Overview

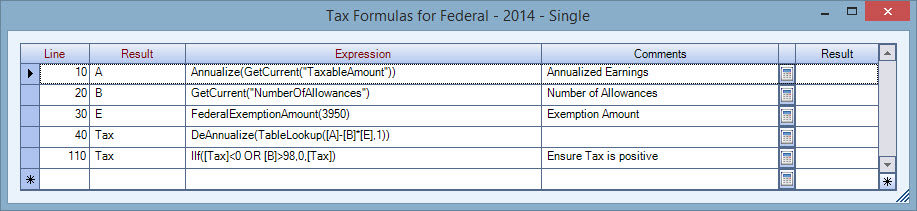

Use the Tax Details Formula screen to affect how taxes are calculated during payroll processing. You should not modify the information on this screen unless you have been instructed to do so.

Tax Details Formula screen

Functions

- Tax function to compute taxes based on Hours worked. The new function that can be used is called “GetWorkedHours”.

This will be used in those cases where the tax jurisdiction calculation needs to be figured by looking at the total Hours Worked. This function will not consider any hours type that is marked as Vacation, Sick or Holiday (these are check boxes within the hours type set up). All other hours will be used in the tax calculation, including overtime and double time hours. - Tax function to compute taxes based on Hours worked but will not include any overtime hours. The new function that can be used is called “GetRegularHours”.

This will be used in those cases where the tax jurisdiction calculation needs to be figured by looking at just regular hours worked. This function will not consider any overtime or double time hours in its calculation. Also it will not include any hours type that is marked as Vacation, Sick or Holiday (these are check boxes within the hours type set up).