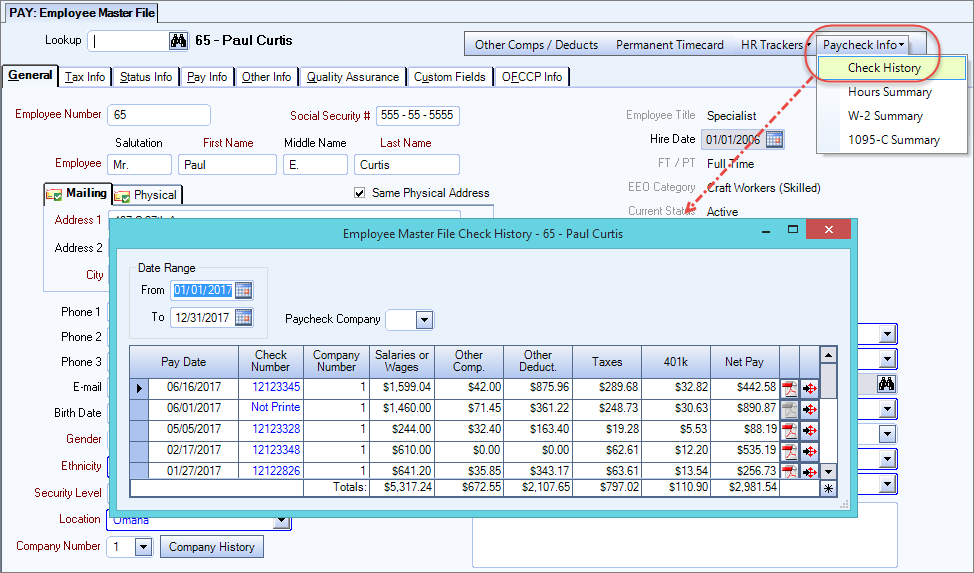

All information contained in the Statement of Earnings can be traced back to its source of information. You may use the Employee Master File to locate any paycheck to verify the source of information. For Multi-Company clients, it is important to note that the information included on pay stubs is for the employees current Company only. Once an employee transfers to a new Company, all earnings, withholdings, tax codes with limits, 401K Earnings, and deferred amounts start over and are tracked by Company. Multi-Company Clients will see a Paycheck Company filter on the Employee Master File Check History, Other Compensations and Deductions (History tab), Employee W-2 Summary, and Hours Summary screens to use when verifying source information from the pay stub. The Other Information is derived from the Benefits By Employee screen.

Note: WinTeam uses the logo from Company Setup when the framed section layout is used.

