Overview

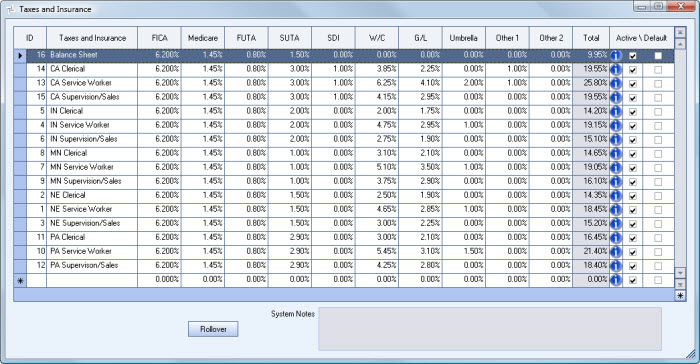

Use the Taxes and Insurance screen to view/edit tax and insurance codes and their applicable percentages. Tax and Insurance Codes are required when setting up a new Job.

The main purpose of the Taxes and Insurance Type screen is to include the employer's portion of payroll taxes and insurance when running Job Cost Reports (On Screen Job Cost Report and/or Job Cost Analysis Report).

In addition to Job Costing, the information is used to identify payroll tax and insurance costs for each management level on the Profit and Loss Financial Statements.

It does not effect the General Ledger, nor does it effect the actual processing of payroll. Therefore, these figures are used solely for estimating and budgeting in Job Costing.

The system does not store these estimated Tax and Insurance dollars with each labor record, but instead calculates and stores them with each Daily Budget record.

Any changes made to this information are not reflected in Daily Budgets that have already been calculated (Posted - Not Editable).

When Payroll is run, the system calculates and stores the Actual (rather than estimated) Payroll Tax and Insurance dollars (FICA, Federal, Medicare, SUTA, FUTA, State, State UC, etc) to the General Ledger with ONE job instead of to each individual job. Because of this, we use the Job Tax and Insurance Type Total (%) to estimate the payroll taxes and insurance for job costing.

The Taxes and Insurance screen can be accessed from the Job Master File (Accounting Info tab) screen. Double-clicking in the Taxes and Insurance Type field displays the Taxes and Insurance screen.

Note: If you are using the Tax Allocation Program, the Taxes and Insurance screen has some different functionality. For details on Taxes and Insurance using the Tax Allocation Program, see Allocating Payroll Taxes and Insurance.

Key Functionality

WinTeam automatically assigns an ID to each new record, and uses the ID field to identify each record. You may change system-assigned ID Numbers.

Use this description when selecting a Tax and Insurance Type on the Job Master File (Accounting Info) screen. The Description should be specific to the Worker Compensation Class and State (i.e. NE Service Worker). For more information, see Setting Up Payroll Taxes and Insurance.

This is the applicable tax percentage for the Employers portion of FICA. The system does not look at the limit of wages during the calculation.

This is the applicable tax percentage for the Employers portion of Medicare. The system does not look at the limit of wages during the calculation.

This is the applicable percentage for Federal Unemployment Tax. The system does not look at the limit of wages during the calculation.

This is the applicable percentage for State Unemployment Tax. The system does not look at the limit of wages during the calculation.

This is the applicable percentage for State Disability Insurance.

This is the applicable percentage for Worker's Compensation.

This is the applicable percentage for General Liability.

This is the applicable percentage for Umbrella.

This is the applicable percentage for any Other Taxes and Insurance items, which are not included in any other column.

This is the total Taxes and Insurance Percentage, based on the percentages displayed for the selected line of information. If you change a percentage, the system automatically updates this field.

Hover over the Change Information icon to see User Added, Date Added, User Changed and Date Changed information. WinTeam records the logon name of the user entering or changing this record. The Date Added is the original date this record was entered into the system. The Date Changed is the date the record was last changed. Right-click on the Change Info icon to filter for records added or changed by a specific user or date.

When you hover over the User Changed or Date Changed filters, you can:

- Filter By Selection - Filters for all records that match your current records field value.

- Filter by Exclusion - Excludes from your filter all records that match your current records field value.

- Filter For - Filters based on the text/value you enter.

- Sort Ascending - If you already have a filter applied, the Sort Ascending command is available. Also used to include all records in the filter and sort in ascending order based on the current records field value.

- Sort Descending - If you already have a filter applied, the Sort Descending command is available. Also used to include all records in the filter and sort in descending order based on the current records field value.

Select the Active check box to indicate that the Taxes and Insurance Type is active.

Click the Rollover button to make a copy of the selected record. This saves time by not having to retype like information. Make sure to give the new record a different description.

For each Tax & Insurance record, the system records in the System Notes field the User Name, Date, and other pertinent information that relates to the record. You cannot modify this information.

In addition, each time a user makes a change to an existing record, the system records these changes in the System Notes field, including a description of the change that occurred.

Security

The JB Taxes and Insurance screen has its own Security Group, JOB Taxes and Insurance.

The JB Taxes and Insurance screen is part of the JOB ALL Security Group.

The JB Jobs Taxes and Insurance add/edit list is part of the SYS Add Edit List ALL Security Group.