It is important that you reconcile the Accounts Payable balance with the General Ledger balance each month.

To Balance Aging with the General Ledger:

- Ensure all invoices are entered in the system.

- Ensure all invoices, payments and voids have been updated to the General Ledger.

- Use the AP Vendor Aging Analysis Report with an older Date Range in order to capture all transactions for this report. The TO date will default to the Aging Date and the Outstanding Thru date. You will want to use a TO Date through the end of the fiscal period.

- Create a GL Report (could be Trial Balance or Balance Sheet) to view the balance of the Accounts Payable Trade account, using the date range for the period you are trying to balance. The balance on the GL Report for the Accounts Payable Trade account should match the ending total on the Aging Analysis Report.

- If you are out of balance, you may have invoices with an invoice date in a different month than the posting month. You will need to select the G/L Reconcile check box (the default setting is cleared) to view items aged by the posting date.

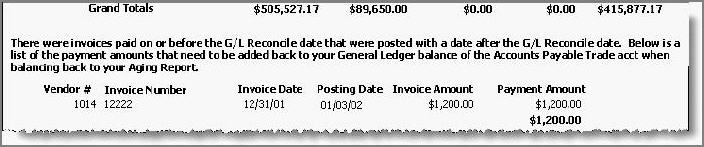

- If there are any payments that were made on or before the G/L Reconcile date for invoices that were posted with a date after the G/L Reconcile date, these will be listed at the bottom of the report. You will have to ADD this amount in to your General Ledger balance in order to get a good comparison between your Aging and your Accounts Payable Trade balance in the G/L.

Example: You may have an invoice that was dated 3/30/15 and for whatever reason have decided to POST this with a 4/01/15 date. A payment then is made dated 3/31/15 for this invoice. This situation causes reconciliation issues when trying to reconcile your General Ledger A/P Trade account with your Aging balance as of the end of each fiscal period. If the G/L Reconcile option is selected you will receive a listing at the end of this report indicating any invoices that were paid on or before the G/L Reconcile Date, but were not posted until after the cut-off date.

Note: If you are out of balance and you were in balance the previous month, then something else has occurred.

If you are still out of balance:

Check the to see if any Adjusting Journal Entry may have caused you to be out of balance or any other type of entry that posts to the Accounts Payable account that was NOT generated by the APC - Accounts Payable Checks Written, APJ - Accounts Payable Invoice Journal, or APV - Accounts Payable Voids.