About the Law

NOTICE OF MANDATORY TAX CHANGES

In 2008, the Commonwealth of Pennsylvania amended the Local Tax Enabling Act (LTEA), better known as Act 511 of 1965, to streamline and reform the local earned income tax collection system. This has resulted in major changes to the manner in which you are now required to withhold and remit earned income taxes on behalf of your employees. The following changes are a required part of Act 32 of 2008, and are effective as of January 1, 2012 for the 2012 tax year.

All employers with locations within Pennsylvania are required to withhold earned income taxes from their employees based on the higher of the two tax rates to which the employee may be subjected, i.e., the employee's resident tax rate or the employer jurisdiction's non-resident tax rate. The employer is required to identify the rate for each employee, and withhold and remit at the higher of the two rates.

Act 32 requires that all taxing bodies within each county choose one tax collector to administer the earned income tax for that county. As of the first quarter of 2012, all employers/self reporting individuals are required to file the taxes due with the county's chosen administrator. Under the rules of the act, employers are required to:

- Report a residence and workplace political subdivision (PSD) taxing jurisdiction for each employee via PSD codes.

- Withhold EIT for each employee at the resident or workplace non-resident taxing jurisdiction rate, whichever is higher.

- Remit the EIT taxes for each employee to the county tax collection bureau associated with the workplace for the employee.

Note: Your employees must complete a Certificate of Residency. This will help determine the correct EIT rate based on residence or workplace taxing jurisdiction. Call your county tax office for further information. Some counties require copies of the certificates.

The withholding is still based on where the employee works. An employee who worked in multiple cities (PSDs) during the pay period, with each PSD having its own rate, would have been subject to withholding for multiple cities (PSDs).

However, with PA Tax Act 32, withholding is based either on where the employee resides (PSD code in the Employee Master File,) or where the employee earned the most wages (PSD code in the Job Master File). The withholding applied to all PSD earnings will be whichever is rate is higher: the Resident PSD rate or the PSD job where the employee earned the most during the pay period. This eliminates the need to withhold at different rates.

Some caveats exist. For example, someone who lives in Philadelphia is exempt from PSD withholding, regardless of whether he worked at job locations that have a PSD code.

Berkheimer offers a free service to assist employers in identifying the appropriate resident jurisdiction and tax rate for its employees. Through "Berk-e," their e-file portal (http://www.berk-e.com/), you have the opportunity to upload a file of employee's addresses, which their system standardizes, matches to their internal coding system, and returns to you the appropriate resident rate and jurisdiction.

If you have questions regarding the appropriate tax rate for an employee, information can be obtained on the State's Municipal Statistics website at: http://munstatspa.dced.state.pa.us/Registers.aspx.

WinTeam Setup

Have each of your employees who work in PA complete a Certificate of Residency.

Set up a City Tax Code for each PSD that applies to your company, based on where your jobs are located and where your employees live. It is not necessary to set up every PSD code (there are hundreds); only set up the ones that apply to your company.

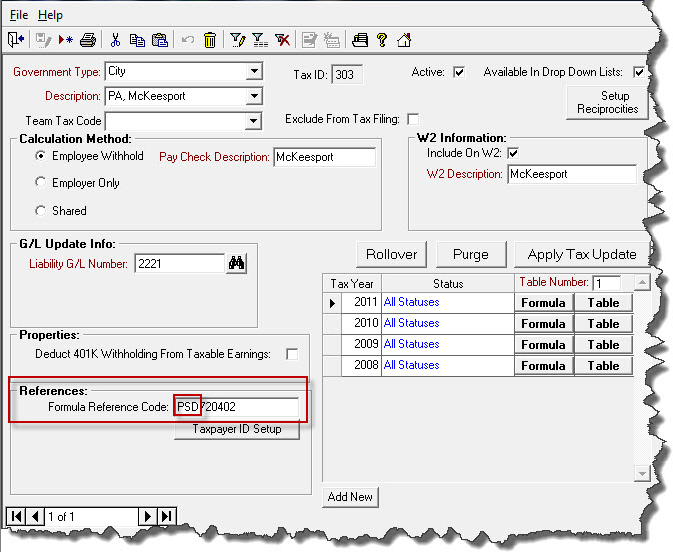

To determine PSD codes, the system looks at any tax codes set up in PAY: Taxes that have a Formula Reference code entry beginning with PSD.