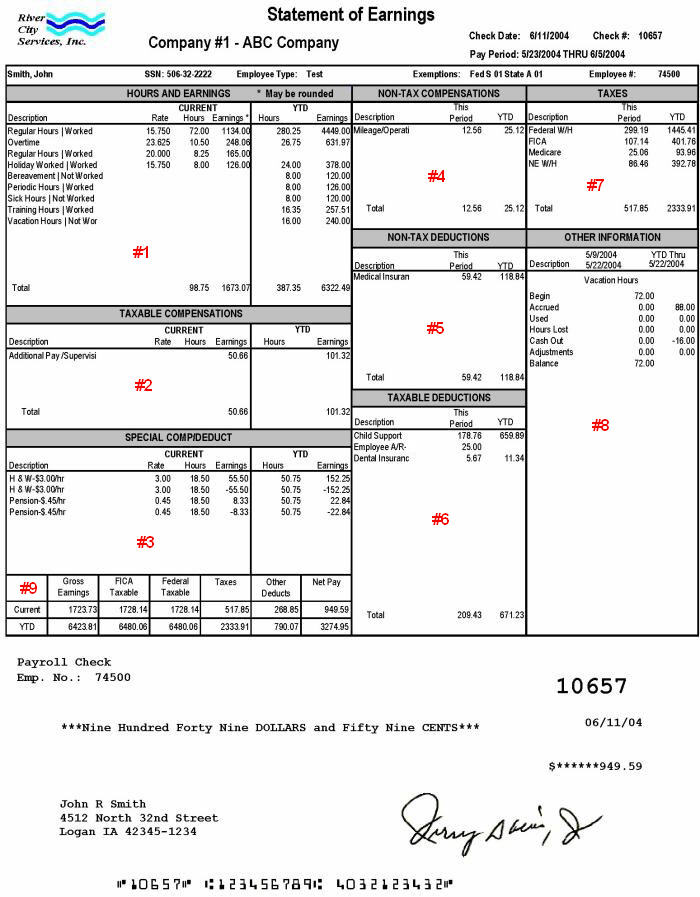

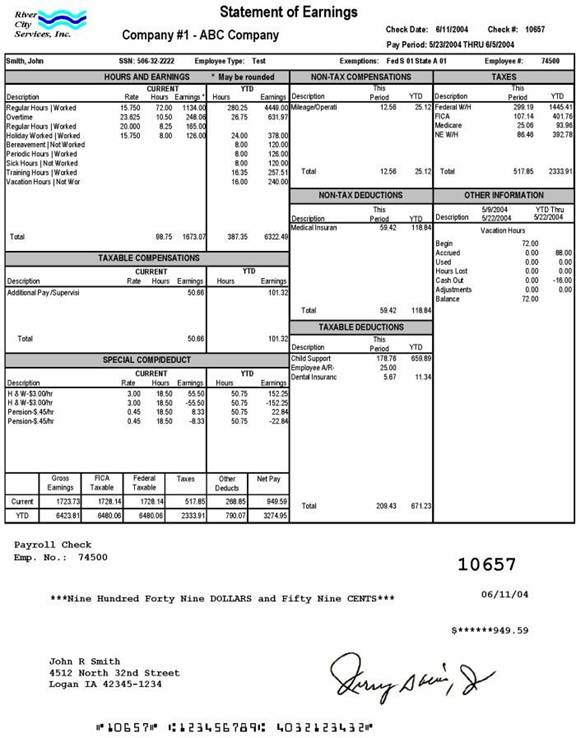

Here is an example of a Statement of Earnings.

Hours and Earnings

#1 - HOURS AND EARNINGS

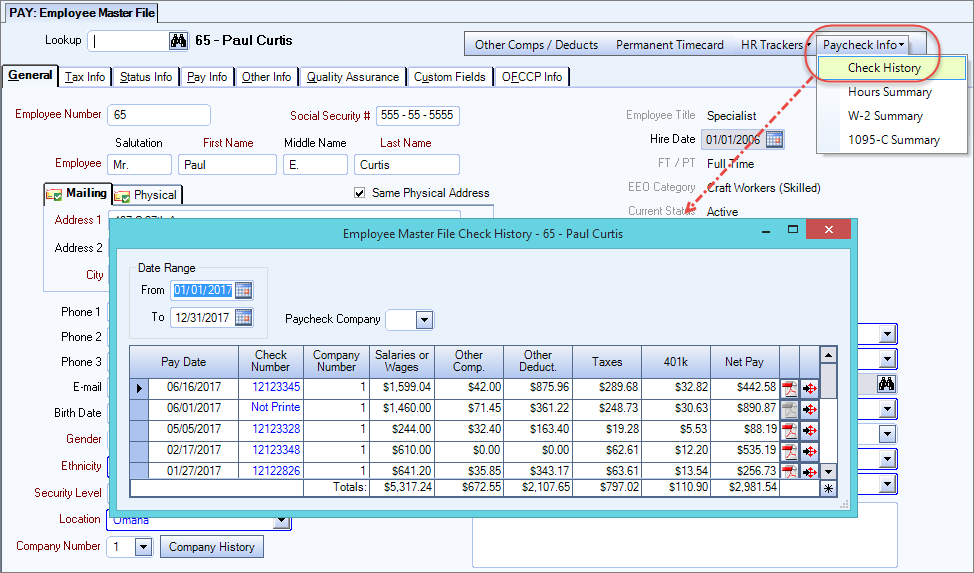

- To verify hours and earnings, open the PAY: Employee Master File, click the Paycheck Info button and then the Check History drop-down to display the Employee Master File Check History window.

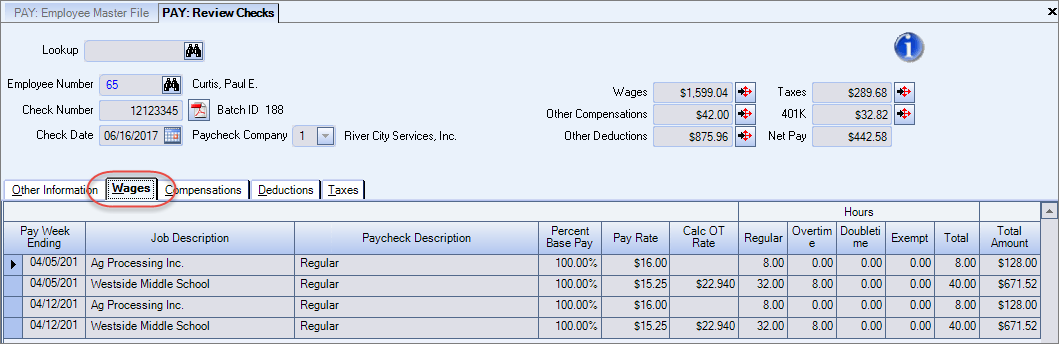

for the appropriate paycheck to see additional details. The PAY: Review Checks screen displays the details from that paycheck.

for the appropriate paycheck to see additional details. The PAY: Review Checks screen displays the details from that paycheck.The Rate, Hours and Earnings information is derived from the Wages tab.

