Updated Payroll Tax Engine Calculations (Colorado, Illinois, Indiana, Louisiana, Michigan, Pennsylvania, West Virginia)

This topic provides information about the state-specific sections on the Payroll Taxes tab of the PAY: Employee Master File (applicable to the updated tax engine.)

Important: If you have questions on this tax information please contact your tax professional for assistance.

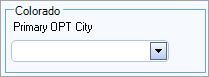

Primary OPT City

If an employee works in multiple cities and you want to make sure that OPT is only withheld in one city per month, then select the city in which the employee earns the majority of their wages. The OPT tax is only withheld in this city once the employee's wages are over the minimum threshold. However, if the employee does not work in this city (or makes under the minimum threshold) during the month, then no OPT tax is withheld. If no city is selected, then it is possible to withhold OPT from multiple cities during a single month period. Only mapped city taxes display in this drop-down list. You should set this at the beginning of the month and leave it unchanged during the month to avoid incorrect results.

Note: This option can be used alone or in conjunction with the Upfront Withholding for Colorado OPT check box on the PAY: Defaults window.

Examples

Per paycheck, only the city with the highest wages is used to determine if OPT should be calculated or not. Once the city with the highest wages is determined, all wages earned within that city for the current month are compared against the city's minimum threshold to determine if OPT should be withheld. If the determined city is not set as the Primary OPT (if set), then no tax is calculated. Regardless of whether or not they made over the city's minimum threshold.

In the following examples, the employee is paid weekly and the minimum thresholds are:

Aurora - $250

Denver - $500

Glendale – $750

Greenwood Village - $250

Sheridan - $500

Working a single location, no upfront withholding or primary OPT

If the employee only ever works in one OPT location, then the outcome would be the same if the primary OPT was set to that city or not at all.

First check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $0 subject/$200 gross, but no tax is calculated (no subject wages are returned because they are under the minimum threshold)

Second check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $200 subject/$200 gross AND tax is calculated (total wages are $400 between the first and second checks)

- Aurora EHT is also returned with tax is calculated (no subject or gross wages are returned because this tax is based on whether or not the city tax is calculated)

Third and fourth checks of the month:

- Aurora wages are $200

- Aurora City tax is returned with $200 subject/$200 gross, but no tax is calculated because it was already withheld for the month

- Aurora EHT is not returned because it was already withheld

Working multiple locations, no upfront withholding or primary OPT

First check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $0 subject/$200 gross, but no tax is calculated (no subject wages are returned because they are under the minimum threshold)

Second check of the month:

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (no subject wages are returned because they are under the minimum threshold)

Third check of the month:

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $200 subject/$200 gross AND tax is calculated (total wages were $400 between the second and third checks)

- Greenwood Village EHT is also returned with tax is calculated (no subject or gross wages are returned because this tax is based on whether or not the city tax is calculated

Fourth check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $200 subject/$200 gross AND tax is calculated (total wages were $400 between the first and fourth checks)

- Aurora EHT is also returned with tax is calculated (no subject or gross wages are returned because this tax is based on whether or not the city tax is calculated)

Working multiple locations and upfront withholding on

First check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $200 subject/$200 gross AND tax is calculated (based on $200 per week the employee will make over the minimum threshold and therefore tax is withheld)

- Aurora EHT is also returned with tax is calculated (no subject or gross wages are returned because this tax is based on whether or not the city tax is calculated)

Second check of the month:

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (no subject wages are returned because they are under the minimum threshold)

Third check of the month:

- Tax is withheld for Greenwood Village because total wages between the second and third checks are over the minimum threshold

Fourth check of the month:

- Aurora City tax is returned with $200 subject/$200 gross, but no tax is calculated because it was already taken on the first check

Working multiple locations and primary OPT set to Aurora

First check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $0 subject/$200 gross, but no tax is calculated (no subject wages are returned because they are under the minimum threshold)

Second check of the month:

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (because Aurora is set as Primary OPT)

Third check of the month:

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (because Aurora is set as Primary OPT)

Fourth check of the month:

- Aurora wages are $200

- Aurora City tax is returned with $200 subject/$200 gross AND tax is calculated (total wages are $400 between the first and fourth checks)

- Aurora EHT is also returned with tax is calculated (no subject or gross wages are returned because this tax is based on whether or not the city tax is calculated)

Working multiple locations, upfront withholding on and primary OPT set to Aurora

First check of the month:

- Aurora wages are $20

- Aurora City tax is returned with $0 subject/$20 gross, but no tax is calculated (no subject wages are returned because they are under the minimum threshold and based on these wages they would not hit the minimum threshold during the month. This is the only time the upfront withholding validation is done)

Second check of the month:

- Aurora wages are $100

- Aurora City tax is returned with $0 subject/$100 gross, but no tax is calculated (under the minimum threshold, but not used in validation because they made more wages in Greenwood Village)

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (because Aurora is set as Primary OPT)

Third check of the month:

- Aurora wages are $100

- Aurora City tax is returned with $0 subject/$100 gross, but no tax is calculated (under the minimum threshold, but not used in validation because they made more wages in Greenwood Village)

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (because Aurora is set as Primary OPT)

Fourth check of the month (scenario 1):

- Aurora wages are $100

- Aurora City tax is returned with $0 subject/$100 gross, but no tax is calculated (now over the minimum threshold, but not used in validation because they made more wages in Greenwood Village)

- Greenwood Village wages are $200

- Greenwood Village City tax is returned with $0 subject/$200 gross, but no tax is calculated (because Aurora is set as Primary OPT)

- No OPT is calculated for this employee–the system only tries to calculate OPT for the city with the highest wages

Fourth check of the month (scenario 2):

- Aurora wages are $100

- Aurora City tax is returned with $100 subject/$100 gross AND tax is calculated (now over the minimum threshold, total monthly wages of $320)

- Greenwood Village wages are $20

- Greenwood Village City tax is returned with $0 subject/$20 gross, but no tax is calculated (not the highest wages and because Aurora is set as Primary OPT)

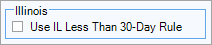

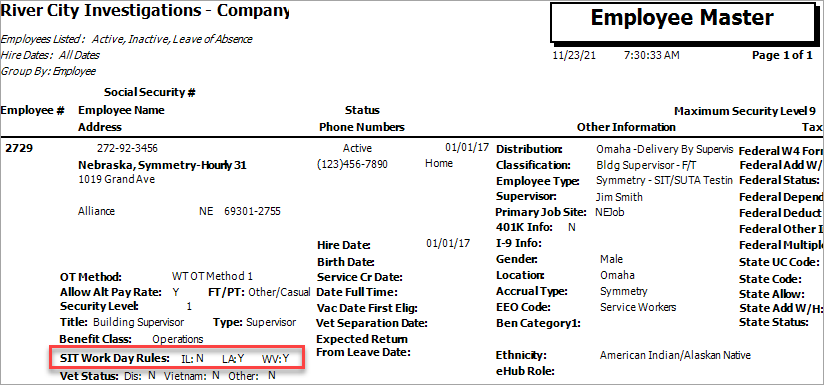

Select this check box when Illinois state income tax withholding does not apply to the employee. Under Illinois SB 1515 and effective January 1, 2020, non-resident employees are subject to Illinois income tax only if they work 30 or more days within the state. See Illinois Public Act 101-0585 and Illinois Publication 130 for details. Please work with your internal council before stopping any tax withholding. If you do manually stop tax withholding for an employee, you must remember to remove that manual stop after the employee works 30 days.

