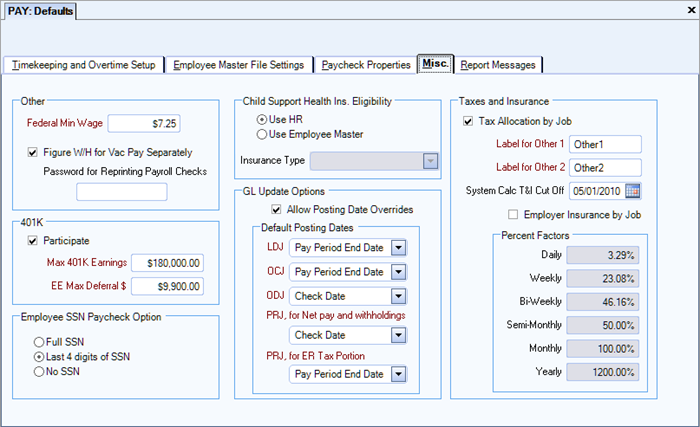

If the Tax Allocation by Job check box is selected, the System Calc T & I Cut Off field is looked at for Job Costing and Financial Reports. Clients who are currently using the Tax Allocation program more than likely did not start using it at the beginning of a fiscal year. Without this option, the taxes and insurance actuals are incomplete for each Job and other tiered reports. However, the company report would be accurate since you had to create an adjusting journal entry (if you were not using the Tax Allocation program) to "book" the employer's portion of taxes and insurance.

Enter the last date you want the system to look at for computing the system calculated actual tax and insurance dollars. This information is stored in every labor posting in the General Ledger. Whether or not it is used on reports, depends upon what is entered here. The system will not use any system calculated actual tax and insurance dollars if you do not enter a date.

Including System Calculated Actual T & I

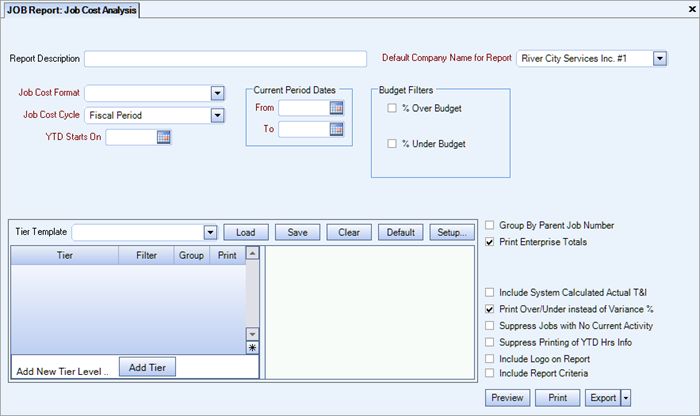

The Include System Calculated Actual T & I check box is visible on the Job Cost Report and the On Screen Job Cost Report if the Taxes and Insurance check box for Tax Allocation by Job is selected on the Payroll Defaults (Misc. Info tab) screen. With this option selected, it will ALWAYS pick up ALL system calculated Actual Taxes and Insurance. The new System Calc T & I Cut Off date will not be looked at in this case.

You will need to select this check box to print the system calculated actual tax and insurance dollars. If the Job Cost format that you are using includes a line using Type, Taxes and Insurance, the actual system calculated tax and insurance dollars will print.

If this check box is not selected, the report includes only the budgeted system calculated tax and insurance dollars.

If your Job Cost format is including the G/L Accounts of your Tax Allocation journal, you will NOT want to select this new check box, as this would overstate your payroll tax and insurance Actuals.

If this check box is NOT selected AND you are using the Tax Allocation program (Pay Defaults - Tax Allocation by Job is selected), the date entered in the System Calc T&I Cut Off will determine whether or not any system calculated Actual Tax and Insurance dollars will be picked up on the report.

Other Reports

The Budget Income Statement, Budget Income Statement:Current vs. Prior, Comparative Income Statement, Cross Tab Income Statement, and the Trend Income Statement will all look to the System Calc T&I Cut Off field (Payroll Defaults (Misc tab)) for knowing what system calculated actual taxes and insurance should be included.

All Income Statements will always look to this date if your database is set up for Tax Allocations and if the financial formats include the system calculated T & I (properties 9 and 10).

A date must be entered in order to include system calculated actual tax and insurance dollars.