Using the Processing Fee – CC Adjustment Type

Overview

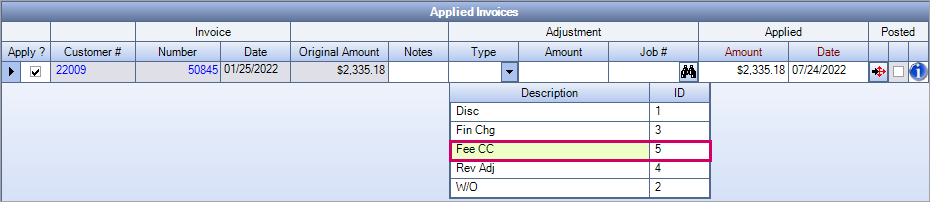

The Fee CC (short description) or Processing Fee - CC (long description) is an adjustment type (Type 5) for use on accounts receivable credit card payments. The purpose of the adjustment is to help you allocate credit card processing fees directly to paid invoices to improve job costing calculations. Unlike other adjustments, this adjustment type does not reduce the payment amount. It is posted differently than the other types–they are deducted from the company's cash account as a direct expense, rather than impacting trade account balances.

Important: This adjustment type is enabled using a custom setting. It is important to fully understand the implications of using this adjustment type before you enable the custom setting. If the custom setting is enabled and then later disabled, you must re-enable the custom setting to edit or delete records that include the Fee - CC adjustment type.

When the custom setting is enabled, you will see changes to AR Defaults, AR Payments, the AR Payments Report, and the Cash Posting Journal and Payments Journal generated by the AR Update to GL.

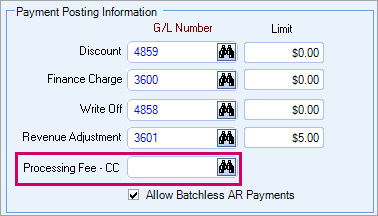

AR Defaults

The Processing Fee - CC adjustment type is used to apply merchant settlement fees specific to credit card processing and does not influence the amount of the payment itself.

You must enter a G/L Number for the adjustment type–it can be the same or different G/L Number that is used for any other adjustment types (expense or contra-revenue). The Limit does not apply to Processing Fee - CC adjustments, but when used, the system will not allow the applied adjustment amount to exceed the amount of the applied payment.

