Use this procedure to create a new single entry check batch.

To create a new single entry check batch

Check Processing Wizard

- Open the Check Processing Wizard.

- Select Create a New Batch from Functions.

- Select Single Entry Checks from Batch Types.

- Select the Paycheck Frequency to process. The Paycheck Frequencies are set up in Payroll Defaults and are assigned to employees. The batch is limited to only the employees assigned the selected Paycheck Frequency.

- Enter the Check Date to print on the paychecks.

- Enter the Pay Period Dates the system should use to indicate Timekeeping records to process.

- Use the Notes page to enter any notes to keep with the batch. These notes do not print and are not visible except when editing a batch. Click Finish.

Note: A warning message box displays when the weekly or bi-weekly periods do not equal 7 or 14 days respectively. You can click OK in the message box to continue without changing the number of days in the pay period

Note: The Date Range must be consistent with the Paycheck Frequency. Timekeeping records previously processed with another batch will not be processed again.

Review Checks

- Once you click Finish, the system displays a blank Review and Edit Paychecks screen.

- Select the employee you want to create a check for.

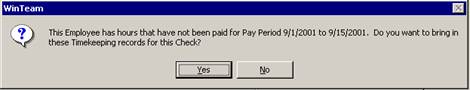

- If the employee has hours that have not been paid for the selected pay period, you have the option to bring in the Timekeeping records. If hours do not exist in Timekeeping, click the Wages Detail button and enter the needed hours in Timekeeping. You will see a message similar to this:

- Click Yes.

- Enter the Employee Number.

- The system does not pull in Other Compensation and Deduction records, so you must import them manually.

- After you have completed all entries, click the Recalculate Pay button in order for the system to calculate the wages and taxes.

- You may proceed to the Print Checks screen.

Multi-Company Feature: Once you enter the Employee #, the Paycheck Company field will populate with the employee's current Company Number. You can modify as necessary, if you have the Can Change Emp Company check box selected in User Security. Only the Companies the User has security will display in the Paycheck Company List.

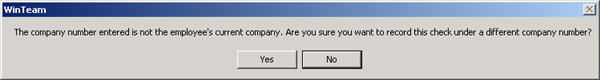

Once you change the Paycheck Company you will receive this message:

Click Yes if you want to record this check under a different Company number.

Click No to cancel the Paycheck Company change.