To print and update employer healthcare costs in WinTeam's Human Resources module:

- On the HR Report: Healthcare Cost Report options screen, click the Print/Update button to either print or create a tax adjustment batch using the Special W2 Description of Employer Sponsored Health Coverage. Normally, this is run on a timely basis, and should coincide with the amount represented in the ER Premium.

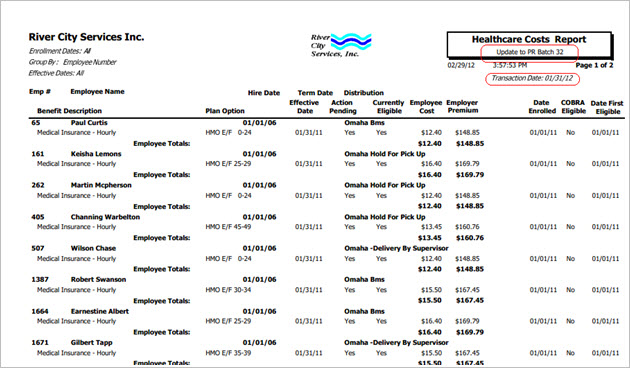

- The system will display a message asking if you wish to create a Payroll Tax adjustment batch. Click the Yes button to create an adjustment record for each employee(just as if you are making a Tax Adjustment in the Check Processing Wizard) with the Employer Premium amount. The system also sends the report directly to your default printer. The printed report includes the PR Batch (Tax Adjustment) number for the batch that was created, showing the items created in the tax adjustment batch.

- The Edit Checks Notes screen populates with a system note indicating that this was a Employer Sponsored Healthcare Coverage batch.

Note: You cannot reprint this report.

The Edit Checks Notes screen populates with a system note indicating that this was a Employer Sponsored Healthcare Coverage batch.

Note: This information will eventually be totaled and shown on the Employee W-2 as Employer Sponsored Health Coverage (Box 12 using Code DD).

When the update is complete, the system displays a message that the Payroll tax adjustment batch was created successfully.