New functionality has been added to WinTeam to comply with the state of New York's requirement that any shift or combination of shifts exceeding ten hours from the start of the first shift to the end of the last shift within a day is subject to a penalty. The penalty is extra pay the employer must pay to the employee and may be up to one hour of minimum wage.

How do I set it up?

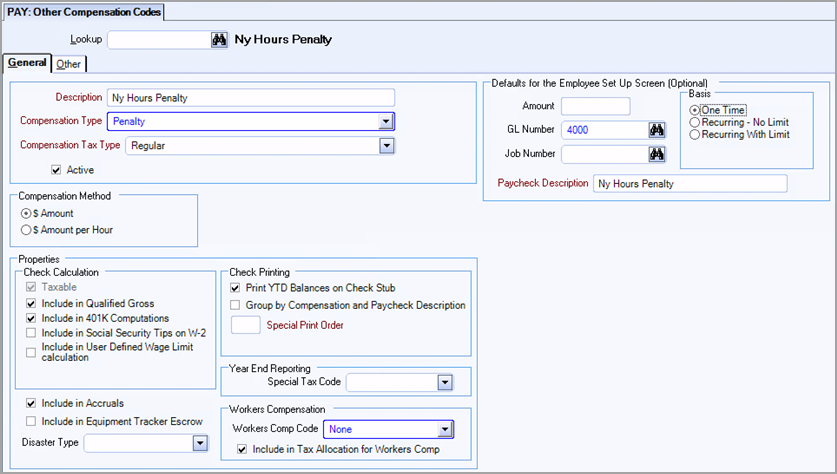

- In the Other Compensation Codes window, create a compensation code for spread of hours penalties.

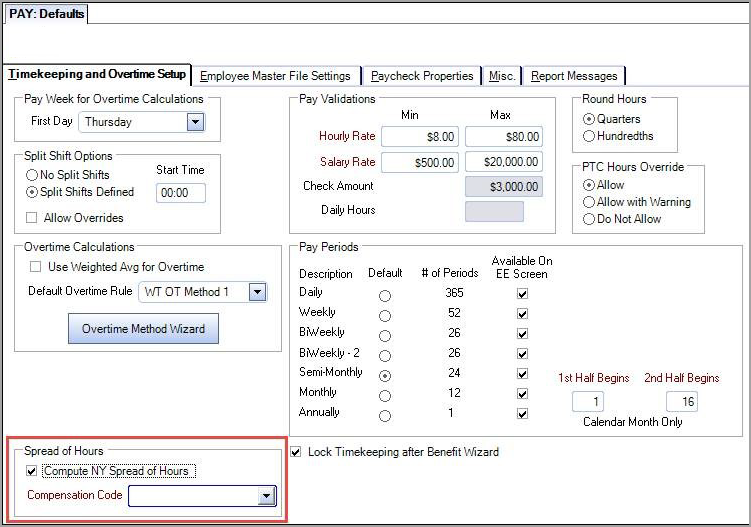

- In the PAY Defaults window, on the Timekeeping and Overtime Setup tab, select the Compute NY Spread of Hours check box and then select the Compensation Code from the drop down list.

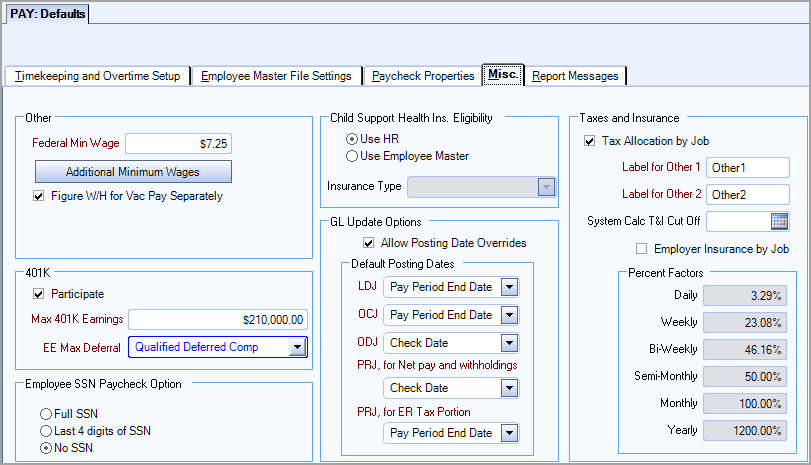

- On the Misc tab, verify the federal minimum wage value is correct. You can create alternate minimum wage values using the Additional Minimum Wage option here or you can add them by job by assigning a Minimum Wage Override on the General tab of the Job Master File.

