Enforcement of child support orders are a joint federal/state responsibility. With federal laws providing standards, state laws must meet or exceed in order to qualify for federal funding of the state’s child support enforcement programs. Contact your company’s legal counsel to review the order and answer any outstanding questions regarding validity, disposable earnings determinations, complying with out-of-state orders, priorities and allocation, state laws, etc. The federal requirements are explained in the following paragraphs.

Under the Consumer Credit Protection Act (CCPA), the maximum amount that can be withheld from an employee’s wages for spousal or child support is:

- 50% of the employee’s “disposable earnings” if the employee is supporting another spouse and/or children;

- 55% of the employee’s “disposable earnings” if the employee is supporting another spouse and/or children and is at least 12 weeks in arrears in making support payments;

- 60% of the employee’s “disposable earnings” if the employee is not supporting another spouse and/or children; and

- 65% of the employee’s “disposable earnings” if the employee is not supporting another spouse and/or children and is at least 12 weeks in arrears in making support payments.

If arrearages are being paid, the total of the current support and the arrearages cannot exceed the applicable maximum amount. State child support withholding laws may impose lower limits on the amount that may be withheld, but may not exceed the limits imposed by the CCPA.

Child Support Garnishment using a % of Disposable Earnings and Linking Admin Fees

Example: A child support order has been received against Michael’s wages ordering that $250 per pay period be withheld. The order states that the maximum percentage that can be withheld is 50% of Martin’s disposable pay. We want to update to AP Invoices and remit the payment to Pennsylvania SCDU.

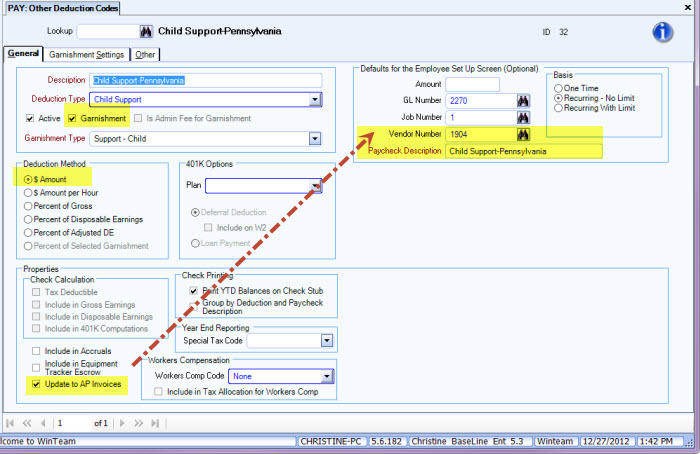

The Other Deduction Code is marked as a Garnishment and the Deduction Method is a $ Amount. You do not need to enter the actual $ Amount when setting up the garnishment. You can enter the $ Amount for the specific employee on the Employee Master File Other Deductions.

Select the Update to AP Invoices check box, and enter the Vendor # 1904 for Pennsylvania SCDU.

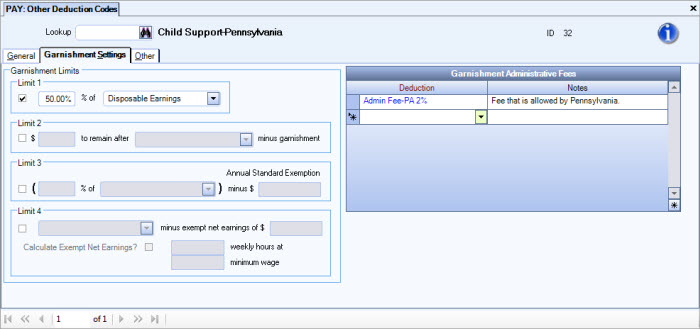

We will use Limit 1 to set up this garnishment.

The maximum amount that can be withheld for this garnishment is 50% of the employees disposable earnings.

There is an Administrative Fee attached to this garnishment.

Next, you need to add the Garnishment and associated Admin Fee to the employee's pay record.

For more information see Adding Garnishment Deductions and associated Admin Fees to Employee Deductions.