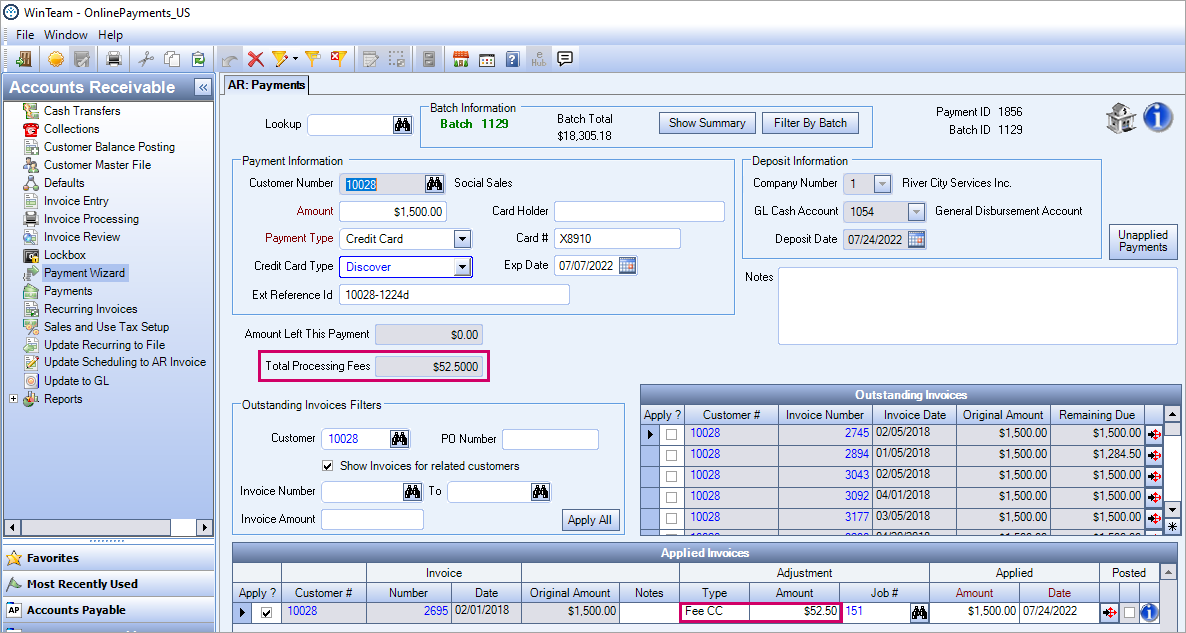

AR Payments

Manually Applying Fee to Credit Card Payment

Typically every credit card transaction has a processing fee charged by the payment facilitator, which we refer to as a merchant or processing fee. This fee may be settled every day or once per month. If you know the fee at the time of entering your AR Payment record, you can enter it using the Fee CC adjustment. Using the new adjustment type has no effect on the payment amount or how that original payment was allocated across invoices (it does NOT impact the AR trade accounts). The original payment amount in the invoice header is unchanged and continues to reflect the total amount paid by the customer. Applying the Fee CC adjustment does not impact the original payment application to the invoices (the Amount Left This Payment balance and the Unapplied Cash balance are not impacted).

After you enter the Fee CC adjustment amount, the job number associated with the adjustment defaults to the Primary Service Location job associated with the applied invoice. The adjustments cannot exceed the applied payment amount for the invoice.

For each payment the applied Fee CC amounts are summed and display next to the Total Processing Fees field.

Note: The Unapplied Fees field is visible in the Advanced Filter, but it does not apply unless the fees are system-generated as part of the Online Payments enhancement.

