Overview

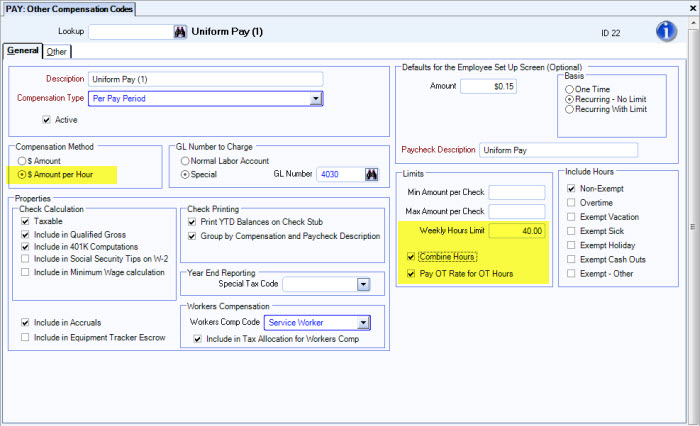

If an Other Compensation/Deduction Code is being used more than once for the same employee and the same paycheck you can combine hours in order to force the system to adhere to any Weekly Hours limits that have been defined.

The only time you would use this feature is to prevent an employee from being paid on hours more than what is specified for the weekly limit.

Rules

This option is only available for Other Compensations or Deductions with an Amount Per Hour Method.

You must have a Weekly Hours Limit specified for the Other Compensation Code or Other Deduction Code.

In order to prevent the employee from being paid on a combined basis for more than 40 hours, select the Combine Hours check box.

Week of 12/26/04 through 1/01/05

Health and Welfare is being paid at a rate of $1.25/hr through 12/31/04. This rate changes to $1.75/hr effective 1/01/05. Your company policy states you will pay the Health and Welfare up to a weekly hours limit of 40 hours.

Employee Master File – Other Compensations and Deductions (Other Compensations tab)

H & W $1.25/hr Start Date: End Date: 12/31/04

H & W $1.75/hr Start Date: 1/01/05

Employee worked 38 hours between 12/26/04 and 12/31/04

Employee worked 8 hours on 1/01/05.

If the Combine Hours check box is selected, the employee would be paid:

$1.25/hr x 38 hours = $47.50

$1.75/hr x 2 hours = $3.50

If the Combine Hours check box was NOT selected, the employee would be paid:

$1.25/hr x 38 hours = $47.50

$1.75/hr x 8 hours = $14.00

What happens if there is not a Start or End Date defined?

The system will pay the first compensation/deduction line first and then if the hours limit has not been reached, it will continue to pay the next compensation/deduction line up to the Weekly Hours Limit.