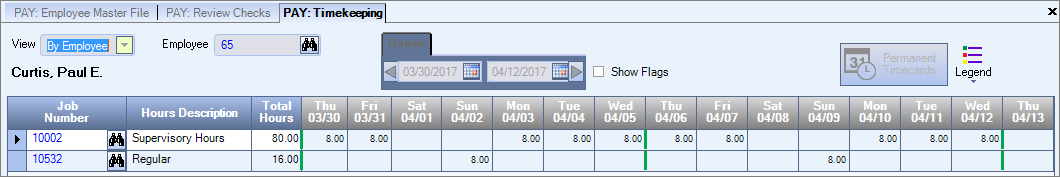

You can see the timekeeping details by clicking the Wages drill-down button  .

.

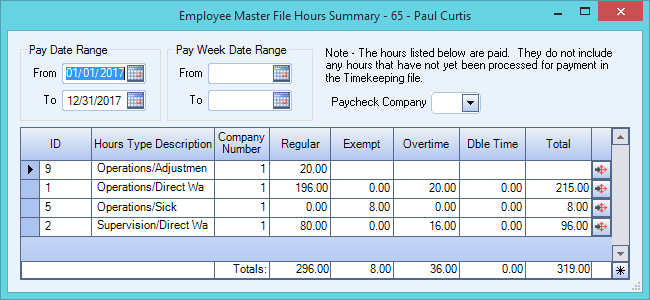

To verify the year-to-date total hours information, click the Paycheck Infobutton and then the Hours Summary drop-down to display the Employee Master File Hours Summary window.

Compensations

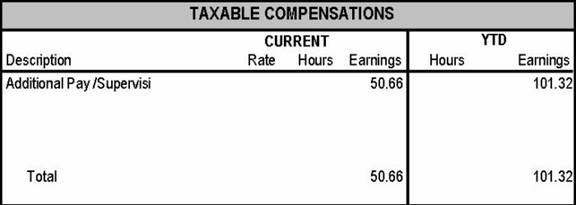

#2 - TAXABLE COMPENSATIONS

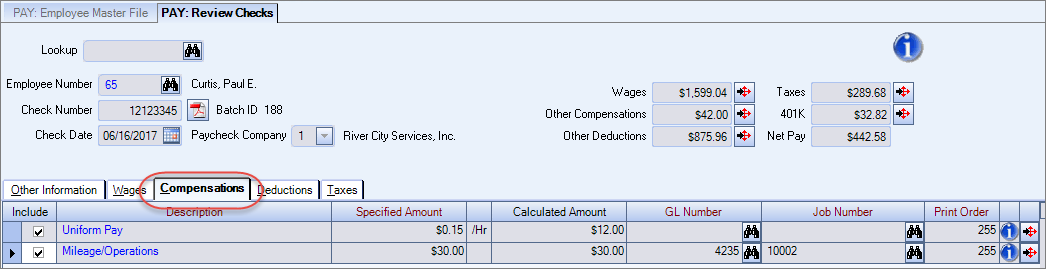

Although the Compensations tab lists all compensations, only the taxable compensations are displayed in section #2 on the Statement of Earnings.

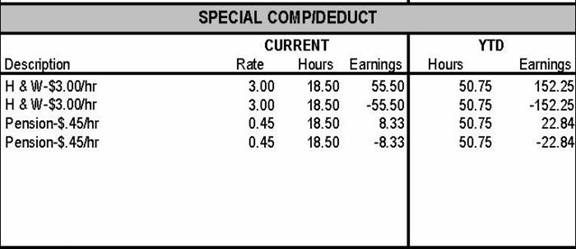

#3 - SPECIAL COMP/DEDUCT

Some Compensations (like H & W and a pension) might be setup with a Special Print Order in Other Compensations and are displayed in section #3 on the Statement of Earnings.

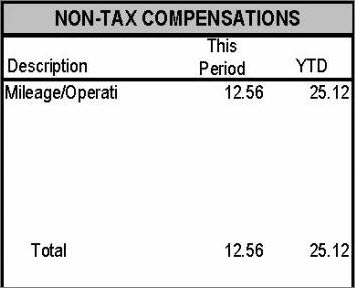

#4 - NON-TAX COMPENSATIONS

Compensations are designated as Taxable or non-Taxable based on the Taxable check box in the Other Compensation Codes screen.