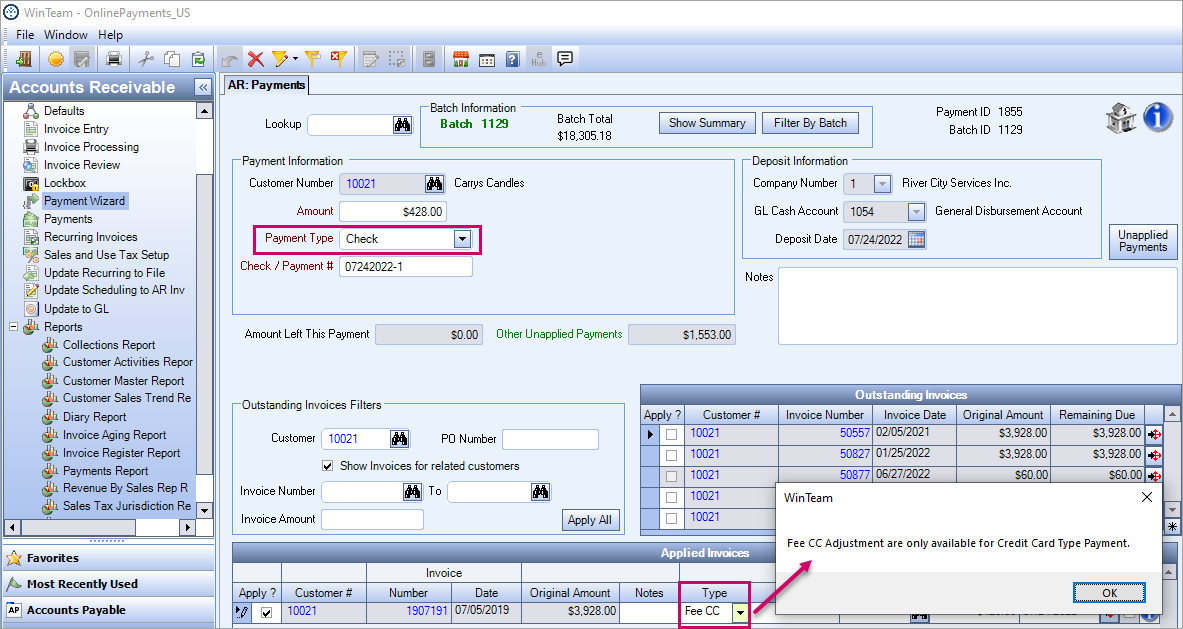

The Fee CC adjustment type can only be applied to credit card payments. An error message displays if you attempt to apply it to a different payment type.

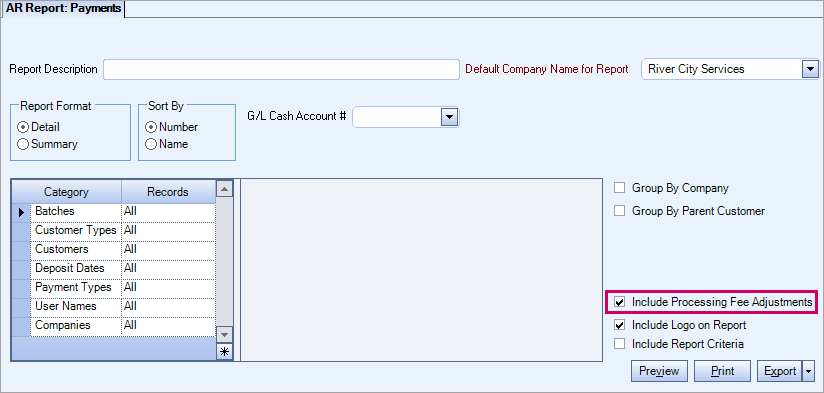

AR Payments Report

In the AR Payments Report window, the Include Processing Fee Adjustments check box is selected by default to include the processing fee adjustments. If the processing fee is not used, the report is not impacted. However, if the WinTeam database contains payments that use the Fee CC adjustment, then this option produces different results in the report.

The following four fields in the grid view export of the detail format support the Fee CC adjustment type:

- ExternalReferenceId–This field is an optional field for manually-entered credit card payments. This value is automatically populated on each payment transaction as part of the Online Payment integration to include a 36-character number that can be cross-referenced in the Merchant Portal. Since the grid view shows one row for each applied invoice, this value repeats because it applies to the total payment.

- ProcessingFee–Aligned with the Total Processing Fee that displays on the AR: Payments window when the Fee - CC adjustment type is applied to a payment. Since the grid view shows one row for each applied invoice, this value repeats because it applies to the total payment.

- UnappliedFee–The portion of the processing fee that has not been applied in the Applied Invoices grid in the AR: Payments window. This value is always 0.00 if the Fee - CC adjustment was added manually. This value is only calculated when the Processing Fee has been applied by the system as part of the Online Payments integration. Since the grid view shows one row for each applied invoice, this value repeats because it applies to the total payment.

- NetDeposit–The payment amount less the total processing fees that have been applied to the payment. Where the payments are submitted through the Online Payments integration, the NetDeposit values align with the net deposit amount calculated in the Merchant Portal for each settled transaction.

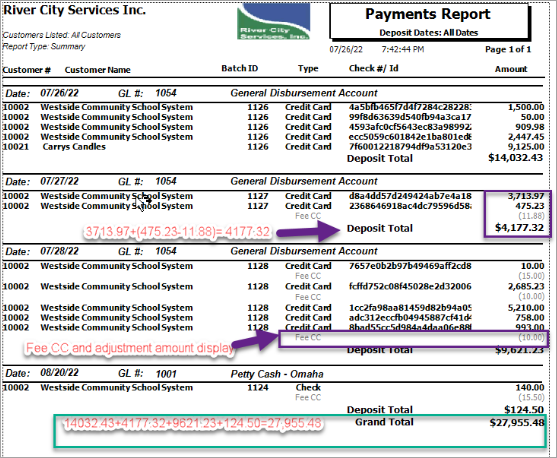

The Fee - CC adjustment type is included in the Summary report format.

