Use this procedure to make one time adjustments to the amounts that will appear on Employee W-2 and W-2C forms, all Tax Reports, and Other Compensations and Other Deductions. This procedure is also used to enter beginning W-2 balance information from your previous accounting system so that W-2 forms may be printed at the end of the year from WinTeam.

- Confirm there is an existing W2. To verify, display the employee information in PAY: Employee Master File. Click Paycheck Info, then W-2 Summary, then the PDF tab. Verify there is a PDF record displayed for that tax year.

- From the Payroll Menu, click Check Processing Wizard.

- Select Create a New Batch, and select batch type Adjustments then click Next.

- Enter any Notes that are applicable to this adjustment.

- Select the Adjustment Type of W-2c Adjustments, and then click Finish.

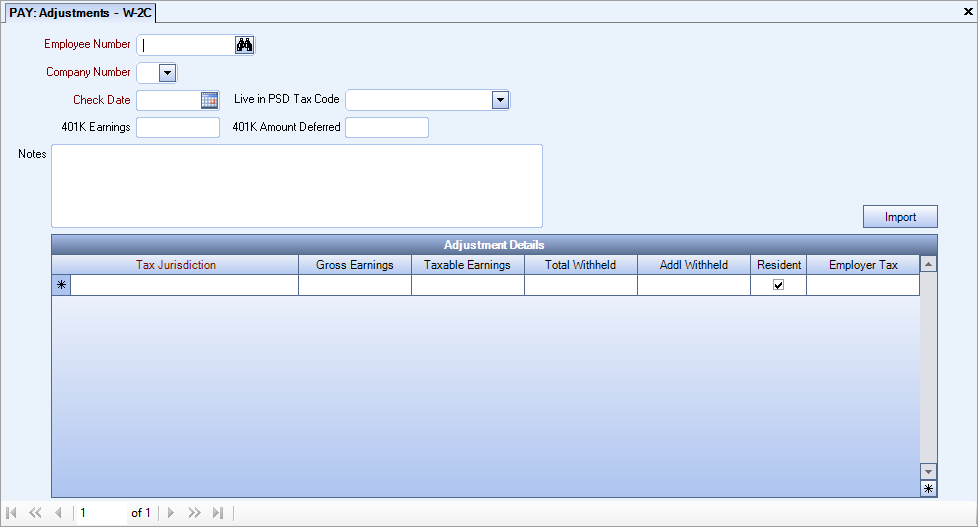

- On the Adjustments - W-2C screen, fill in the header fields and the information that needs to be changed.

Example: To correct the Social Security Number, enter the Employee Number, Company Number and Date, then in the Employee Master File correct the Social Security Number. This information change will be picked up when you complete W-2C processing.

Example: To correct other item types, add the Tax Jurisdiction and the difference of the adjustment needed. Example, for employer sponsored health coverage, the W2-C adjustment is made to the Taxable Earnings field.

Tip: If you are entering W-2 balances you should enter a Check Date that does not correspond with a regular check run date. This will make it easier to locate these records later, if needed.

For Gross Earnings, enter the total amount of gross earnings for the employee which is not subject to any taxable earnings limit. It should include all earnings regardless of whether the employee has reached the taxable limit for the corresponding tax jurisdiction. Note: WinTeam does not validate these amounts.

For Taxable Earnings, enter the total amount of taxable earnings for the employee. Note: If the Tax Jurisdiction has a taxable earnings limit and the employee has already reached that limit, you will not want to add to the employee's taxable earnings.

For the Total Withheld, enter the total withheld amount. This reflects the total tax amount withheld from the employee's paycheck.

Note: The Total Withheld field is not a calculated field. Total Withheld amount must be manually entered. The amount entered here must be greater than or equal to the Additional W/H Portion amount.

For Additional Withheld, record how much of the Total Withheld amount is additional to the system calculated amount. If you enter an amount in this field, you would need to manually enter an amount in the Total Withheld field. These additional amounts to withhold are stored in the Employee Master File, Tax Information tab. Note: The amount entered in this field must be less than or equal to the Total Withheld Amount.

- Click Close to save the record(s).

- Open the PAY: W-2C Report.

- Select Output Type of Laser Forms.

- Enter Check Date range for the entire year.

- Filter for the appropriate employees using the Category filter

- Click Preview to review the selected information.

- Click Print to print out the Laser Forms.

- Click PDF to lock down the W2-C. It can now be accessed from the Employee Master File.

- From the Payroll Menu, click Check Processing Wizard.

