Overview

Use this procedure to copy an existing Invoice and create a new Invoice.

Rolling Over an Invoice allows you to easily create an Invoice that is very similar to an existing Invoice. It also allows you to replace an existing Invoice for a Customer with a new Invoice (in this case, you should make sure that a credit was previously issued).

Balance Posting Invoices (those entries entered through the Customer Balances screen) are NOT available for Rollover.

The Rollover button is available from the toolbar on all Invoice records (except those Invoices marked as Balance Posting).

SCENARIO I

To rollover when there is NOT a Tax Rate increase for any jurisdiction.

- Open an existing invoice.

- Click the Rollover button

on the toolbar.

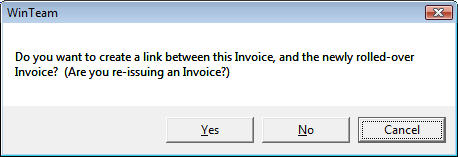

on the toolbar. - Then you will receive this message:

-

Verify the Posting Date.

If the Posting Date from the original invoice falls within the AR Valid Dates for Data Entry, then it will also be the Posting Date for the Credit Memo.

If the Posting Date of the Invoice is not within the range of dates considered valid dates for data entry you will receive a message stating so.

Then we compare the last valid date for data entry to current date. If the last valid date for data entry is less than current date then we default the last valid date to Posting date, otherwise we default current date to Posting date.

- Click Yes if you want the original invoice number to be linked with the new invoice being created. The original invoice number will display in the Original Invoice # field on the new invoice.

Click No if you do NOT want a link between the Invoices. In this case, you will not see any information related to the Inv Being Replaced on the new invoice.

Click Cancel to disregard the rollover process.

If Tax Information was edited on the original invoice, you will receive a message stating the following:

"Special tax editing existed on the original invoice but will not be used for the new invoice. You may need to edit the Tax Details of the newly created invoice."

To rollover an Invoice when the Valid Dates for Data Entry include the original invoice/posting date and there is a Tax Rate increase for any jurisdiction.

- Open an existing invoice.

- Click the Rollover button

on the toolbar.

on the toolbar.

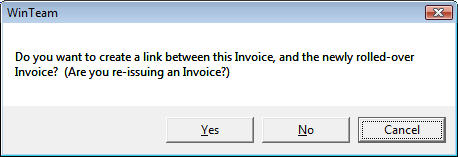

You will receive this message:

-

Verify the Posting Date. If the Posting Date on the original invoice is not in the valid data entry range then we compare the last valid date for data entry to current date. If the last valid date for data entry is less than current date then we default the last valid date to Posting date, otherwise we default current date to Posting date.

- If you select Yes, the record set includes the new invoice and the original invoice. A link is created with the new Posting Date.

- If the User has Special Security to Edit Tax information, you will receive the following message:

"There is at least one jurisdiction with a tax rate change since the original Posting Date. Select Yes to keep tax calculation the same as the original invoice. Select No to recalculate taxes using the current tax rates." The system defaults to No. If you select Yes, then the tax of the new invoices shows Taxes Edit for all tax jurisdiction line items. - If the User does NOT have Special Security to Edit Tax information, you will receive the following message:

"There is at least one jurisdiction with a tax rate change since the original Posting Date. The new invoice will have taxes calculated using the current tax rates." Click OK. - If you select No (to the message in 2. above), the record set includes the new invoice and the original invoice. The new invoices is created with NO reference to the original invoice.The new invoice is with the new Posting Date.

- If the User has Special Security to Edit Tax information, you will receive the following message:

"There is at least one jurisdiction with a tax rate change since the original Posting Date. Select Yes to keep tax calculation the same as the original invoice. Select No to recalculate taxes using the current tax rates." The system defaults to No. If you select Yes, then the tax of the new invoices shows Taxes Edit for all tax jurisdiction line items. The system defaults to No. If you select Yes, then the tax of the new invoice shows as Taxed Edited for all existing Tax Jurisdiction line items.- If the User does NOT have Special Security to Edit Tax information, you will receive the following message:

"There is at least one jurisdiction with a tax rate change since the original Posting Date. The new invoice will have taxes calculated using the current tax rates." Click OK.

- If you select Cancel (to the message in 2. above), a new invoice is not created and you are taken back to the original invoice in the record set.

To rollover an Invoice when the Valid Dates for Data Entry does NOT include the original invoice/posting date and there is NOT a Tax Rate increase for any jurisdiction.

- Open an existing invoice.

- Click the Rollover button

on the toolbar.

on the toolbar.

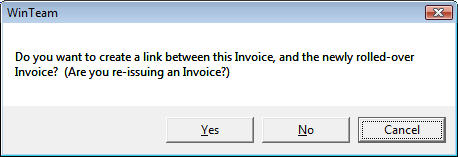

You will receive this message:

Important Information

- The Print Status of the new invoice will be "Print Invoice", unless the Customer is set up to not Print Invoice. In this case the Print Status will be "Don't Print".

- The Notes field of the new invoice will include the verbiage "Auto created using the Rollover".

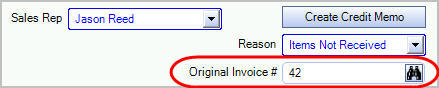

- If you clicked "Yes" to create a link with the existing (old) invoice, the Original Invoice # field is visible on the screen with the original invoice number displaying.

- If the original invoice was linked to Personnel Scheduling Details, Work Order Details, or Resale Details, these links are not carried over to the new invoice.

- Posted and Paid status information from the original invoice are NOT carried over to the new invoice. So, if you rollover a Posted or Paid invoice, the new invoice will have an "Outstanding" status.

- If the Posting Date of the Invoice is not within the range of dates considered valid dates for data entry, the Posting Date for the new invoice will be created using the current date.

- The User Name of the person doing the rollover will be on the new invoice, not the User Name of the original invoice.

Credit Memos

If a Credit Memo was created using the Create Credit Memo button, the system will rollover an exact duplicate of the original credit memo, including Tax Details.

If you change the invoice in ay way, the system will go through the normal tax calculations and will use the "current" rate info (based on the Posting date of the invoice) and recalculate taxes, This means if you changed your tax rates or added a new jurisdiction to a Job, the system will recompute taxes.

If you are recreating a new invoice, the new invoice would use the "current" rates and jurisdictions for the Job for the Posting Date of the new invoices.

If there was a rate change between the credit memo's posting date and the original posting dates (this could happen if you are not able to use the same posting date of the original invoice since that period was closed), the system will mark the credit memo as having Taxed Edited since we do not want the system to recompute taxes.

Note: If the Posting Date on the original invoice is not in the valid data entry range then we compare the last valid date for data entry to current date. If the last valid date for data entry is less than current date then we default the last valid date to Posting date, otherwise we default current date to Posting date.