Document: Summary Report Format with Fees Example

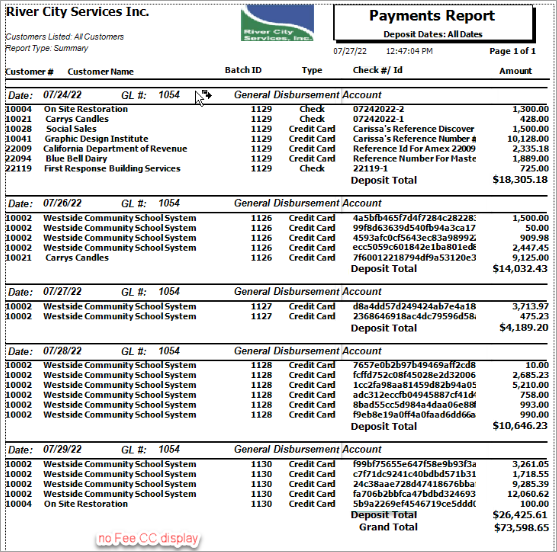

Document: Summary Report Format No Fees Example

If the Include Processing Fee Adjustments check box is selected and the Fee - CC adjustments have been applied to payments included in the report, then:

- The payment amount equals the actual amount charged to the payer's credit card

- A row is inserted below the payment item that contains the total adjustment amount each payment where processing fee adjustment were applied

- The Fee CC label is contained in the Type column.

- The total adjustment amount for the Fee - CC adjustment displays as a negative value in the Amount column. This value is the total fee associated with the payment itself (both applied and unapplied) and is equivalent to the ProcessingFee in the grid view.

- The Deposit Total is the net amount deposited into the bank account (e.g., payment minus total processing fees) for each grouped batch and is equivalent to the NetDeposit values in the grid view.

- The Grand Total is the sum of the Deposit Total amounts which is the sum of all the payments minus the processing fees logged under the adjustment type.

If the Include Processing Fee Adjustments check box is cleared, regardless of the use of the Fee - CC adjustment type, then the report ignores the adjustment fee.

- The payment amount equals the actual amount charged to the payer's credit card

- The Deposit Total equals the sum of the actual payment amounts

- The Grand Total equals the sum of the Deposit Total amounts (ignoring any processing fee adjustments)

This report format aligns to the PDF summary view for easy export to Excel.

