Overview

Only three Local/Disability taxes can be added to an employee when using the existing tax engine. This topic details the method to create a single Parent tax and then assign multiple child taxes to it. This allows the Parent tax to be assigned to the employee and all the Child taxes to be calculated on each paycheck.

This logic is only available when there is the possibility of more than three applicable taxes. Currently it only applies to New Jersey, Oregon, and Washington.

New Jersey Taxes

- NJ State Disability Insurance (SDI) - Employee

- NJ State Disability Insurance (SDI) - Employer

- NJ State Unemployment Insurance SUI

- NJ Paid Family Leave (PFL)

- NJ Work Force Development/Supplemental Work Force (WF/SWF)

Oregon Taxes

- OR Workers Compensation (WC)

- OR Statewide Transit Tax

- Eugene OR Community Safety Payroll Tax (CSPT)

- OR Paid Family and Medical Leave (PFML)

Washington Taxes

- WA Paid Family and Medical Leave (FLI)

- WA Industrial Insurance (SDI)

- WA Long-Term Care Insurance (LTI)

PAY: Taxes

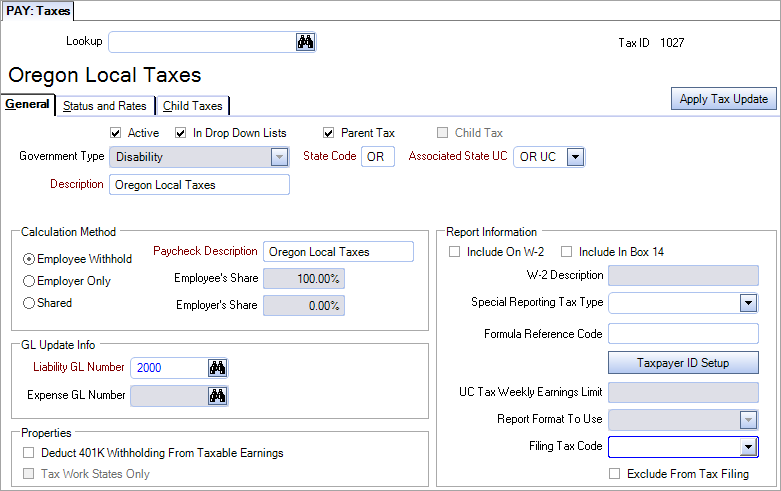

General Tab

Two additional checkboxes may be displayed:

- Parent Tax – This option is only available when the Government Type = Disability AND the State Code is NJ, OR, or WA. If selected, the tax becomes a Parent tax and the Child Taxes tab is made available. At least one Child tax must be assigned. The fields within the Calculation Method, GL Update Info, Properties and Report Information are not applicable to a Parent tax. This is the tax that must be assigned to the EMF, however, no calculation is done for the Parent tax.

- Child Tax – This option is only available when the Government Type = Disability AND the State Code is NJ or when the Government Type = Disability, City or County/School Districts AND the State Code is OR or WA. If selected, the tax is set as a Child. This tax must be assigned to a Parent tax to be calculated. It cannot be assigned to the EMF. So, if this tax needs to be assigned to an employee individually, then a separate tax needs to be created.

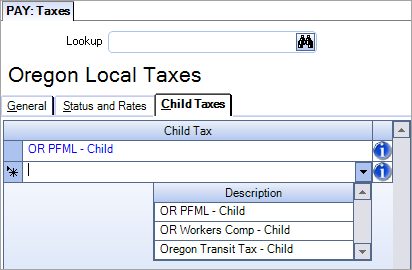

Child Taxes Tab

The Child Taxes Tab tab allows you to assign the Child taxes to the Parent tax. Only taxes marked as a Child tax with the same State Code are displayed in the drop down.

A Child tax can be assigned to multiple Parent taxes. Each child tax can only be selected/assigned once to a Parent tax. If selected a second time, an error message is displayed, and the tax removed from the grid.

Child Tax Creation

To set up a tax code as a Child:

- Open the Payroll module, and then click Taxes.

- Create the tax filling out both the General and Status and Rates tab information as needed.

- Select the Child Tax checkbox.

Note: This tax will not be displayed on the EMF, but will be available on the Child Taxes tab of a Parent Tax for the same State.

Parent Tax Creation

To set up a tax code as a Parent:

- Open the Payroll module, and then click Taxes.

- In the Government Type field, select Disability.

- In the Description field, enter the description.

- In the State Code field, enter NJ, OR, or WA.

- In the Associated State UC field, enter NJ UC, OR UC, or WA UC.

- Make sure both the Active and In Drop Down Lists checkboxes are selected.

- Select the Parent Tax checkbox.

- Fill in other required fields, however, the values imputed in the following sections are not used:

- Calculation Method

- GL Update Info

- Properties

- Report Information

- Click the Child Taxes tab

- Select all of the Child taxes that should be assigned to the Parent.

- Click the Status and Rates tab.

- In the Tax Year column of the grid enter the tax year, and in the Status column select All Statuses.

- Both the Formula and Table can be left blank.

Assign tax in the Employee Master File

- Open the Employee Master File window.

- Locate the record for the eligible employee and then click the Tax Info tab.

- Remove any existing taxes assigned in the Local 1, Local 2 or Local 3 fields.

- In any of the Local fields, select the Parent tax.

- In the Filing Status field, select All Statuses.

Note: Child taxes are not available.