Make sure that the formula for the PSD code is set up as shown below. Since there is a single rate, the formula is simple and will direct the system in tax calculations.

| Line Number | Result | Expression | Comments |

|---|---|---|---|

| 10 | A | GetCurrent("TaxableAmount") | City Taxable Amount |

| 15 | D | GetResidentStatus() | D=False->NR |

| 20 | B | TableLookup([A], 1) | Resident Percentage |

| 25 | C | TableLookup([A], 2) | Non-resident percentage |

| 30 | E | IIf([D],[B],[C]) | |

| 40 | Tax | [E] | |

| 110 | Tax | IIf([Tax]<0,0,[Tax]) | Ensure tax is positive |

Set up must include Table 1 (Resident) and Table 2 (Non-resident) since many PSD codes have different resident and non-resident rates. As a best practice, even if the PSD has the same rate for resident and non-resident, set up Table 2 regardless. A rate change for the resident or non-resident rate could occur at some point in the future, and if Table 2 already exists, the change is much easier to make. In addition, some PSD non-resident rates are 0.00%, so having Table 2 set up for this rate is important in order for tax calculations to be accurate in all instances.

If you do not set up Table 2 for a PSD code, the system will use Table 1 as the non-resident table, per usual.

Whichever PSD the employee resides in must be set up in the Employee Master File. Enter all employees' PSD codes of residence in the Tax Info tab of the Employee Master File within the Local 1 or Local 2 field. If the employee is a non-resident of PA, this is not applicable.

In the Job Master File (Accounting Info tab - Tax Information section), enter the PSD code that correlates to the Job's location. Each PA job should have a PSD code, unless the job is located in the city of Philadelphia (Philadelphia is not considered a PSD).

How WinTeam handles Political Subdivisions (PSDs)

When a batch is created (or recalculated), and if there are no PSD tax codes set up in the database, the logic related to PA Act 32 is bypassed and payroll processing will proceed as normal. This is determined quickly and should not affect payroll processing for those clients where PSD codes do not apply. For each paycheck that has a PSD code associated with it, the following determinations will be made:

Does the employee live in Philadelphia?

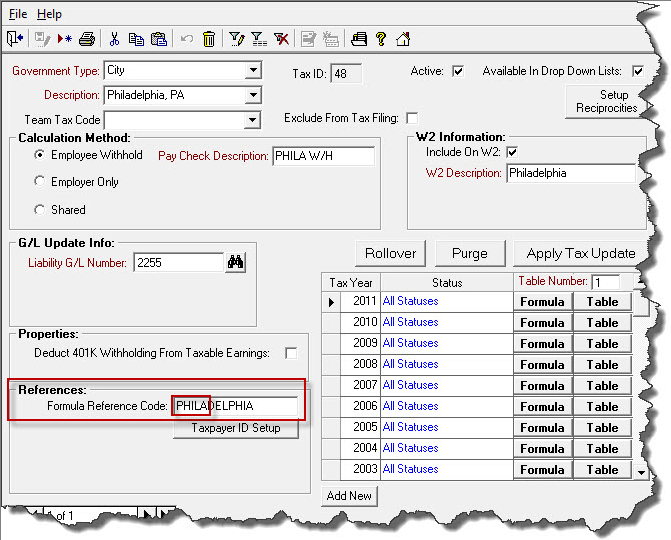

The system determines this by looking at the Employee Master File (Tax Info tab), to see if there is a Formula Reference Code that begins with "PHILA."

If yes, the employee is considered a resident of Philadelphia, and is exempt from any PSD-related local tax withholding. Even if the employee works at a job with PSD codes, no PSD tax is figured (nor earnings). PHILA is the only code that exempts employees from PSD taxes.

If no, the system moves on to Step 2.

Does the employee live in a PSD code?

