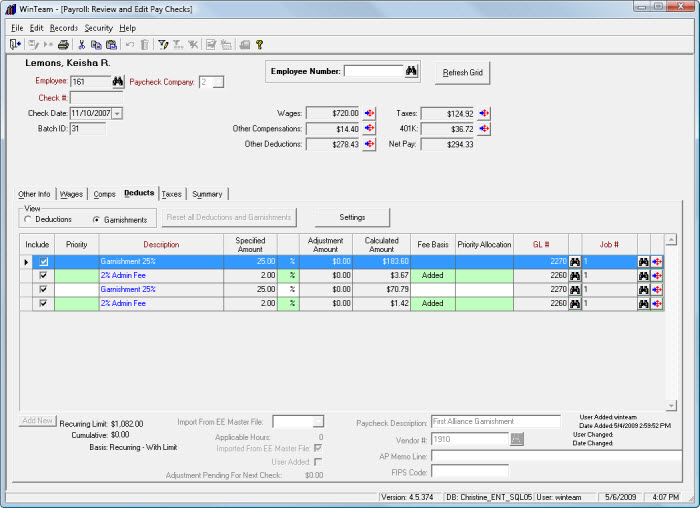

This employee has two garnishments, each with a linked Admin Fee. There is no Priority assigned, so the garnishments are handled in the order they are received. Based on the setup, one garnishment amount can be satisfied in full and the other partially due to the Garnishment Limits met.

Since the Priority column for both garnishments are "blank", the garnishments are satisfied in the order they were entered into the system. Both garnishments use the following limits:

Garnishment # 1 Calculation

Step 1 (Before Priority Group Allocations):

The system goes through the following process:

- Determines Gross income.

- Calculates Disposable Earnings.

- Determines the garnishment initial calculated amount (I.C.A.) based on the Deduction Method.

- Determines the Administrative Fee I.C.A. based on the Deduction Method and garnishment I.C.A.

- Sum of garnishment I.C.A. and admin fee I.C.A.

- Determine I.C.A. before recurring limits are checked.

- Apply Limits.

Wages + Other Compensations = Gross

720.00 + 14.40 = Gross: $734.40

Gross - Taxes = Disposable Income

734.40 - 124.92 =: Disposable Income $609.48

This garnishment is 25% of Gross.

Gross x 25% = Garnishment I.C.A.

$734.40 x 25% = Garnishment I.C.A. $183.60

Garnishment I.C.A. x Admin Fee % = Administrative Fee I.C.A.

183.60 x 2% = $3.67 Administrative Fee I.C.A.

$183.6 + $3.67 = $187.27 initial calculated garnishment and admin fees

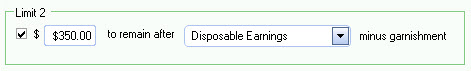

In this example we only used Limit 2. Apply Limit 2.

Disposable Earnings minus $ amount to remain = garnishment limit

$609.48 - $350.00 = $259.48

The Lowest Limit is always used. In this case the Lowest Limit is $ $259.48. This is the maximum amount that can be used for garnishments and fees.

Step 2 (Allocation of Garnishments and Fees)

Determine that we have allocated $187.27 of the funds to apply towards garnishments and fees.

Step 3 (System checks for recurring limit)

The 1st garnishment has a recurring limit in the amount of $1,082.00.

$183.60 will be applied towards that limit.

Notice that the admin fee does not reduce the actual garnishment amount that is to be collected.

Admin Fees #1 Calculation

Step 1. No Garnishment Limits were hit.

Min Per Check:

Max Per Check:

Fee Amount: $3.67

Garnishment #2 Calculation

Step 1 (Before Priority Group Allocations):

Gross: $734.40

Disposable Earnings: $609.48

Adjusted Disp Earn: $0.00

Garn Initial Calc Amount: $183.60

Dollar Fees: $0.00

Fee Percentages: 2.00%

Fees based on I.C.A.: $3.67

Initial Garn + Fees: $187.27

Initial Calc Amount w/o Rec Limit: $183.60

Limit 2: $259.48

Lowest Limit: $259.48

Garn + Fees before this Group: $187.27

Garn + Fees before this Garn, in this Group: $0.00

Amount Left For this Garn And Fees: $72.21

Step 2e (Allocation of Garn and Fee):

# Garns in Group: 1

Limits Hit for Group: Yes

Amt Allocated: $72.21

Step 3b:

Limits altered Admin Fee calculations, and/or Garnishment was affected.

Add Fees after Limits: $1.42

Garnishment Amount: $70.79

Step 4:

Adjustment Amount: $0.00

Recurring Limit: $1,435.50

Cumulative: $0.00

Garnishment Amount: $70.79