- Select Create a New Batch, and select batch type Adjustments then click Next.

- Enter any Notes that are applicable to this adjustment.

- Select the Adjustment Type of Tax, and then click Finish.

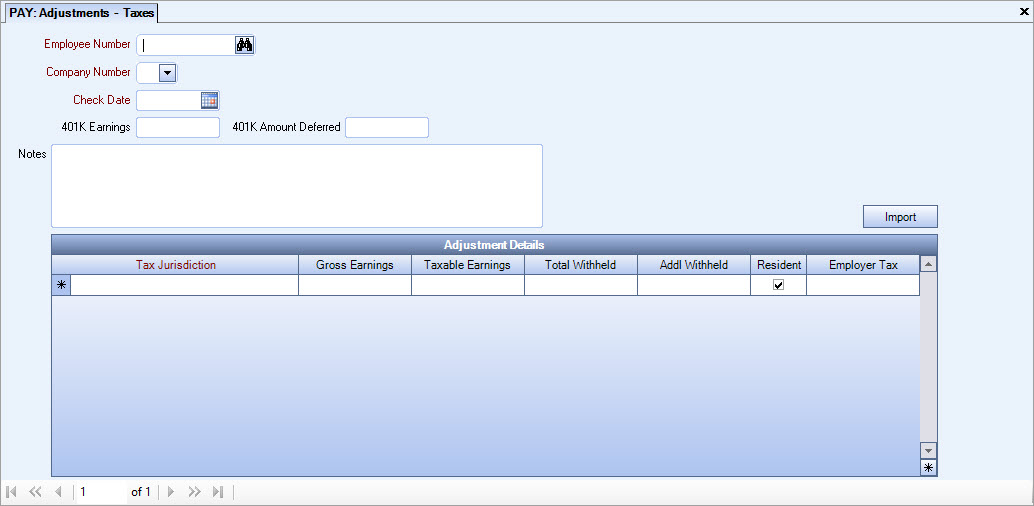

- On the Adjustments - Taxes screen, fill in the header fields and the information that needs to be changed.

- Click Close to save the record.

Note: To correct a tax adjustment, add the Tax Jurisdiction and the difference of the adjustment needed.

For Gross Earnings, enter the total amount of gross earnings for the employee which is not subject to any taxable earnings limit. It should include all earnings regardless of whether the employee has reached the taxable limit for the corresponding tax jurisdiction. Note: WinTeam does not validate these amounts.

For Taxable Earnings, enter the total amount of taxable earnings for the employee. Note: If the Tax Jurisdiction has a taxable earnings limit and the employee has already reached that limit, you will not want to add to the employee's taxable earnings.

For the Total Withheld, enter the total withheld amount. This reflects the total tax amount withheld from the employee's paycheck.

Note: The Total Withheld field is not a calculated field. Total Withheld amount must be manually entered. The amount entered here must be greater than or equal to the Additional W/H Portion amount.

For Additional Withheld, record how much of the Total Withheld amount is additional to the system calculated amount. If you enter an amount in this field, you would need to manually enter an amount in the Total Withheld field. These additional amounts to withhold are stored in the Employee Master File, Tax Information tab. Note: The amount entered in this field must be less than or equal to the Total Withheld Amount.

Tip: You can also import tax adjustment records from a .csv file. For more information see Importing Tax Adjustments.

- From the Payroll Menu, click Check Processing Wizard.

- Select Create a New Batch, and select batch type Adjustment, click Next.

- Enter any Notes that are applicable to this adjustment.

- Select the Adjustment Type of Other Compensation or Other Deduction, and click Finish.

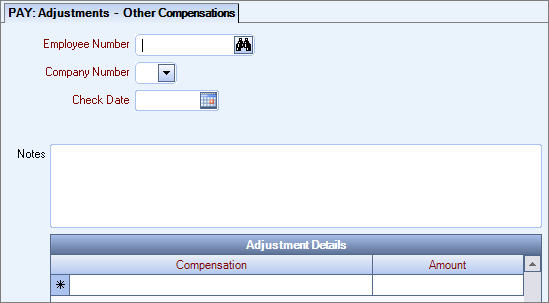

- On the Adjustments - Other Compensations/Other Deductions screen, fill in the header fields, chose the appropriate Compensation/Deduction from the drop down and the difference of the adjustment needed in the Amount field.

- Click Close to save the record.

Note: To make an adjustment for a subcontractor who is paid through payroll, complete an other compensation adjustment and the change will reflect on their 1099 form.