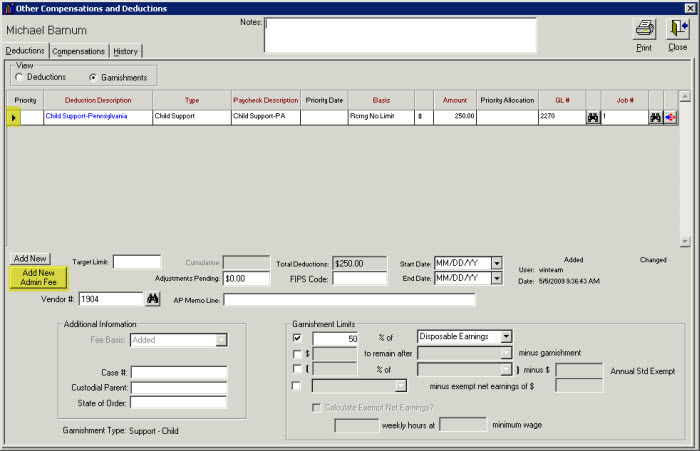

- Open the Employee Master File for the selected Employee.

- Click the Other Comps/Deds button. The screen displays with focus on the Deductions tab.

- Under View, click Garnishments.

- Select the Garnishment by clicking on the line item of the Garnishment you want to associate the admin fee with.

- Click Add New Admin Fee.

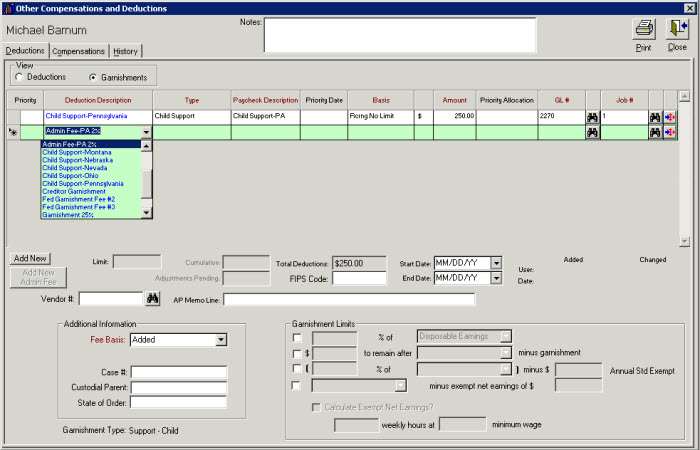

- Select the Admin Fee from the Deduction Description list. Even though both garnishments and admin fee codes are show in the list, you can only select codes set up as Admin Fees.

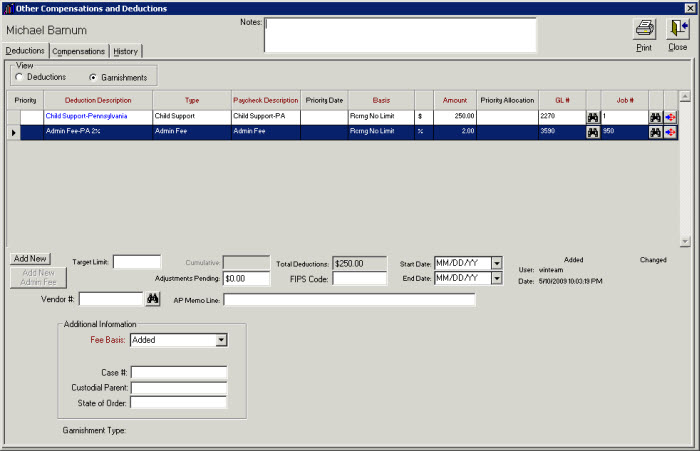

- The grid populates with the information from the Other Deduction Code.

- This particular garnishment is not set up to be Updated to AP Invoices, therefore, the Vendor # field is locked.

You are required to enter a Vendor # if you selected the option to Update to AP Invoices when setting up the Other Deduction code. However, if you do not select the Update to AP Invoices check box, the Vendor # field is locked on the employee's record and you cannot enter a Vendor #.

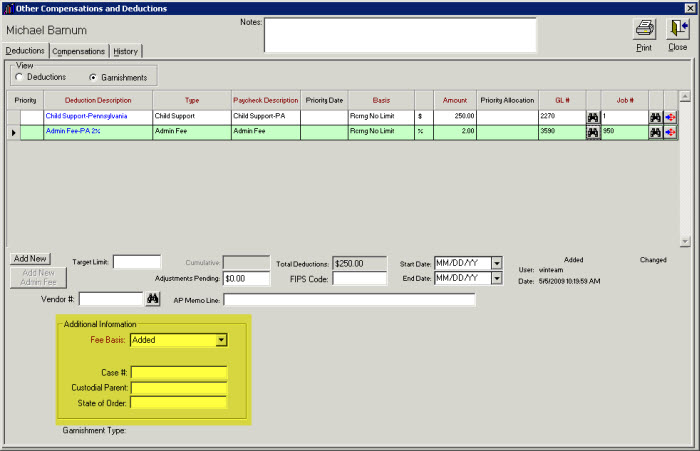

Once the Admin Fee has been added, you will need to determine if the Fee Basis is Added or Subtracted. Typically, Admin Fees are Added, and Added is the default selection.

If the Fee Basis is Added, the fee will be an additional withholding on top of the garnishment deduction. Fees can be set up so that the employer keeps the fees or pays the fees directly to a vendor to help cover their costs of administering the garnishment.

If the Fee Basis is Subtracted, you must have the Update to AP Invoices check box selected on the Other Deduction Code for the Admin Fee in order for the subtract fee to come through as a credit on the AP Invoice.

If the Fee Basis is Subtracted, the fee will be deducted from the garnishment amount before remitting to the vendor. This does not reduce the employee’s garnishment amount withheld on their check. The Subtract Fee does not update to the General Ledger when payroll is processed. It is subtracted from the Vendor’s garnishment payment at the time of AP Update to Invoice Entry (Payroll Deductions option). The Subtract fee comes through as a credit on the Vendor’s AP Invoice created for the garnishment.

Example: $100 garnishment with a 5% employer fee subtracted (fee paid by the creditor), would result in a distribution of $95.00 to the creditor and $5 to the employer. A $100 garnishment with a 5% employer fee added (paid by the employee), would result in a $105.00 deduction distributed with $100 to the creditor and $5 paid to the employer (or agency).

Although not required, it is a good idea to enter the Case #, Custodial Parent, and State of Order to the record. This information does not print on a report.

Close the record.