Overview

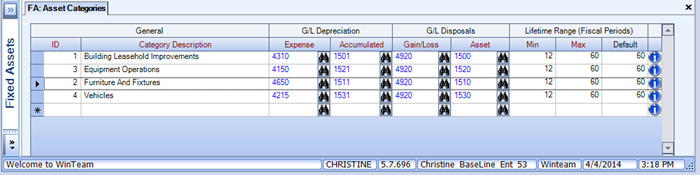

You can use the Asset Categories screen to enter new or edit existing asset categories. An asset category contains the Category Description, the General Ledger Accounts, and the Lifetime Range (in fiscal periods, or months) that an entire group of Fixed Assets uses.

When you enter a Fixed Asset record in the FA: Master File, the system compares the Expected Life value to the Lifetime Range values entered in the Asset Categories screen for the same Category.

During the Fixed Assets General Ledger Update process, the system refers to the General Ledger Accounts from the Asset Categories screen to post the depreciation expense and to post Fixed Asset disposals.

You can filter all Fixed Asset Reports by Asset Categories.

Security

You must belong to the FA Categories and SYS Drop Down Lists in order to access this screen.

Key Functionality

The system assigns an ID number to the Asset Category. You may modify the ID, but it must be unique.

Use the Category Description field to enter a description for the record.

For example, a Category Description might be Furniture and Fixtures, Vehicles, Building Improvements, and Office Equipment. Category Descriptions are used in the Asset Master File for the Category list, and some Fixed Asset Reports use Category Descriptions for sorting.

Use the Depreciation Expense field to select the general ledger account number (always a debit) to use when posting depreciation expenses to the general ledger during the fixed assets general ledger update process.

Use the Depreciation Accumulated field to select the general ledger account number (a credit in the case of depreciation, a debit in the case of disposal) to use when posting depreciation accumulated to the general ledger during the fixed assets general ledger update process.

For example, the General Ledger Account Number 1511, Accum. Depre. - Furniture & Fixtures, may be used to post both accumulated depreciation and Fixed Assets disposals for the Furniture & Fixtures Asset Category.

Use the Disposals Gain/Loss field to select the general ledger account number (always a debit) to use when posting disposed (sold or discarded) fixed assets to the general ledger during the fixed assets general ledger update process. The gain/loss posted to this general ledger account number is the difference between the disposed fixed asset’s cost and accumulated depreciation.

For example, the General Ledger Account Number 4920, Gain Loss Sale of Assets, may be used to post the Gain or Loss on Disposal for all Asset Categories.

Use the Disposals Asset field to select the general ledger account number (always a credit) to use when posting disposed (sold or discarded) fixed assets to the general ledger during the fixed assets general ledger update process. The amount that posts to this general ledger account number is the cost of the disposed fixed asset from this asset category.

For example, the General Ledger Account Number 1510, Furniture & Fixtures, may be used to post the disposal of a Fixed Asset for the Furniture & Fixtures Asset Category.

Lifetime Range Min

Use the Min Lifetime Range field to enter the shortest possible life span in fiscal periods or months for a fixed asset in this asset category.

For example, if you determine that three years (or 36 fiscal periods for a company using a 12-month calendar year) is the shortest possible life for an item in the Furniture & Fixtures Category, type 36 in the Min Lifetime Range field. In determining the Min Lifetime Range for an Asset Category, keep in mind the minimum allowable life for tax (Federal, State) purposes. Min Lifetime Range must be greater than zero, and may not be greater than the Max Lifetime Range. When you enter a Fixed Asset record in the Asset Master File, the system compares the Expected Life value to the Min Lifetime Range value entered in the Asset Categories screen for the same Category.

Lifetime Range Max

Use the Max Lifetime Range field to enter the maximum (longest) possible life span (in fiscal periods or months) for a fixed asset in this asset category.

For example, if you determine that 10 years (or 120 fiscal periods for a company using a 12-month calendar year) is the longest possible life for an item in the Furniture & Fixtures Category, enter 120 in the Max Lifetime Range field. In determining the Max Lifetime Range for an Asset Category, keep in mind what maximum allowable life for tax (Federal, State) purposes. Max Lifetime Range must be both greater than zero and greater than the Min Lifetime Range. When you enter a Fixed Asset in the Asset Master File, the system compares the Expected Life value to the Max Lifetime Range value entered in the Asset Categories screen for the same Category.

Lifetime Range Default

Use the Default Lifetime Range field to enter the most common life span (in fiscal periods, or months) for a fixed asset in this asset category. You can leave this field blank or enter a value. If you enter a value in the Default Lifetime Range field, it should fall between the Min and Max Lifetime Ranges for this Asset Category. When entering a new Fixed Asset in the Asset Master File screen, the system automatically fills the Expected Life field with the Default Lifetime Range value for the Asset Category selected, provided the Asset Category has a Default Lifetime Range value.