Use this procedure to dispose of a fixed asset.

You may want to review the following topics before disposing an Asset:

To dispose of a fixed asset

- On the Fixed Assets menu, click Asset Master File.

- Enter the Asset ID, or use the Find Feature to locate the asset record.

- Enter the date the asset was sold or disposed of in the Date Disposed field.

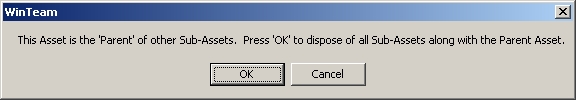

- If the Fixed Asset has Sub Assets, the system displays the following message:

- If you click the OK button, the system disposes all of the Sub Assets with the Parent Asset. Click the Cancel button if you do not want to dispose the Sub Assets assigned to this Parent Asset.

Warning: WinTeam does not allow you to dispose of a Parent Asset without also disposing of the Sub Assets. If you must dispose the Parent Asset, but need not dispose the Sub Assets, you must unassign each of the Sub Assets.

In the Parent Asset record in the Asset Master File screen, click the Show Subs button to open the Sub Assets screen. In the Sub Assets screen, click the Detail button for each Sub Asset to open its Asset Master File record.

In the Sub Asset record, delete the value in the Parent Asset Id field, and then save the Sub Asset record.

After unassigning each of the Sub Asset records, you may dispose of the Parent Asset.

- After you enter the Date Disposed, the system displays the Sales Proceeds and Sold To fields. If you sold the Fixed Asset, enter the amount you received in the Sales Proceeds field. In the Sold To field enter the name of the person or company that bought the Fixed Asset from you. If you did not sell the Fixed Asset, leave the Sales Proceeds and Sold To fields blank.

Make sure when you deposit the funds from the sale that you use the Gain/Loss account as the G/L number so that the two accounts offset each other. - In the Asset Master File for the Fixed Asset just disposed, click the Depreciation Details button. In the Depreciation Details screen, the system lists a Disposal in the last fiscal period. This is the amount that the system posts to the accumulated depreciation account (to reverse the accumulated depreciation). The system posts this amount when it updates the last fiscal period for this Fixed Asset to the General Ledger.

Example of entries made to the General Ledger when disposing a Fixed Asset

An item that originally cost $12,000.00 is being disposed.

The amount of depreciation that was already previously expensed for this item is $8,500.00.

The original cost is credited. The General Ledger Number is determined by the Asset account that is indicated in the Asset Categories table. Our example is using G/L #1510.

The accumulated depreciation that was previously expensed is debited. Our example is using G/L # 1511.

The remaining amount that was not already depreciated and debited to the Gain/Loss Account that is indicated in the Asset Categories screen. Our example is using G/L #4920.

Below is the entries that are made to the General Ledger for this item:

| Debits | Credits | |

|---|---|---|

|

1510 Furniture/Fixtures |

|

$12,000.00 |

|

1511 Furniture/Fixtures Accum Depr |

$8,500.00 |

|

|

4920 Gain/Loss Account |

$3,500.00 |

|

When depositing any monies relating to the sale of this item in Accounts Receivable, Cash Posting, you will want to be sure to distribute the miscellaneous deposit for this resale to the Gain/Loss Account #4920. The difference between the two entries will be the Gain/Loss amount realized by the sale of this item.

EXAMPLE

Let's say you resold the item for $2,500.00 and that the money is being deposited into Cash Account #1054. The following are the entries made when the Cash is updated to the General Ledger in Accounts Receivable:

| Debit | Credits | |

|---|---|---|

|

1054 Cash Account |

$2,500.00 |

|

|

4920 Gain/Loss Account |

|

$2,500.00 |

Since the item was resold at $2,500.00 but had an amount of $3,500.00 still left that was not depreciated, the gain/loss was a loss of $1,000.00