If no, then continue payroll processing as normal. Any PSD codes that the employee works in will have normal tax withholding applied based on the earnings they accrued in each PSD code. The tax rate used will be the non-resident tax rate for the PSD code from Table 2. If Table 2 does not exist, the system will use the rate from Table 1. When sending to ADP, we will use the Out of State PSD code (880000) for the Resident PSD Code.

If yes, the system will determine the resident rate from Table 1 for the PSD code the employee resides in. The system will then determine where the employee earned the most.

Did the employee work at a PSD Job?

It is possible that an employee may live in a PSD (Political Subdivision) but work outside of Pennsylvania. In this case, there will be no PSD withholding of any kind since there were no earnings earned in Pennsylvania.

Example: An employer is not required to withhold PSD tax from a Pennsylvania resident that works solely outside of the state. For answers to this question and more, visit the Pennsylvania Department of Community & Economic Development Act 32-Local Earned Income Tax page.

Is the job where the employee earned the most a PSD job?

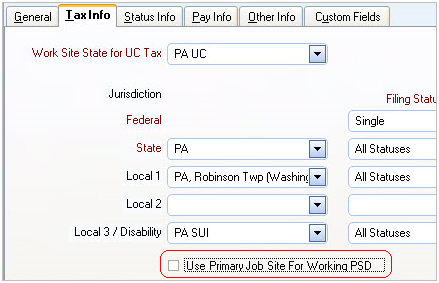

Normally WinTeam will look at the Wage records to determine the job sites that the employee worked to find the working PSD tax code. However, it could be that the employee is set up to Use Primary Job Site as their Working PSD. If this check box is selected, the Primary Job Site indicated in the Employee Master File will be used. If it is not selected, WinTeam looks at the job sites that the employee earned their wages:

If the 'Use Primary Job Site For Working PSD' check box is not selected, WinTeam will then look at the Wage records. If the job where the most wages was earned does not have a PSD code associated with it, WinTeam will look at the job that has the second-highest earnings and so on until a PSD job is found. If the system does not find any jobs with PSD codes, no PSD withholding will be applied, and no earnings will be stored for the PSD code.

If WinTeam finds a PSD job, it will compare the Non-resident rate (Table 2, if it exists; otherwise, Table 1) of the PSD to the Resident rate (Table 1). Whichever rate is higher will be used in calculating the PSD withholding. The withholding is only applied to the amount earned in a PSD location. Anything not earned at a PSD location will not be included in the calculations of earnings and withholding. For instance, any location outside of Pennsylvania would not have a PSD code so those earnings would not be figured in.

Note: The earnings and withholding are stored with the work site's PSD code (where the employee earned the most). The Resident PSD code is stored in the paycheck record since that is needed for quarterly reporting and ADP tax filing, if applicable.

If there are two PSD jobs with the same amount of earnings, WinTeam looks at the Non-resident tax rate (Table 2, if it exists; otherwise Table 1) to identify which job had the highest tax rate and use that job for the working PSD code. If the rates are the same, the system will use the minimum Job Number, and that job's PSD code will be considered the primary working PSD code.

Any job located in PA that does not have a PSD code identified in the Job Master File (with the exception of Philadelphia) will be considered as qualifying for PSD in order to protect against improper setup. Since each PA job should have a PSD code identified in the City field, WinTeam will always include the earnings garnered at a PA job in the PSD calculation, regardless.

Earnings from a job will not be included if PA is not the Payroll Tax State code set up in the Tax Info section of the Job Master File. This indicates the employee worked out of state. If the employee lives in Philadelphia and works in a PSD location, no earnings will be subject to PSD tax.

Companies who do business in Pennsylvania are required to send Monthly reports to the proper agency showing the current month’s earnings and withholdings for each PSD code. The Electronic reporting file includes only current information, not year-to-date totals.

When creating the electronic file, WinTeam will look at the Formula Reference Code of the Tax Code to know whether the Locality you are creating an Electronic file for is a PSD Code. If the Formula Reference Code starts with PSD, then the electronic file will include only the current earnings and withholdings (based on your date range entered), not year-to-date information.