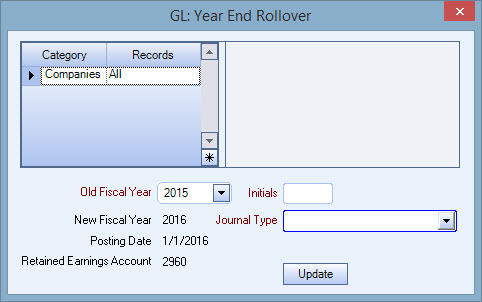

Overview

The Year End Rollover program should be used once a year to bring forward ending balances from the prior fiscal year for all balance sheet general ledger accounts.

Key Functionality

Companies

The Company Pick option filters for AR Invoice and Payment records. The Companies category is available for Clients using the Multi-Company feature.

Select the Companies to include on the report.

Select All to include all companies on the report.

Select Pick to define specific Companies for the report. When you select Pick, the Companies list displays. Select the check box next to each Company to include on the report.

Note: When running reports using the Company Category/Record Pick and the company name exceeds the maximum number of characters, WinTeam will truncate the name.

Old Fiscal Year

Displays the current fiscal year that the rollover will occur from.

Initials

Use the Initials field to enter the initials of the person performing the rollover. This is a required field.

Note: Multi-company users must use different initials for each company you rollover. The system will not allow you to perform a rollover for a company if the initials are the same. This will prevent you from rolling over the same company twice.

New Fiscal Year

Displays the new fiscal year and cannot be directly changed (set up in SYS: Fiscal Year Setup).

Posting Date

The Posting Date displays the first day of the new fiscal year. The Posting Date is based on the fiscal year information set up on the Set Fiscal Years screen and cannot be changed here.

Retained Earnings Account

Displays the General Ledger account where the total earnings (or losses) from the Old Fiscal Year update into the New Fiscal Year. This General Ledger account number is set on the System Defaults screen and cannot be changed here.

Journal Type

Type or select the Journal Type to group adjusting entries for sorting General Ledger reports. To add a new Journal Type, double-click in the Journal Type field, or type a new Journal Type and press Enter. The Journal Types add/edit list displays.

Update button

Click the Update button to update the income and expense accounts to the Retained Earnings account.

This process clears the balance in all of the Income and Expense accounts and updates the net earnings (or loss) to the Retained Earnings account in the General Ledger.

When the update is complete, a message displays stating that the system has created an adjusting journal entry, which you can view on the Adjusting Journal Entries screen. Click OK to return to the Year End Rollover screen.