YEAR-TO-DATE COMPENSATIONS

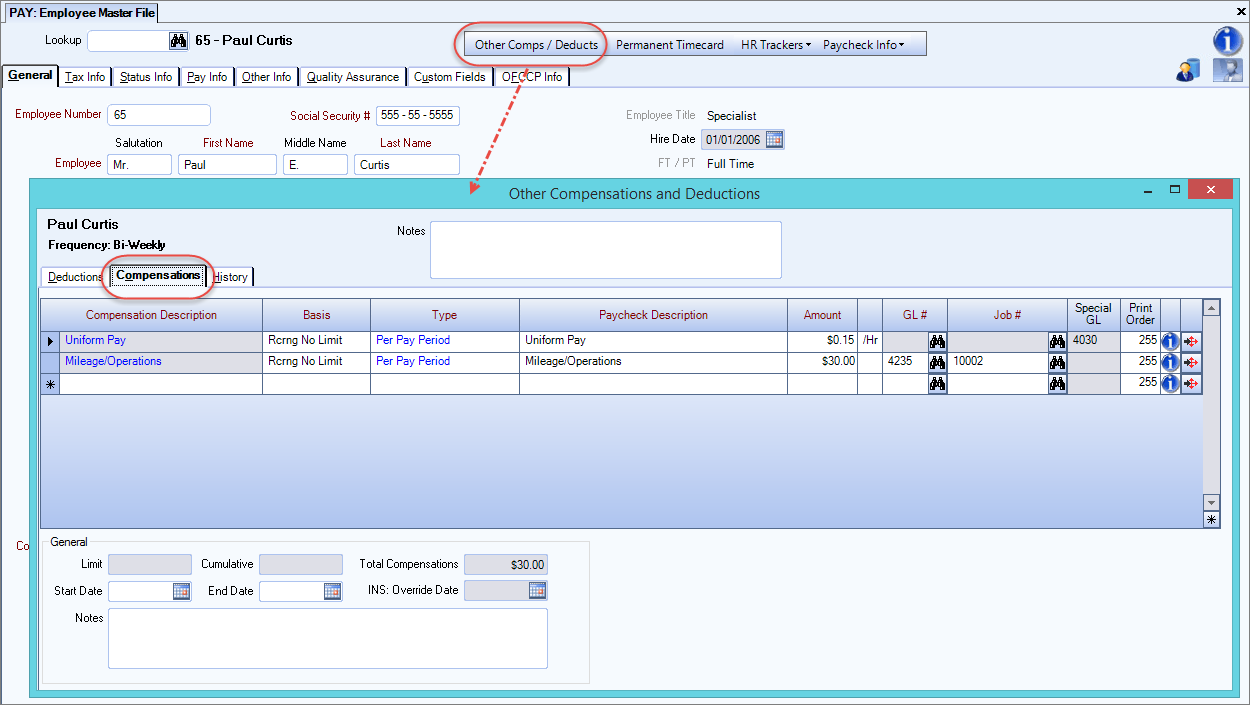

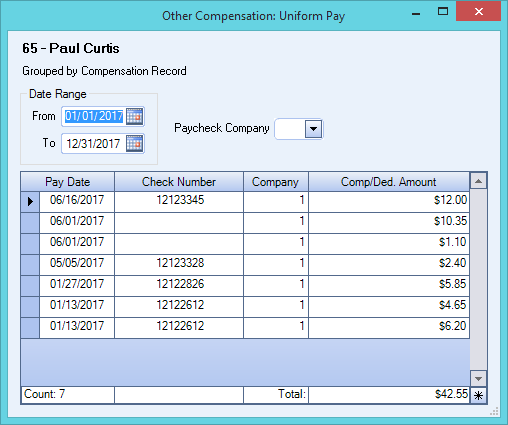

- To verify year-to-date compensations, open the PAY: Employee Master File, click the Other Comps/Deducts button to display the Other Compensation and Deductions window.

- Click the Compensations tab.

- Click the drill down button for the selected compensation to display the year-to-date compensation total.

Click the drill down button for each compensation to verify the year-to-date totals.

Deductions

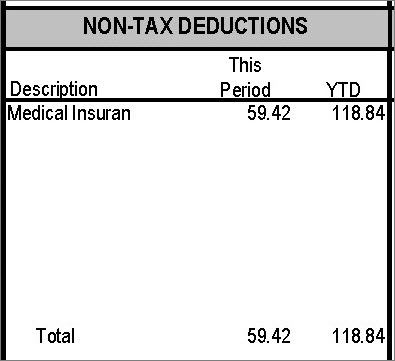

Deductions are designated as taxable or non-taxable based on the Tax Deductible check box on the Other Deductions Codes screen. If the Tax Deductible check box is selected the deduction is non-taxable. If the Tax Deductible check box is cleared, the deduction is considered taxable.

