system to automatically assign mapping.

Yes, all local taxes relative to your company need to be mapped to the new tax codes to work with the updated tax engine.

Contact your tax professional for advice.

The updated payroll engine assumes nexus, then applies the reciprocity rules before withholding taxes in payroll. The Employee Master File has the required taxes based on the employee’s address. The job has all the taxes assigned in the background based on the job address. Payroll looks at both addresses when applying nexus and reciprocity.

Note: Nexus is something a business can “have”. At the most basic level, if a business has nexus in a state, it means that the business has a presence in the state, and therefore subject to state income taxes within the state. A business has nexus in a state if it owns or leases property in the state, derives income from within the state, has capital or property in the state, or employs personnel in the state in activities that exceed “mere solicitation”. Nexus requirements vary from state to state.

If you have employees living or working in a state different than your main business state, these are considered non-resident employees. In some states, the non-resident certificate allows the employee to declare that they are exempt from income taxes for the business state, and instead income taxes will be withheld for their home state.

Employees can submit a non-resident certification which insures State Income Tax is paid to the resident location.

Some employment types require an employee to pay income tax based on work location, or an employee may also be required to pay income taxes based on work location, based on the amount of time the employee worked in the state, county or city, or the employer has nexus in the state.

If the resident and work state have a reciprocity agreement a non-resident certificate may not be required.

Use the address the employee provided on the Federal (W4) and State withholding certification. See the details on the form for information on what address needs to be entered or refer to the IRS website for Federal information, or the assigned state website.

The updated tax engine stores each of the disability tax withholdings separately for reporting purposes. Taxes need to be setup for each of the new tax codes.

Example: For NJ UC you might need four different WinTeam taxes. These need to be mapped to the following tax codes.

- NJ SDI (shared tax)

- NJ SUI

- NJ FLI (Family Leave Insurance)

- NJ Work Force Development/Supplemental Work Force

SUTA surcharges and credits need to be combined into a single UC rate.

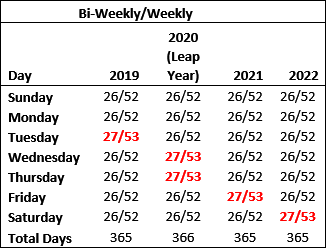

Monthly and Semi-Monthly—12 and 24 (consistent each year)

Daily—365 (366 in a leap year)

Weekly and Bi-Weekly—Calculated based on the pay frequency and the day of the check (the number of periods can fluctuate each year and between checks if the same day is not always used)

Example: You pay employees bi-weekly on Friday. In 2020, the pay periods per year is calculated to 26 as long as the check date is on a Friday. If you change the check date to Thursday (because of a holiday), then the pay periods per year for that one check is calculated to 27. This affects the amount of taxes calculated since we annualize taxes.

Post- implementation

The system automatically updates the tax codes assigned to an employee based on their new physical address. You will need to verify and possibly update the filing status, withholdings or misc. parameters.

With any physical address change your responsibility is to gather the required withholding documentation at federal and state levels. This documentation directs you to set the selected options.

With the updated payroll tax engine you can complete a cash out on vacation, sick or holiday hours with the following setup.

On the Payroll Defaults window, Payroll Tax Automation Settings tab:

- The Tax Cash out as Regular Wages check box is selected for regular wages

- The Tax Cash out as Regular Wages check box is cleared and disabled for supplemental wages

No, once the updated tax engine is active you cannot switch back to using the original tax engine.

Note: If a payroll batch was created using the original tax engine, it will continue to process and recalculate with the original tax engine whether the updated tax engine is turned on or not.