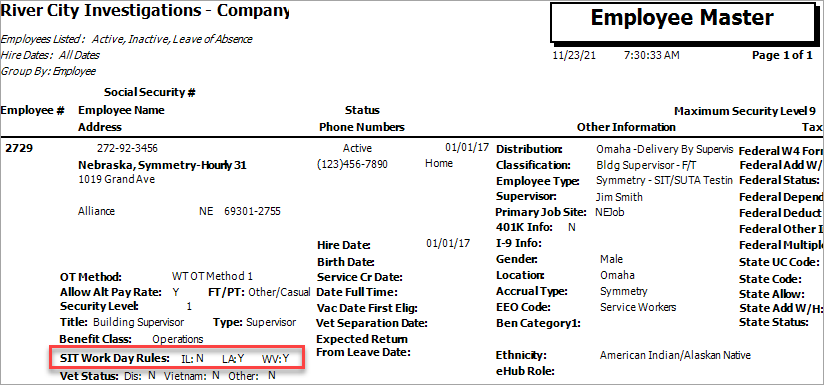

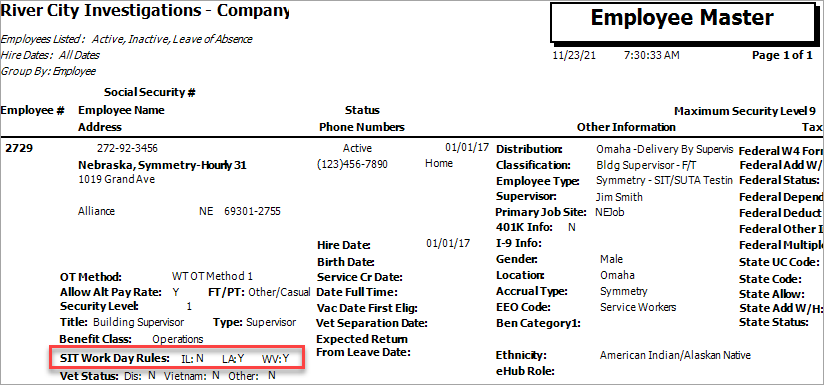

The setting for this check box displays in the Employee Master Report (detail report and grid view).

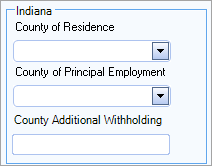

When your employee lives in Indiana you may need to manually set the County of Residence or the County of Principal Employment field on the Employee Master File, Payroll Taxes tab.

These taxes are not set by default, not required and are not automatically set based on the employees address. They must be manually completed to have them calculated/withheld.

Note:

– If both fields are cleared, the Indiana County tax is calculated based on the resident location code

– If the County of Residence is set, it takes precedence over the County of Principal Employment

– Indiana County of Residence tax is withheld at the resident rate of the county set – based on all wages (if the county selected has no county tax, then it uses the County of Principal Employment) calculation

– If the County of Principal Employment is set (and County of Residence is not set or has no rate), Indiana County tax is withheld at the non-resident rate of the county set – based on all wages

– The Indiana County tax calculation is on all wages earned

– Select the Is Exempt check box for no county tax

If you have an Indiana county tax assigned and you set a value for the County of Residence, a message box displays notifying you that the Indiana county tax will be removed and the employee will be taxed at the resident rate for the selected county of residence.

Tip: When running a payroll batch in Check Review, the original WinTeam payroll engine displays the taxes in both the Calculated and Add-WH columns. When running a batch using the updated payroll engine both of those column values are combined into the Calculated column.

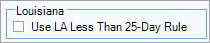

The state of Louisiana implemented a Less Than 25-Day Rule to determine if state income tax should be withheld effective January 1, 2022. For tax years beginning on or after January 1, 2022, employers are not required to withhold Louisiana income tax from nonresident employee wages for services performed within Louisiana, unless the nonresident employee spends more than 25 days performing employment duties for the employer in Louisiana. If, during the calendar year, the number of days an employee spends performing employment duties in Louisiana exceeds the 25-day threshold, an employer is required to withhold and remit taxes for every day in the calendar year, including the first 25 days, on which the employee performs employment duties in Louisiana. The threshold does not apply to professional athletes, professional entertainers, public figures, qualified production employees (related to the motion picture industry), and staff members of professional athletic teams. Currently, employers must withhold for all nonresidents regardless of the number of days worked in Louisiana. Louisiana does not have reciprocal withholding agreements with any states. See Louisiana State Legislature SB157 for more information.

The check box is available for employees in all states except for the state of Louisiana itself and any reciprocal states (LA has no reciprocal states).

- If the check box is cleared, then state income tax is withheld based on the standard rules.