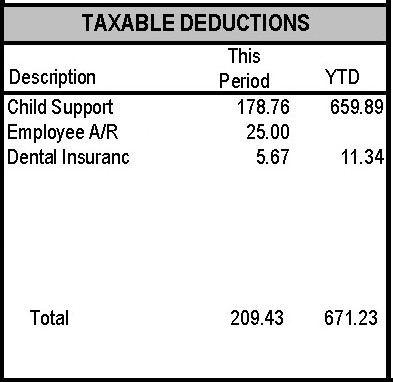

#5 - NON-TAX DEDUCTIONS and #6 - TAXABLE DEDUCTIONS

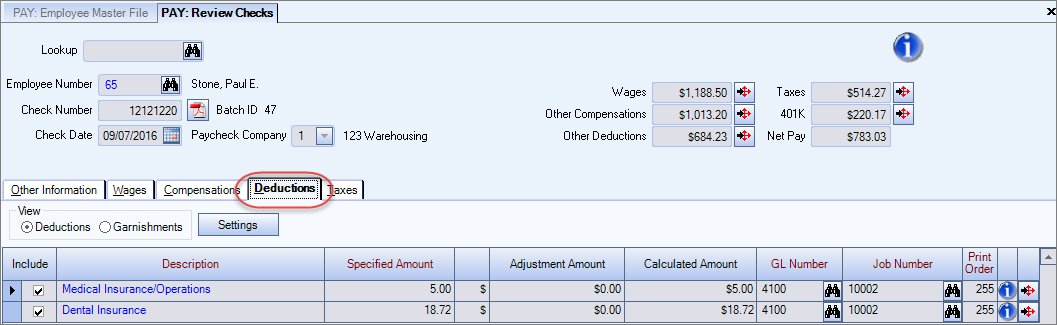

Current deductions are displayed on the Deductions tab of the PAY: Review Checks drill down screen.

YEAR-TO-DATE DEDUCTIONS

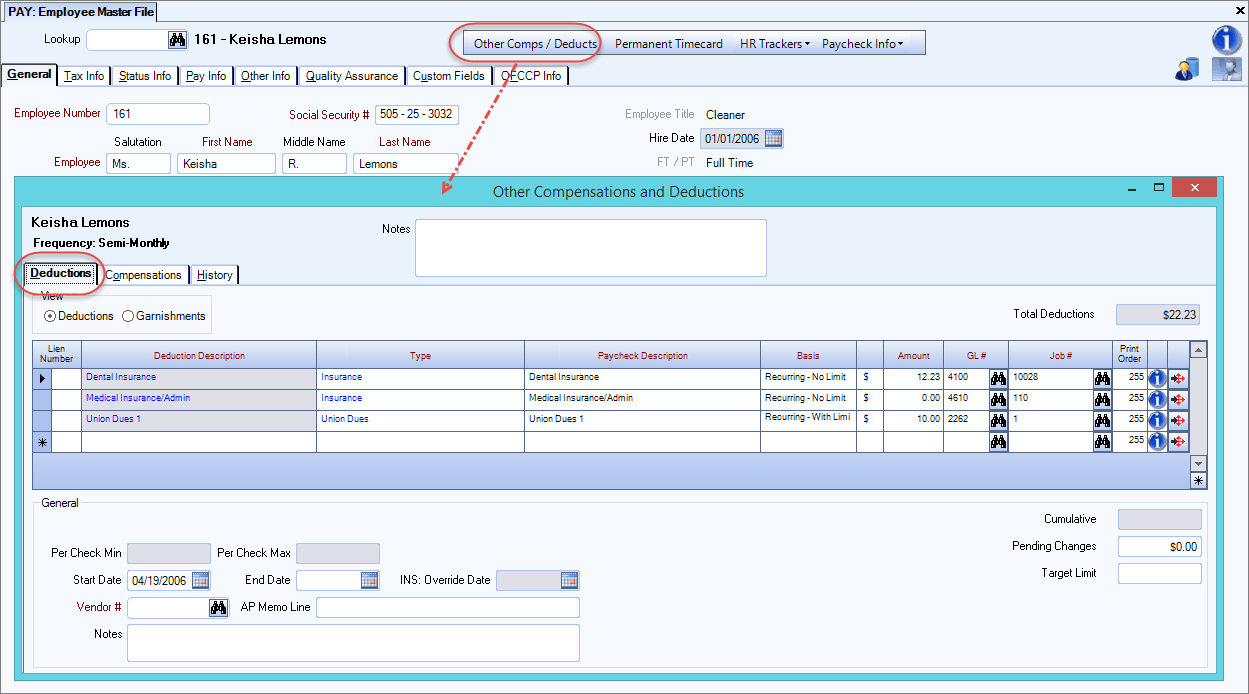

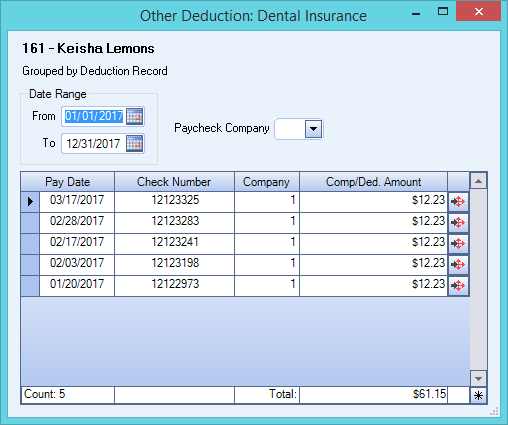

- To verify year-to-date deductions, open the PAY: Employee Master File, click the Other Comps/Deducts button to display the Other Compensation and Deductions window. Deductions display on the default tab.

- Click the drill down button for the selected deduction.