Document: Export to Excel with Fees Example

Document: Export to Excel No Fees Example

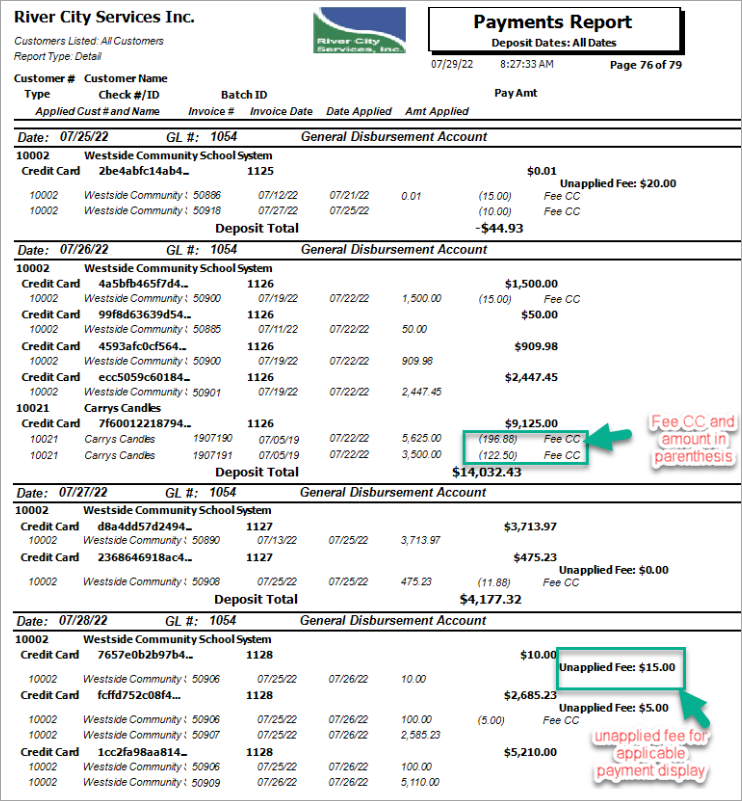

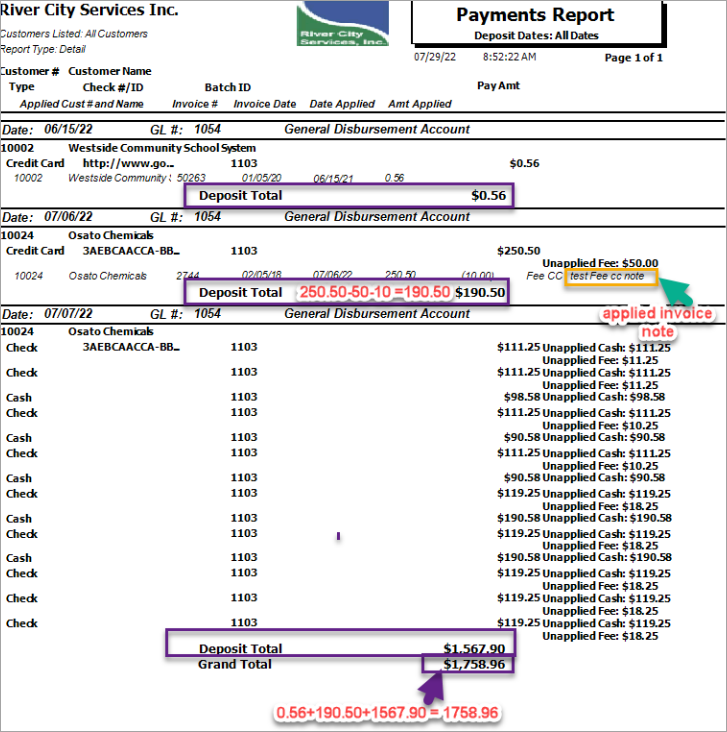

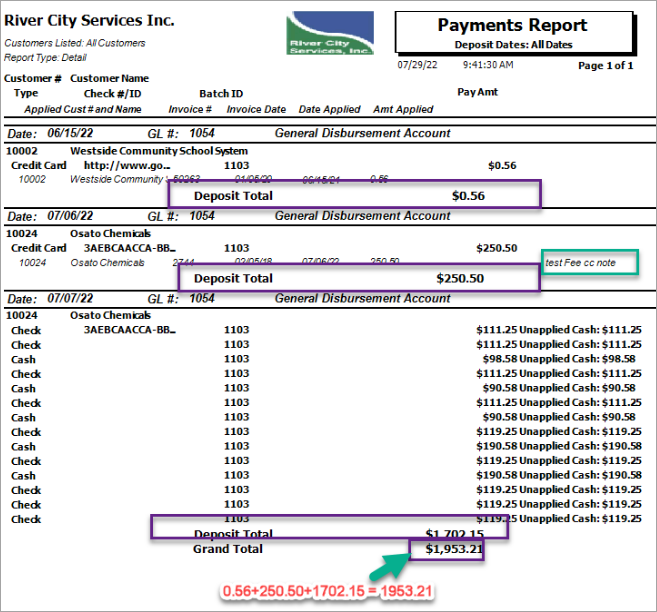

The Fee - CC adjustment type is included in the Detail report format.The Check Amt column is labeled Pay Amt.

