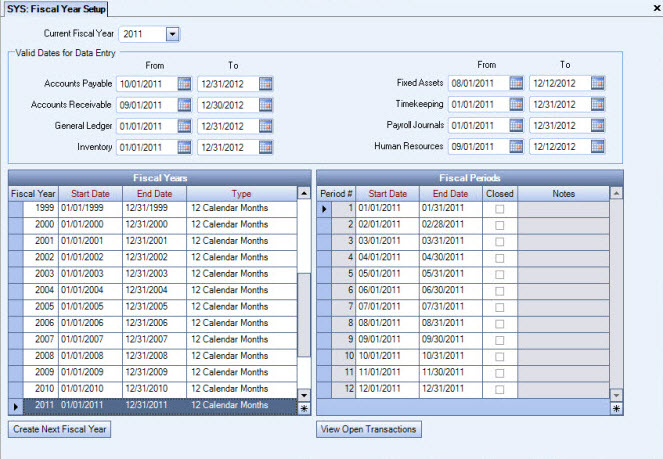

Use the Fiscal Year Setup screen to enter Valid Dates for Data Entry for each WinTeam module listed. Typically, the range of dates entered cover two or three months, and may be as restrictive or permissive to meet your company’s needs. As users enter transactions into each WinTeam module, the system compares the transaction dates to the Valid Dates for Data Entry, to validate that each transaction falls within the valid range of dates. If a user attempts to enter a transaction date outside of the valid date range, the system displays a message and prompts the user to enter a new date that falls within the valid date range.

During the initial setup of WinTeam, you must set up valid dates for data entry. Typically, you would also change your valid dates for data entry when setting up a new year.

If a User has the Can Override Valid Dates for Data Entry Security Feature selected for this screen and a transaction date is entered that is not within the From and To Dates specified as a Valid Date for Data Entry (on the SYS: Fiscal Year Setup screen), a message displays prompting to override the date.

Theses Security Features can be added to a Custom Security Group allowing a User to override dates on transaction screens that are outside of the valid date range. For more information see Security Screen Features and Creating a Super User Security Group.

To enter valid dates for data entry

- From the WinTeam Menu, click Setup, and then click Fiscal Year Setup.

- You need to ensure that if you have changed your Current Year that you save the record before changing the Valid Dates for Data Entry, otherwise you will receive a message similar to this:

- Enter From and To dates for each module listed. The From and To dates entered can fall anywhere within the Past Year up through the Future Year. WinTeam is very flexible in allowing users to enter transactions simultaneously for multiple years.

- Save the record.

Example: At the end of a fiscal year, users may continue to add transactions to both the current and previous fiscal years.