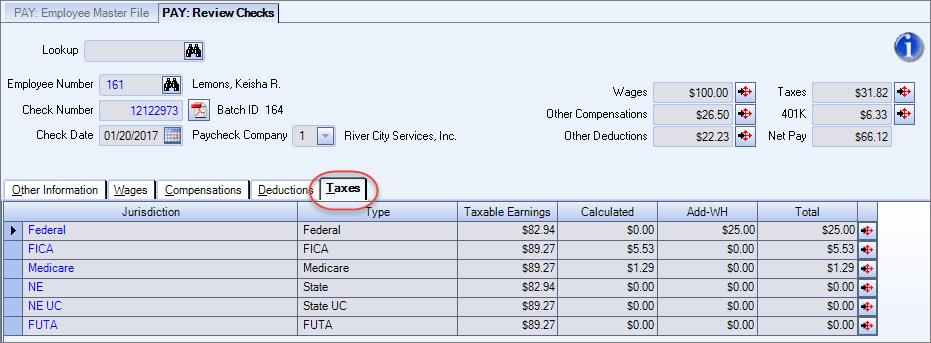

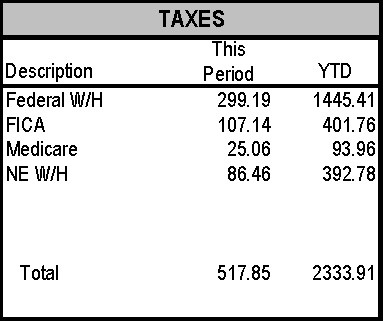

Taxes

#7 - TAXES

Current taxes are displayed on the Taxes tab of the PAY: Review Checks drill down screen.