Document: Detail Report with Fees

Document: Detail Report No Fees

If the Include Processing Fee Adjustments check box is selected and the Fee - CC adjustments have been applied to payments included in the report, then:

- The payment amount equals the actual amount charged to payer's credit card.

- The Fee CC adjustment label is inserted in the same location as other adjustments with the amount in parentheses to indicate a negative value for each payment where the processing fee adjustment was applied.

- The total adjustment amount for the Fee - CC adjustment displays as a negative value in the Amount column. This value is the total fee associated with the payment itself (both applied and unapplied) and is equivalent to the ProcessingFee in the grid view.

- A new row labeled Unapplied Fee is inserted for each payment where the processing fee adjustment has not been applied in full and contains the amount that has yet to be applied (similar to Unapplied Cash balances).

- The Deposit Total equals the net amount deposited into the bank account (e.g., the payment minus total processing fees) for each grouped batch and aligns to the NetDeposit values included in the grid view.

- The Grand Total equals the sum of the Deposit Total amounts which is the sum of all the payments minus the processing fees logged under the Fee - CC adjustment type.

Note: The deposit total matches the payment amount if the settlement fees have not yet been applied.

If the Include Processing Fee Adjustments check box is cleared, regardless of the use of the Fee - CC adjustment type, then the report ignores the adjustment fee.

- The payment amount equals the actual amount charged to the payer's credit card.

- The Deposit Total equals the sum of the actual payment amounts.

- The Grand Total equals the sum of the Deposit Total amounts (ignoring any processing fee adjustments).

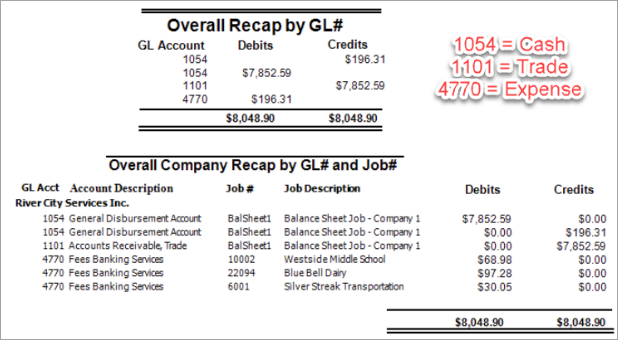

AR Update to GL

GL Posting Single Company

Posting the Fee - CC adjustment type is different from posting the other types of adjustments. It does not impact the associated trade account, instead the cash account is reduced by the amount of the fee and the GL account assigned to the adjustment type is increased.

Debit side of the adjustment:

- GL Number: The GL number of the bank fee from AR Defaults (GL assigned to the Fee - CC adjustment)

- Job Number: The job number from the AR: Payments Applied Invoices grid (default is the primary job of the invoice)

Credit side of the adjustment:

- GL: The cash account of the payment record (this is different from other adjustments which are offset by changes to the trade account)

- Job Number: The balance sheet job number of the company number of the payment record (this is different from other adjustments which use the primary job of the invoice)

GL Posting Multi-Company

If adjustments result in the adjustment job’s company not matching the payment company, then a due to / due from transaction is generated - regardless of the invoice associated with the payment.

Since the Fee - CC adjustment type is different from the other adjustment types, and impacts the cash account, multi-company transactions are handled differently. The fees that were credited (deducted) from the cash that the receiving company posted needs to be similarly deducted in the due to / due from transactions along with the transactions to move the AR Trade balances.

Document: Update Multi-Company Not Advanced Example

Document: Update Multi-Company Advanced Example

Payments Journal

The Fee - CC adjustment type is included in the Payments Journal. The Check # column is labeled Check / Ref # and contains the External Reference ID for credit card payments (as much as can be fit on the PDF report).

Document: Payments Journal with Fees Example

Cash Posting Journal

The Fee - CC adjustment type is included in the Payments Journal reprint report where the Posting Source is CPJ (Cash Posting Journal).

Document: Cash Posting Journal with Fees Example