Adding Federal Tax Levies to Employee Deductions

- Open the Employee Master File for the selected Employee.

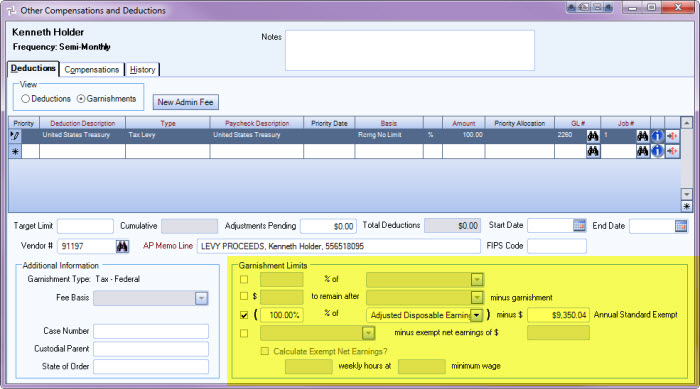

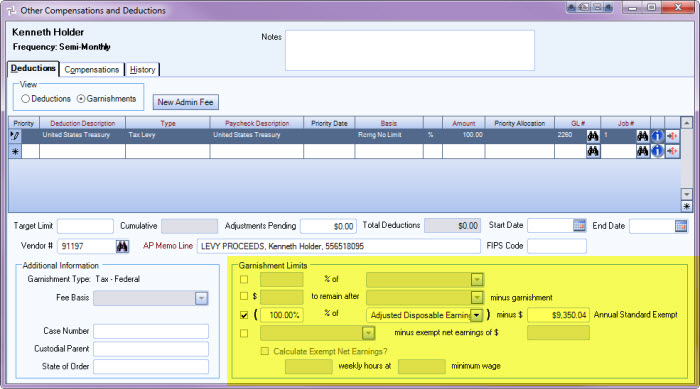

- Click the Other Comps/Deds button. The screen displays with focus on the Deductions tab.

- Under View, click Garnishments.

- Click Add New to open the grid.

- Select the Garnishment Deduction Code you want attached to this employee record. The information defaults from the Deduction Code record.

- Enter the Percentage Amount. In our example, we are entering 100% since we want to take 100% of the employee’s Adjusted Disposable Earnings after applying the Annual Std Exempt amount. (See the Garnishment Limits section highlight below.)

- For a garnishment that is a Federal Tax Levy use the AP Memo Line to add required information that will print on the Accounts Payable check itself. It should include the taxpayer's name, identifying number(s), kind of tax, and tax periods shown on Part 1 of the Levy, and the words “LEVY PROCEEDS.”

- Enter the annual standard exemption amount.

Page link: CSH link will go here