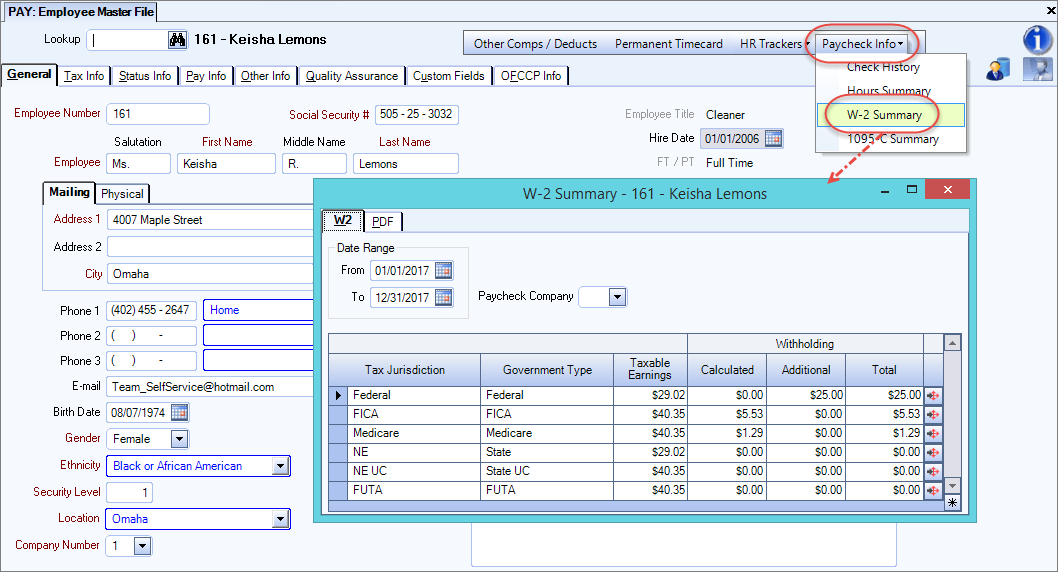

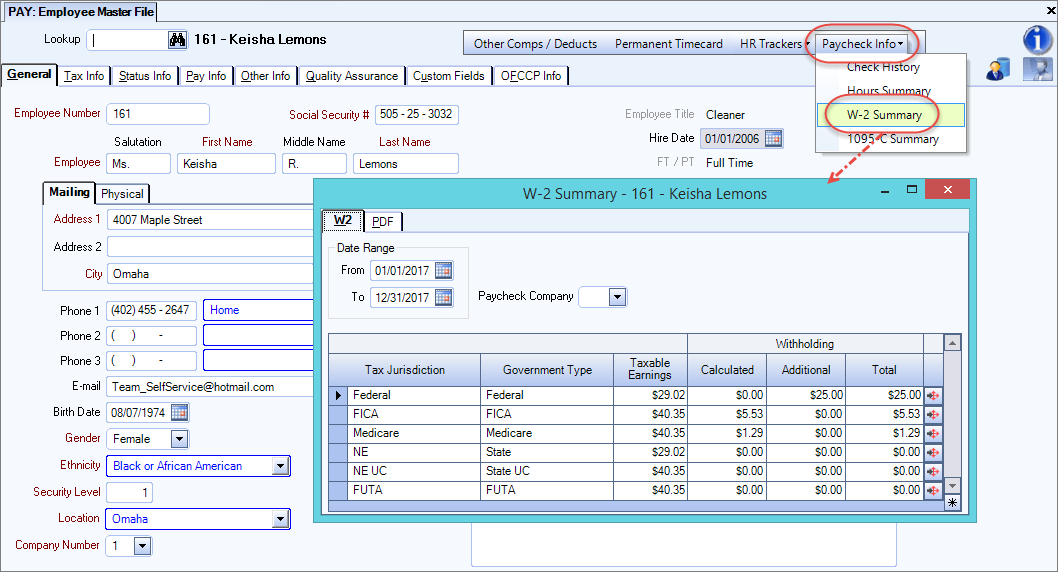

YEAR-TO-DATE TAXES

To verify year-to-date taxes, open the Employee Master File, click the Paycheck Info button and then the W-2 Summary drop down.

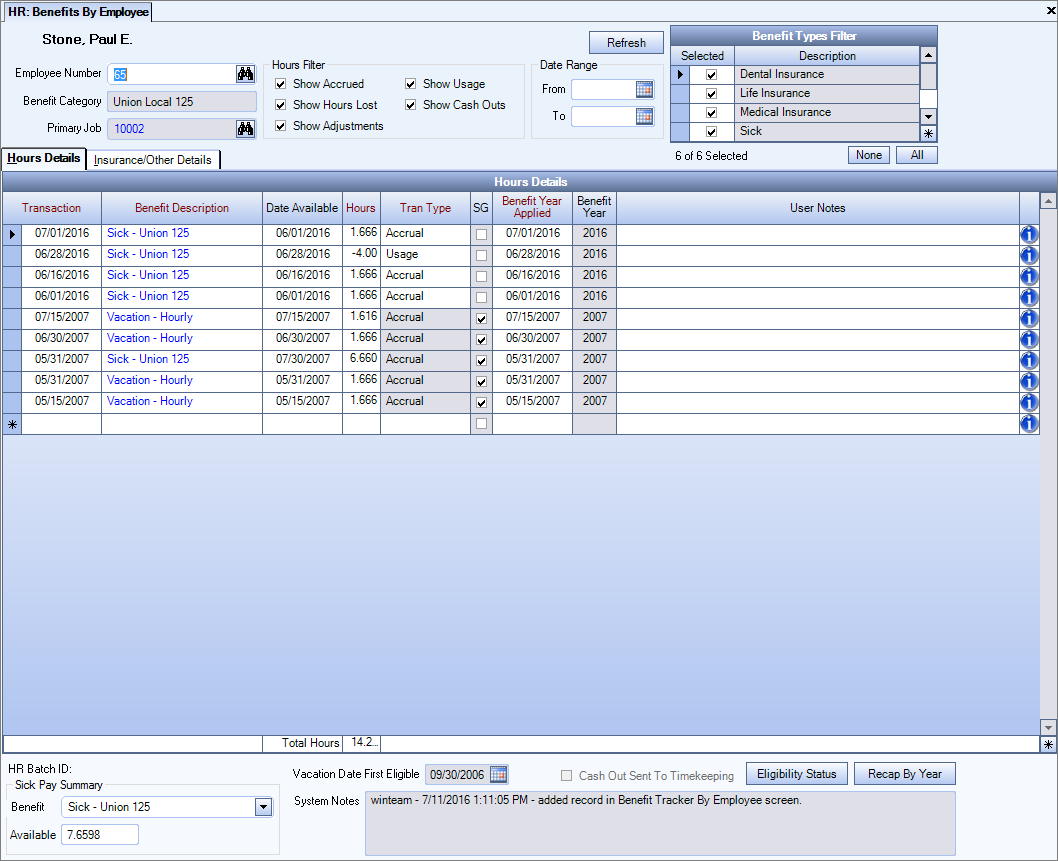

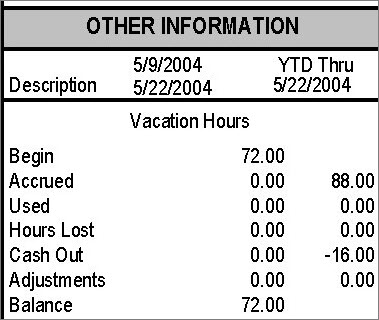

Other Information

#8 - OTHER INFORMATION

The Other Information section displays HR benefit information. This section displays information through the end of the prior pay period.

To verify this information, open the HR: Benefits By Employee screen.

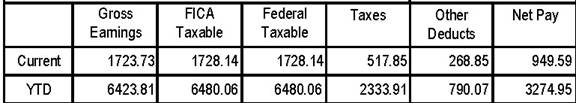

Gross Earnings and Net Pay

#9 - GROSS EARNINGS AND NET PAY

Year-to-date Gross Earnings, FICA taxable, Federal taxable and tax information can be verified from the Employee Master File, Paycheck Info button, on the W-2 Summary drop down.

