What is Employer Sponsored Health Coverage?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan. Reporting the cost of health care coverage on the Form W-2 does not mean that the coverage is taxable. The value of the employer’s excludable contribution to health coverage continues to be excludable from an employee's income, and it is not taxable. This reporting is for informational purposes only and will provide employees useful and comparable consumer information on the cost of their health care coverage. Employers that provide "applicable employer-sponsored coverage" under a group health plan are subject to the reporting requirement.

Reporting on Form W-2

The value of the health care coverage will be reported in Box 12 of the Form W-2, with Code DD to identify the amount. There is no reporting on the Form W-3 of the total of these amounts for all the employer’s employees. In general, the amount reported should include both the portion paid by the employer and the portion paid by the employee.

Entering the Total Amount of Health Care Costs to Print on an Employee's W-2 Form

WinTeam provides the functionality to import tax adjustments from a csv file. This could be useful if you are just starting to use WinTeam and have many entries to make. However, it can be used at any time, including importing special items to be printed on the Employee W-2, like the Employer Sponsored Health Coverage amount. You can enter the record manually, or you could create a spreadsheet to import and have WinTeam create the tax adjustments automatically.

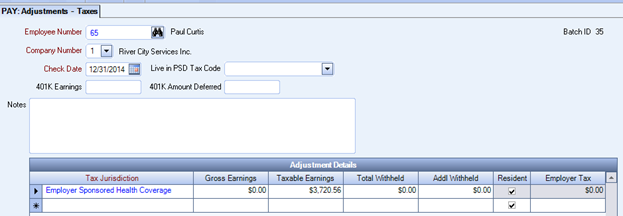

For example, employee Paul Curtis has insurance through your company and the total cost for the year that you had to pay for his insurance coverage was $3,720.56.

Creating a Tax Adjustment Batch:

- From the Payroll Menu, click Check Processing Wizard.

- From Functions select Create a New Batch, and from Batch Types, select Adjustments. Click Next.

- Select Adjustment Type: Tax, enter any notes you want to save with the batch and click Finish. The Tax Adjustments screen displays.

- Enter the Employee Number of the person for whom you want to add the special item for Employer Sponsored Health Coverage. Use a date that is in the year in which you want to report it. Normally, the last day of the calendar year is used, but it can be any day as long as it is in the correct calendar year.

- If the database is multi-company, by default, the system will display the employee’s current Company Number into the Company Number field.

- In the Adjustment Details area, type Employer in the Tax jurisdiction field. The system should auto-fill the code of Employer Sponsored Health Coverage.

- Enter the full cost of this health coverage in the Taxable Earnings field. This amount will be printed with the letters DD on the employee W-2 in Box 12. If the amount is entered into the incorrect field, it will not be picked up and printed on the W-2.

- If there are other special items or tax adjustments that need to be made for this same employee and check date, you can also add them to the Adjustment Details grid.

- After you complete the entry for the one employee, click the New button

and add the next employee. Follow the same instructions for each entry.

and add the next employee. Follow the same instructions for each entry.

Creating a CSV file:

Rather than entering this information manually for each employee, you could have the system automatically create employee tax adjustments by importing a .csv spreadsheet template. See Importing Tax Adjustments for complete instructions on this process.

Example: We recommend that you use this CSV Template for importing your adjustments. Leave the column headings as-is, delete the place holder information and your own employee data. It is important not to change the formatting of the document, as this will interfere with the importing process. To download, right-click and choose "Save As..." (or "Save Target as...").

Fields for Health Care Cost Adjustments:

EmployeeNumber

CompanyNumber - If you are a single company, enter 1; if you have multiple companies in one database, enter the Employee's current Company Number.

CheckDate - Use last day of calendar year.

K401Earnings

K401Deferred

TaxID - You will need to look up the ID of the Employer Sponsored Health Coverage located in the Tax Table setup under Government Type W2 Special Descriptions. This will fill the Tax Jurisdiction column in the grid but the .csv will remain TaxID.

GrossEarnings - comes from the Taxable Earnings table.

TaxableEarnings - Enter the total amount of the healthcare premium (sum of employee and employer share of the cost); comes from the Taxable Amount.

TotalWithheld - The Withheld Amount.

AddlWH - Additional Withholding.

EmployerTax - Tax

Resident

PSDTaxCode - used only for Pennsylvania PSD Codes.

Note: EmployeeNumber, CompanyNumber, CheckDate and TaxableEarnings are the only required fields for this import.

Importing Health Care Cost Adjustments:

- From the Payroll Menu, click Check Processing Wizard.

- From Functions select Create a New Batch, and from Batch Types, select Adjustments. Click Next.

- Select Adjustment Type: Tax, enter any notes you want to save with the batch and click Finish. The Tax Adjustments screen displays.

- Click the Import button and select the .csv file you want to import.

- The system begins to validate the integrity of the data. See Validation Checks for more information.

- If any validations fail, the import is canceled and an error report is displayed.

- Upon successful import, the Tax Adjustment screen displays. A record is displayed for each line item that was imported. The Notes field will populate with the import details (user name, date, and file path).