Add On Amounts and Extra Pay

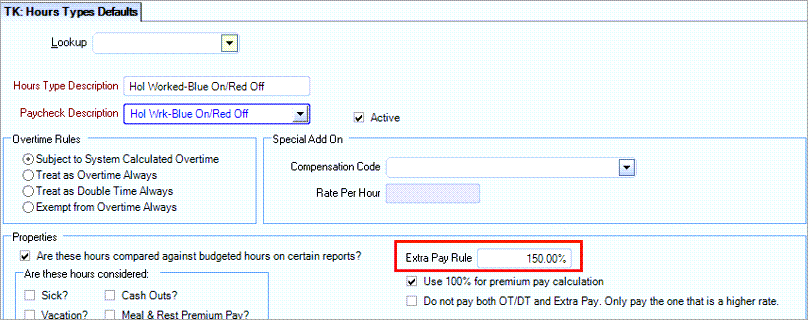

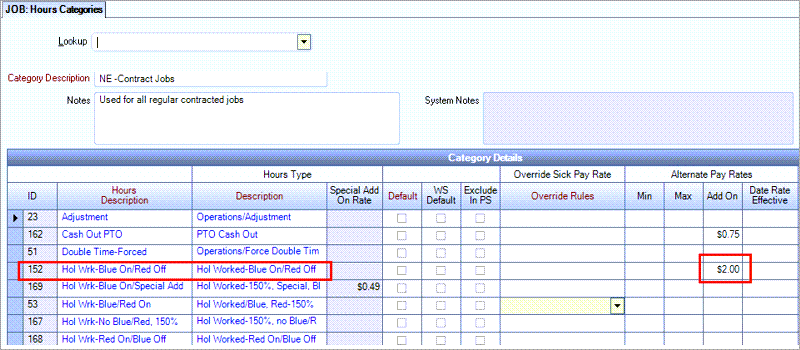

The extra pay rule rate calculation has been adjusted to support this feature. Prior to this feature, if an Hours Type was being used that had an Hours Category detail line with a taxable Add On amount, this amount was not used in the Extra Pay Rule rate calculation. As part of the Store Detailed Pay Rates feature, the taxable Add On amount is now included in the Extra Pay Rule rate calculation.

The employee’s base pay rate is $10.00 per hour. There is a $2.00 add on per hour for an hours type with an extra pay rule of 150%.

The net pay rate calculation prior to the Store Detailed Pay Rates feature did not include the add on rate (the add on was last):

$10.00 (base rate) x 1.5 = $15.00 + $2.00 (add on) = $17.00 (net pay rate)

The net pay rate calculation with the Store Detailed Pay Rates feature enabled includes the add on rate in the rate before the extra pay is calculated (the 150% extra pay rule includes the add on):

$10.00 (base rate) + $2.00 (add on) = $12.00 x 1.5 = $18.00 (net pay rate)