- NOTE: This step is done automatically in the updated tax engine. If you use the original tax engine then you must make these entries.

In the Job Master File window, on the General tab, in the Payroll Tax Address field, set the state to NY (New York). If the General tab is not available, do the following:- Select the JMF Tax Address Validation check box in SYS Defaults (this activates the General tab in the Job Master File)

- Make sure the Physical Address has NY as the state since the Physical Address defaults over the Tax Address

Note: The Compensation Code should be set to $Amount, Not $Amount per Hour. If you set it up as a $Amount per Hour, it will calculate incorrectly.

Which employees are eligible?

The spread of hours only applies to hourly employees.

To be eligible to be paid the penalty, the employee does not need to work 10 hours. For example, the employee may have two shifts, one 0800-1200 and a second 1700-2100 but 0800-2100 is greater than 10 hours so the day is subject to the penalty. If the employee works a single 9.5 hour shift plus a 1 hour lunch break, the shift is subject to the penalty because the start to end time is a spread of 10.5 hours.

If the employee's normal pay rate is greater than the minimum wage rate, then the excess reduces the penalty amount.

Someone works 16 hours during the week, and one of the days they work requires a penalty to be paid. The regular rate for the employee is $10 per hour, and the minimum wage is $9.75 per hour.

The computation would be as follows:

1 (penalty occurrence) x $9.75 (minimum wage rate) = $9.75

($9.75 (minimum wage rate) x 16 (hours worked)) + $9.75 (computed above) = $165.75

$10.00 (employee rate) x 16 (hours worked) = $160.00

$165.75 (computed two lines above) - $160.00 (computed above) = $5.75 owed to the employee

The penalty is paid to the employee as an Other Compensation added to their paycheck when it is calculated in the Check Processing Wizard. Multiple penalties for a single week are rolled into a single compensation for the week. On paychecks that include more than one pay week, one compensation appears per week.

You can manually update the penalty amount, GL Number or Job Number in Review Checks. If the check is recalculated without a change to Timekeeping, all manual changes are saved. If a change is made in Timekeeping, the penalty is recalculated and the penalty amount, GL Number and Job Number are set back to their defaults.

If there are continuous shifts crossing days and the start time on day 1 through the end time of day 2 is greater than 10 hours, a penalty is generated. For example, Monday 1800-2100 and then 2300-0000. Tuesday 0000-0500. Since 1800-0500 is greater than 10 hours, a penalty is generated. If there is any break on the Tuesday shift, a penalty is not generated—if Tuesday was 0001-0500 instead, there would be no penalty.

If there are multiple shifts that generate a penalty, the shifts must be New York jobs. For example, an employee works a shift 1200-1500 for a New York job and another 2000-0000 for a New Jersey job, there is no penalty generated. The calculation for multiple shifts is:

[(Regular Hours Worked * Min Wage) + (Penalty Occurrences * Min Wage)] – (Regular Hours Worked * Employee Pay Rate) = Total Compensation Owed

Total compensation owed cannot exceed total penalty occurrences multiplied by minimum wage accrued over a week.

Other caveats in the credit calculation:

- The credit calculation only uses regular hours (overtime hours are ignored). For example, if someone worked 48 hours during the week and 8 hours were overtime, only 40 hours are used in the calculation.

- Only hours records that have in and out times are included in the credit calculation.

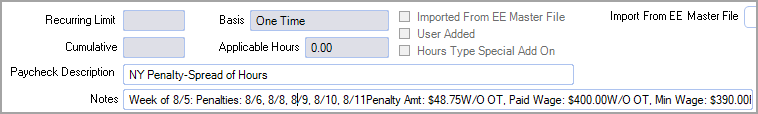

- If there is a penalty calculated for the week, the details of how it is calculated will be shown in the Notes field of the Compensation record that is created. Below is an example showing 5 penalty days in the pay week. The minimum wage rate is $9.75/hr, while the employee wage rate is $10.00/hr.

Below are the contents of the Notes field:

Week of 8/5:

Penalties: 8/6, 8/8, 8/9, 8/10, 8/11

Penalty Amt: $48.75

W/O OT, Paid Wage: $400.00

W/O OT, Min Wage: $390.00

Premium Paid: 390.00 + 48.75 - 400.00 = $38.75