- If the check box selected, then no state income tax is withheld for the non-resident state. All wages earned in the non-resident state are moved to the resident state and calculated there.

The setting for this check box displays in the Employee Master Report (detail report and grid view).

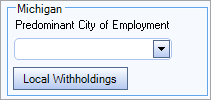

This section only applies when the employee is a resident of Michigan. It is set to blank (None) by default for new employees. For existing employees with taxes assigned, it is set based on the existing city selected for the misc parameter. To validate the field, the employee record must be edited and saved.

When you select a city from the drop-down list and save the record, validation is done to verify that the tax code is properly mapped for the selected city. If not, then the Tax Mapping window is displayed and you must map the tax before it can be assigned.

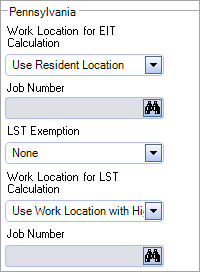

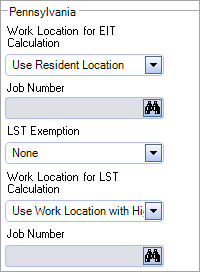

Work Location for Pennsylvania EIT Calculation

Select the default option used to determine the work location for EIT taxes when creating new employee records.

- Use Work Location with Highest Wages –Pennsylvania wages (excluding Philadelphia) are compared on the current paycheck and then EIT is calculated for the location with the highest wages. This is the default option.

- Use Resident Location–EIT is calculated based on the resident location for all wages earned (excluding Philadelphia).

- Use Primary Job Location–EIT is calculated based on the location of the primary job assigned to the employee for all wages earned (excluding Philadelphia).

- Use Selected Job Location–EIT is calculated based on the location of the selected job for all wages earned (excluding Philadelphia). When this option is selected, the Job Number field is available. Use this field to locate and select a job. Only jobs with a validated Pennsylvania address can be selected. The job must have a Pennsylvania location code to determine the correct EIT tax.

Note: Select the Use Work Location with Highest Wages, Use Primary Job Location, or Use Selected Job Location option in this field as long as these are not set to a Philadelphia job. If set to a Philadelphia job, this field defaults to Use Work Location with Highest Wages ; otherwise no EIT would be calculated.

EIT Calculation

The following rates are compared to determine the rate to use in the calculation:

- Resident EIT - Resident Rate

- Determined Work Location EIT - Non-resident Rate

Note: The higher of the two rates is always used. However, the EIT tax returned is always the determined Work Location EIT. Therefore, the rate withheld may not match the Work Location EIT rate.

LST Exemption

Select one of the following three options for the LST Exemption:

- None–The LST tax is calculated in full. This is the default selection.

- Full–The employee is exempt from the full LST tax. This includes both the school and municipality portions of the tax. Valid exemptions could be if the employee works for the military or if they work for multiple employers. The employee must submit an exemption certification.

- Low-Income–The employee may be exempt from either part of or all of the LST tax based on their annual income (annualized per pay period). The employee must submit an exemption certification.

Work Location for Pennsylvania LST Calculation

Select the default option used to determine the work location for LST taxes when creating new employee records.

- Use Work Location with Highest Wages –Pennsylvania wages (excluding Philadelphia) are compared on the current paycheck and then LST is calculated for the location with the highest wages. This is the default option.

- Use Resident Location–LST is calculated based on the resident location for all wages earned (excluding Philadelphia).

- Use Primary Job Location–LST is calculated based on the location of the primary job assigned to the employee for all wages earned (excluding Philadelphia).

- Use Selected Job Location–LST is calculated based on the location of the selected job for all wages earned (excluding Philadelphia). When this option is selected, the Job Number field is available. Use this field to locate and select a job. Only jobs with a validated Pennsylvania address can be selected. The job must have a Pennsylvania location code to determine the correct EIT tax .

Note: Select the Use Work Location with Highest Wages, Use Primary Job Location, or Use Selected Job Location option in this field as long as these are not set to a Philadelphia job. If set to a Philadelphia job, this field defaults to Use Work Location with Highest Wages ; otherwise no LST would be calculated.