Net Pay can be verified from the Employee Master File, Paycheck Info button, on the Check History drop down.

Understanding Your Paycheck (using the Framed Sections Layout)

We are providing the following information as an aid in understanding the items on your pay stub.

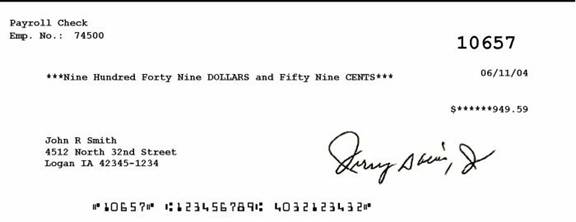

Sample paycheck stub

We will go through each section on the paycheck stub to familiarize you with the contents.

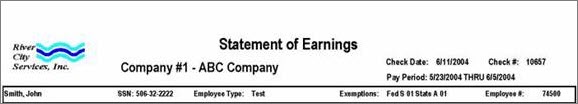

Header section

Company Info and Pay Period

The Header section contains company information, the date the check (or check stub) was issued, the Check # (if applicable), and the Pay Period date range.

The Pay Period date range indicates the starting date of the pay period and the ending date of the pay period.

Personal Info

This section includes your names, Social Security Number, Employee Type, Federal and State Withholding Status and Exemptions, and Employee #.

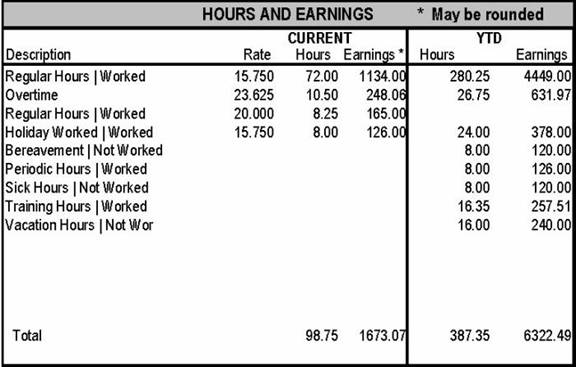

HOURS AND EARNINGS

The Hours and Earnings section lists each hours type (description) that you are being paid for. The items are listed in order by the Description (and pay rate) that has the greatest number of hours down to the least number of hours during this pay period.

Hours Descriptions that have Year-to-Date information only (nothing in this pay period) will be shown last.

This section shows information for the current pay period (05/23/04 through 06/05/04, as shown in the Header section).

This section also displays Year-to-Date hours and earnings.

In our example, this employee has Regular Hours paid at the rate of $15.75 and $20.00. The Regular Hours Description that shows the rate of $15.75 is listed first, since this description has the most number of hours (72).

TAXABLE COMPENSATIONS

This section displays Compensations that are taxable.

In our example, there are earnings associated with Additional Pay / Supervision pay. You may notice that the full "Description" may not print due to space constraints.

This section also displays Year-to-Date earnings for taxable Compensations.

SPECIAL COMPS/DEDUCT

The Special Comp/Deduct area is used to show Health and Welfare benefits, if applicable.

NON-TAX COMPENSATIONS

The Non-Tax Compensation section lists all Compensations that are non-taxable to you.

This section also displays Year-to-Date earnings for non-taxable Compensations.

NON-TAX DEDUCTIONS

The Non-Tax Deductions area is used to display deductions that are non-taxable to you (the employee). These amounts are deducted from your taxable earnings before calculating payroll taxes.

This section also displays Year-to-Date earnings for non-taxable Deductions.

TAXABLE DEDUCTIONS

The Taxable Deductions section shows taxable items that are deducted from your paycheck.

In other words, any deduction from Gross or after-tax (net) pay.

Other examples include union dues, loan repayments, employee-paid insurance, etc.

TAXES

The Taxes section displays all payroll taxes that are deducted from your paycheck.

This section also includes Year-to-Date information.

OTHER INFORMATION

This section shows any benefits that you earn (accrue) on an hourly basis. This section does not display information for the current pay period (05/23/04 through 06/05/04), but displays information through the end of the prior pay period (05/09/04 through 05/22/04).

In this example, the employee had 72 Vacation Hours on 05/09/04, and had not earned (accrued) any additional hours through the end of the current pay period. Although, the employee had earned (accrued) a total of 88 hours Year-to-Date; and Cashed Out 16 hours, leaving a total of 72 hours (88 hours - 16 hours = 72 hours).

TOTALS

This section displays Current and Year-to-Date paycheck information.

Gross Earnings Current and YTD are based off of the Gross Federal Earnings that are in the Employee W-2 file.

FICA Taxable is the amount of earnings that are subject to FICA taxes.

Federal Taxable is the amount of earnings that are subject to Federal taxes.

Taxes is the total amount of taxes withheld.

Other Deducts are deductions that are withheld from your paycheck. It includes both taxable and non-taxable deductions.

Net Pay is the amount of your paycheck.

CHECK INFORMATION