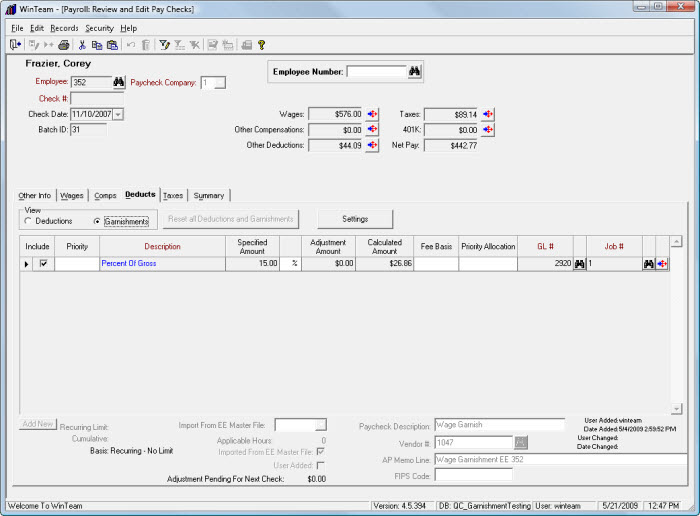

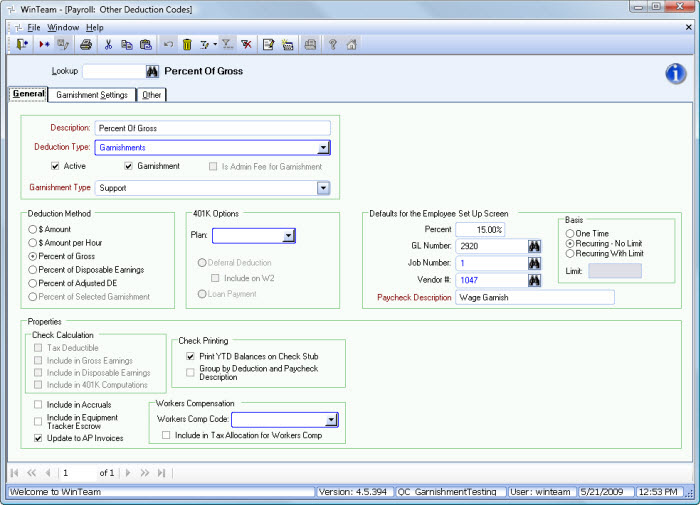

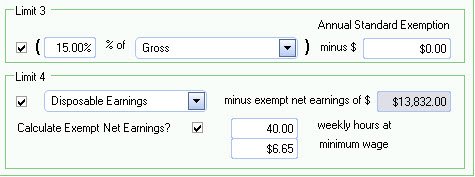

This employee has a garnishment using a Percent of Gross and subject to Garnishment Limits 3 and 4. Based on this setup, the Garnishment is based on the lowest limit, which is Limit 4.

The Garnishment is based on 15% of the employees Gross Pay, but subject to Limits 3 and 4.

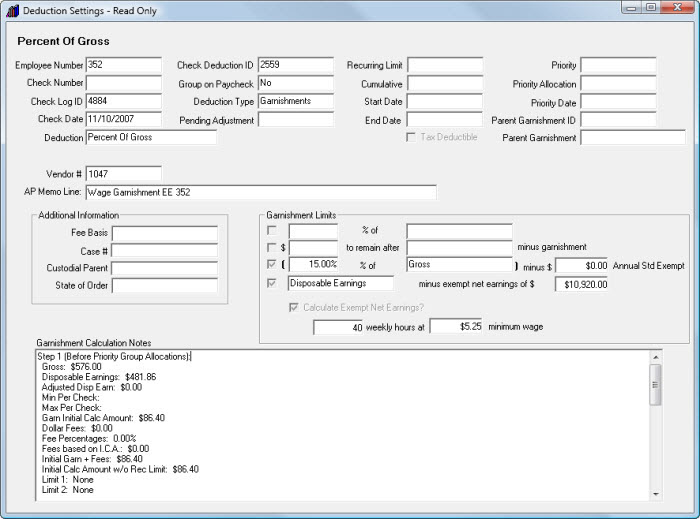

Click the Settings button to display the Deduction Settings and Garnishment Calculation Notes for the selected Garnishment or Admin Fee.

The Deduction Setting screen displays the information that was stored with the check record (at the time of the creation and/or recalculation). It also includes notes on the garnishment calculation. This is especially useful if you need to determine exactly how amounts were computed.

Double-click (or press Shift + F2) in the Garnishment Calculation Notes view the notes in Zoom mode. WinTeam goes through a series of steps in garnishment calculations. Not all Steps are applicable to each Garnishment.

Garnishment #1 Calculation

Step 1 (Before Priority Group Allocations):

Gross: $576.00

Disposable Earnings: $481.86

Adjusted Disp Earn: $0.00

Min Per Check:

Max Per Check:

Garn Initial Calc Amount: $86.40

Dollar Fees: $0.00

Fee Percentages: 0.00%

Fees based on I.C.A.: $0.00

Initial Garn + Fees: $86.40

Initial Calc Amount w/o Rec Limit: $86.40

Limit 1: None

Limit 2: None

Limit 3: $86.40

Limit 4: $26.86

Lowest Limit: $26.86

Garn + Fees before this Group: $0.00

Garn + Fees before this Garn, in this Group: $0.00

Amount Left For this Garn And Fees: $26.86

Step 2e (Allocation of Garn and Fee):

# Garns in Group: 1

Limits Hit for Group: Yes

Amt Allocated: $26.86

Step 3b:

Limits altered Admin Fee calculations, and/or Garnishment was affected.

Add Fees after Limits: $0.00

Garnishment Amount: $26.86

Step 4:

Adjustment Amount: $0.00

Recurring Limit:

Cumulative:

Garnishment Amount: $26.86