Overview

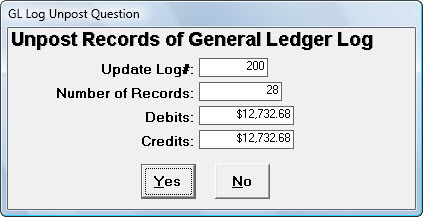

The GL Log Unpost Question window displays when you click the Unpost button in the Journal Update Log window. In it, you verifies the log #, number of records, debit amount, and credit amount prior to unposting.

Special Note when unposting a Payroll Batch

If you are unposting a Payroll batch, the recurring with limit deductions and compensations are restored as they were before the posting occurred. This will prevent the occurrence of a Recurring With Limit cumulative being updated more than once.

The system will also put back all one-time compensations and deductions that were deleted when the original payroll was posted.

Special Note when unposting an Accounts Payable Checks (APC) batch

You can unpost an APC batch even if there are checks in that batch marked as "voided", but you CANNOT unpost an AP Void Check batch.

Effects unposting has on Compensations

- Any one-time compensations that were imported from the Employee Master File and part of the batch being unposted, will be put back into the Employee Master Files (since these would have been deleted with the posting of the payroll batch).

- The cumulative totals for any Recurring with Limit compensations will be put back as they were prior to the posting, as long as the compensation was imported from the Employee Master File and part of the batch being unposted.

- If a Recurring No Limit Compensation had been deleted during the payroll batch update due to it having an ending Date that was within the pay period From and To, it will also be put back.

Effects unposting has on Deductions

- Any one-time deductions that were imported from the Employee Master File and part of the batch being unposted, will be put back in to the Employee Master File (since these would have been deleted with the posting of a payroll batch.

- Any Adjustment for a Recurring - No Limit deduction, if the deduction was imported from the Employee Master File and part of the batch being unposted, will be put back.

- The cumulative totals for any Recurring With Limit deductions will be put back as they were prior to the posting, as long as the deduction was imported from the Employee Master File and part of the batch being processed.

- If a Recurring No Limit deduction had been deleted during the payroll batch update due to it having an ending Date that was within the pay period From and To, it will also be put back.

Key Functionality

Update Log#

Displays the Update Log # of the records to unpost.

Number of Records

Displays the number of records to unpost.

Debits

Displays the total debit amount of the records to unpost.

Credits

Displays the total credit amount of the records to unpost.

Yes button

Click the Yes button to unpost the records for this Update Log#.

If this log is associated with other journal logs, the system displays a message identifying the associated logs and asks whether to proceed. Click OK to proceed unposting this log and the associated logs. Click Cancel to abort unposting this log and the associated logs. Follow the onscreen prompts to complete the process and return to the Journal Update Log screen.

No button

Click the No button to cancel the unposting of this log. The system displays a message stating that the operation was canceled and that no records were updated. Click OK to return to the Journal Update Log screen.