LST Calculation

The rate used is based on the determined Work Location.

- The full amount if $10.00 or less

- The pro-rated amount if $52.00 or more.

OR

The current maximum withheld each pay period is based on the amount of the current LST tax being withheld.

Semi-monthly employee:

- First pay period–LST maximum is $156 and the calculated tax amount is $6.50.

- Next pay period–LST maximum is $10 and the calculated tax amount is only $3.50 because the employee already paid $6.50.

- Next pay period–LST maximum is $52 and the calculated tax amount is $2.17 (the full pro-rated amount).

- Any remaining pay periods–The employee will not be taxed where the LST maximum is $10, the tax withheld is $0.00 because the employee already paid over $10 total.

Note: This will be changing in a future release because per the state, the maximum amount an employee can be taxed in a year is $52.00, and not based on the current LST tax amount.

Philadelphia

Residents of Philadelphia are excluded from Act 32 so EIT is never calculated for these employees. All wages earned (in and out of Pennsylvania), have Philadelphia City Tax calculated instead. If the employee also works in a location outside of Philadelphia, LST is calculated based on the option selected in the Work Location for Pennsylvania LST Calculation field.

Philadelphia City Tax is calculated on those wages by non-residents of Philadelphia who work in the city. If the employee also works in other Pennsylvania cities, then EIT/LST is calculated based on those wages and the value set for the option selected in the Work Location for Pennsylvania LST Calculations field. The wages earned in Philadelphia are not included in these calculations.

Non-Pennsylvania Residents

EIT and LST is calculated on all wages earned in Pennsylvania, regardless of where the employee resides. If either the Work Location for Pennsylvania EIT Calculation field or the Work Location for Pennsylvania LST Calculation field set to Use Resident Location, Use Primary Job Location, or Use Selected Job Location and the job is not a validated Pennsylvania job, then the field defaults back to Use Work Location with Highest Wages.

Pennsylvania Residents Working Outside the State

EIT and LST is calculated on all wages earned in Pennsylvania. Wages earned outside of Pennsylvania may be included in the EIT calculation (not the work location determination) when the Withhold Pennsylvania EIT Courtesy Tax checkbox (on the Payroll Tax Automation Settings tab of the PAY Defaults window) is selected. When this checkbox is cleared, these wages are not included in the EIT calculation. Wages earned outside of Pennsylvania are never included in LST.

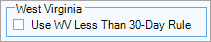

The state of West Virginia implemented a Less Than 30-Day Rule to determine if state income tax should be withheld. Law H.B. 2026 effective January 1, 2022 provides relief from income tax for employees working temporarily within the state. The legislation, which also includes other tax reforms, was enacted in support of Ascend WV, a program to recruit remote workers to the state. West Virginia Code §11-21-31 provides that wages paid to a West Virginia nonresident are exempt from income tax and withholding if:

- The compensation is paid for employment duties performed by the individual within the state for 30 or fewer days in the calendar year.

- The individual performed employment duties in more than one state during the calendar year.

- The compensation is not paid for employment duties performed by the individual in the individual's capacity as a professional athlete, professional entertainer, or public figure.

- The nonresident individual's state of residence provides a substantially similar exclusion or does not impose an individual income tax, or the individual's income is exempt from taxation by West Virginia under the United States Constitution or federal statute.

Employees are considered present and performing employment duties within the state for a day if they perform more duties in West Virginia than in any other state during that day. Any portion of the day during which the employee is in transit is not considered in determining the location of an employee's performance of employment duties. If the number of days during the calendar year exceeds the 30-day threshold, the employer is required to withhold West Virginia income tax on wages earned for all days in the calendar year the nonresident employees performs services within the state, including the first 30 days.

The check box is available for employees in all states except for the state of West Virginia itself and any reciprocal states (KY, MD, OH, PA, and VA).

- If the check box is cleared, then state income tax is withheld based on the standard rules.

- If the check box selected, then no state income tax is withheld for the non-resident state. All wages earned in the non-resident state are moved to the resident state and calculated there.

The setting for this check box displays in the Employee Master Report (detail report and grid view).