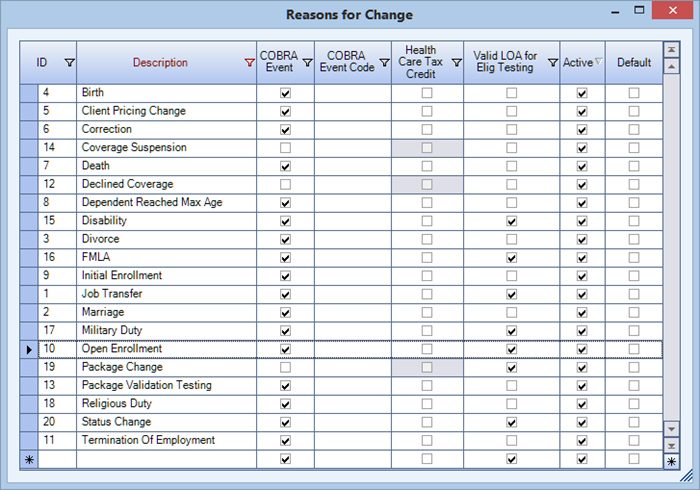

A reason for change, also called a reason code, is a description of the event that caused you to change an employee's benefit, and details about whether the event qualifies eligible employees and their families for COBRA benefits, a health care tax credit, and leave-of-absence eligibility testing. You can manually enter a reason code.

Example: Some examples of reasons for change could include termination, divorce or initial enrollment.

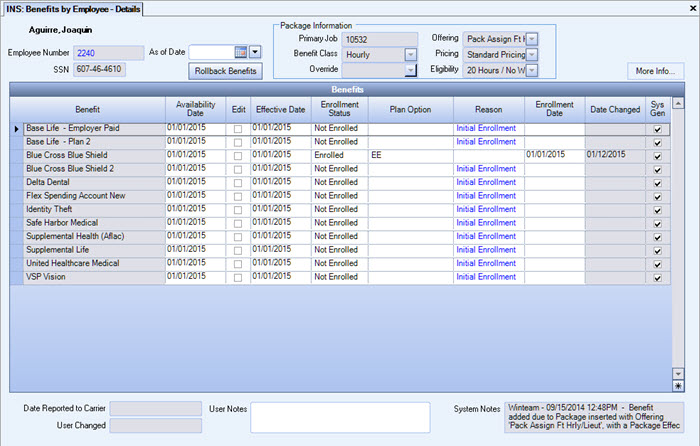

Note: Before you set up a reason code, you must associate a benefits package with an employee.

To set up a reason for change:

- On the Benefits by Employee Details screen in the Benefits grid, double-click in the Reason field. The Reasons for Change Add/Edit list appears.

- In an empty row, type a Description for the new reason for change, and then press Tab. The system automatically assigns a unique identification number that appears in the ID box, and the Active check box is selected by default.

- To indicate that event qualifies the employee (and family, if applicable) for COBRA benefits, do the following:

- Select the COBRA Event check box.

- In the COBRA Event Code field, type text for your information only.

- To indicate that the change causes the employee to qualify for the Health Coverage Tax Credit (HCTC), select the Health Care Tax Credit check box.

- To indicate that the reason for change is a leave of absence that is valid for eligibility testing purposes, select the Valid LOA for Elig Testing check box.

- To make the new reason for change the default value, select the Default check box.