Overview

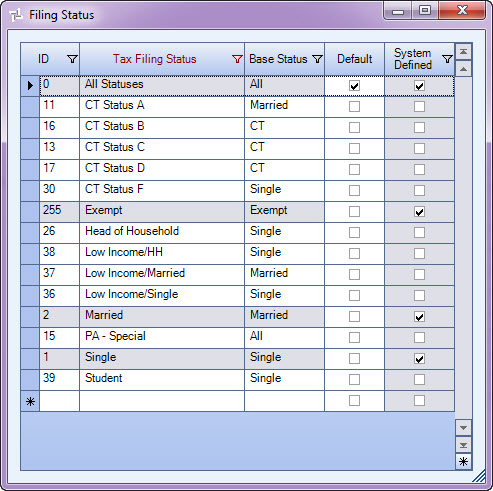

The Filing Status add\edit list is accessed from the Taxes screen by double-clicking in the Status cell. The Status field further defines the information in the Table and Formula Details section for a Tax Code. The most common Filing Status used in the Table and Formula Details section are Single, Married, All Statuses, and Exempt. Besides Single, Married, and All Statuses, the system initially includes three other Filing Statuses for very specific reasons.

- The state of Connecticut requires CT Status A (for Single) and CT Status C (for Married) tables. (If you are a Connecticut company and want to add the CT Status B and CT Status D, along with their respective Formulas and Tables, call TEAM for assistance.)