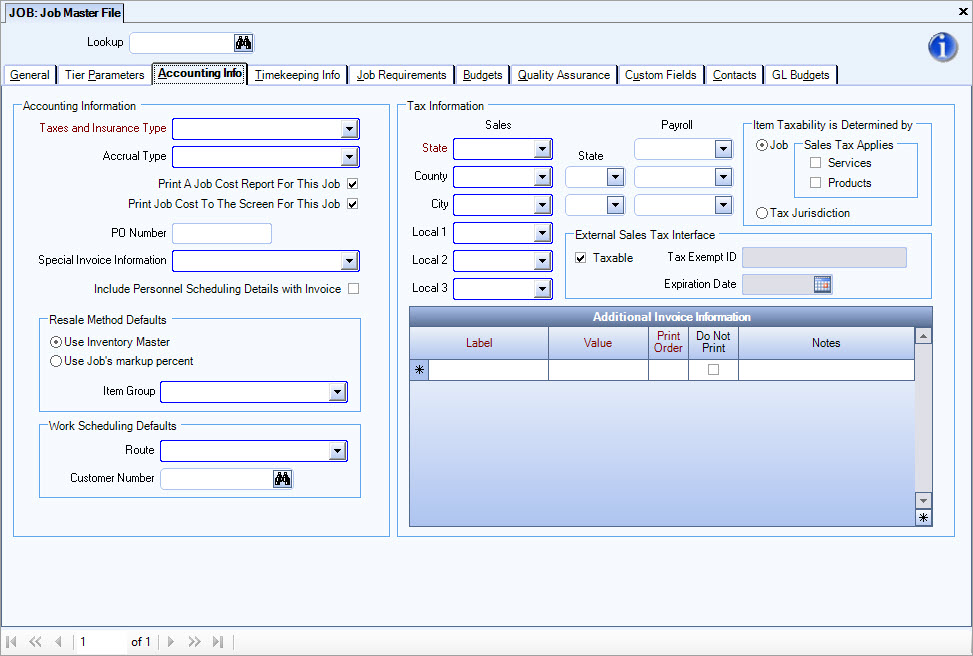

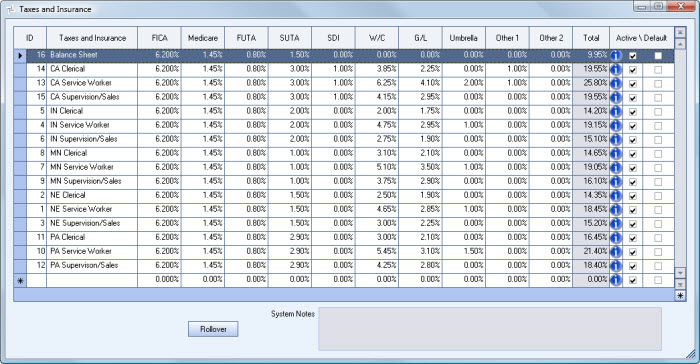

The Payroll Taxes and Insurance Types screen can be accessed from the Job Master File (Accounting Info) screen. Double-clicking in the Taxes and Insurance Type field displays the Taxes and Insurance screen.

The system uses these rates to determine the payroll tax and insurance costs to use for each labor posting.

The rates entered on the Payroll Taxes and Insurance screen are multiplied by the labor $’s updated for each job/department at the time the Labor Distribution Journal is updated to the General Ledger (ie: General Ledger labor posting multiplied by Payroll Taxes and Insurance Rate equals General Ledger memo posting). For more information, see Calculating Actual Payroll Taxes and Insurance and Calculating Budgeted Payroll Taxes and Insurance.

Due to the various Workers Compensation and State Unemployment rates, you will need to add a description for each Workers Compensation classification and each state you are doing business in.

You should record, in this area, any employer percentage that is calculated based on a percentage of payroll. FICA, FUTA, SUTA, Workers Compensation Insurance, General Liability Insurance, Insurance Umbrella, and Disability Insurance are all usually based on a percentage of payroll dollars, therefore this screen has predefined columns. The last column is available for any Other percentage that is employer paid based on a percentage of payroll. The Total column sums the percentages from each column.

If there are different classifications of labor at the same job site, you may want to set up a Parent and Sub job.

If you make changes to your Tax and Insurance Rates AND you want to include the updated rates in previously calculated budgets, you will need to recalculate the job daily budgets. For more information, see Recalculating Payroll Taxes and Insurance.

If you wish to include Payroll Taxes and Insurance in your Job Cost Reports, see Formatting the Job Costing Report to Include Payroll Taxes and Insurance.

If you wish to include Payroll Taxes and Insurance in your Financial Statements, see Formatting Financial Statements to Include Payroll Taxes and Insurance.