Payroll Taxes Window with the Updated Tax Engine

When you start the implementation with the updated tax engine the Payroll Taxes window changes with the phases. This page includes the details of these changes and other relevant information.

Phase 1

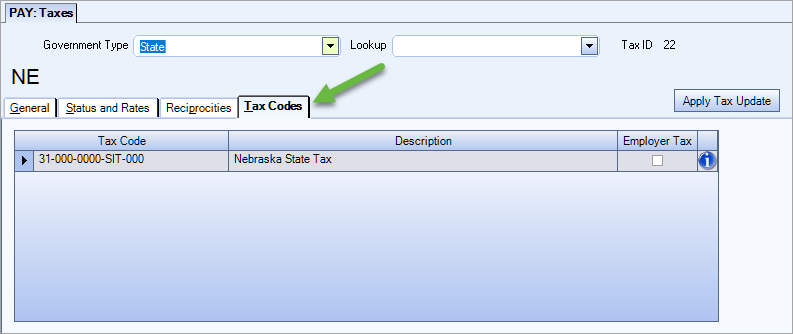

In the first phase the Payroll Taxes window displays an additional Tax Codes tab. This tab displays a grid of mapped taxes. This is the updated tax engine value. The Employer Tax check box is checked if this is an employer based tax.

Note: The Tax Codes tab is only displayed once taxes are mapped.

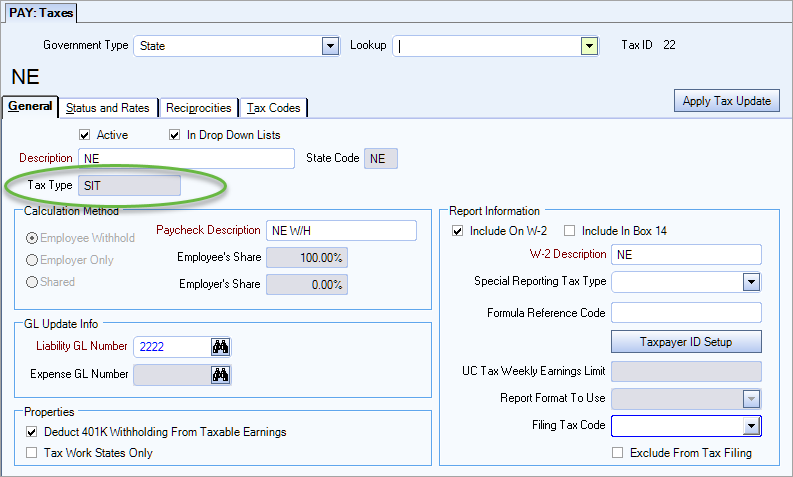

Also, with this phase the Tax Type field is displayed under the Description field. This is the updated tax engine value.

Phase 2

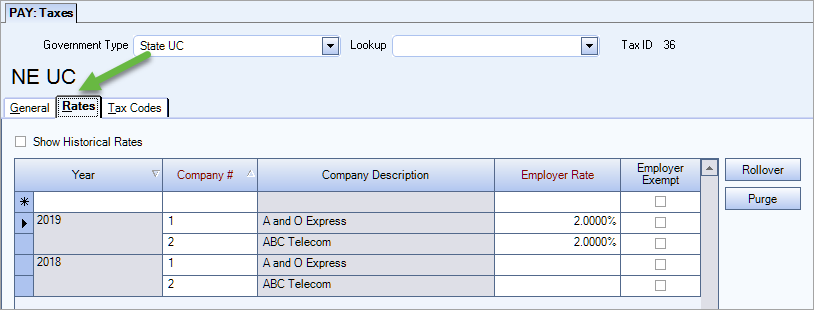

In phase 2 a Rates tab may be displayed. This tab contains the various fields available and/or required for the updated tax engine, based on the tax type. It also is where you would mark a rate Employer Exempt.

Licensed

Status and Rates/Reciprocities Tab Removed

Once your database is licensed with the updated tax engine we remove the Status and Rates tab and the Reciprocities tab. With the updated tax engine, the information that was on the Status and Rates tab is now on the Rates tab and the reciprocity information is held in the calculation processing behind the scenes.

Apply Tax Update Button Removed

Also, the button is removed from the header since the updated tax engines calculations automatically update to WinTeam.

General Tab updates

On the General tab the In Drop Down Lists check box, Employee/Employer Pct Share fields, and the Properties section are removed, as these fields are no longer applicable with the updated tax engine.

The following table includes the available Tax Type abbreviations (on the General tab), the definitions to them and the applicable states (if appropriate).

| Tax Type | Definition | State(s) |

|---|---|---|

| City | City tax | |

| County | County tax | |

| DAF | Development Assessment Fee | Kentucky |

| EHT | Employer head tax | |

| EIT | Earned income tax | Pennsylvania |

| EMAC | Employer Medical Assistance Contributions | Massachusetts |

| EMACS | Employer Medical Assistance Contribution Supplement | Massachusetts |

| FICA | Federal insurance contributions act (Social Security) | |

| FIT | Federal withholding | |

| FLI | Family Leave Insurance | |

| FUTA | Federal unemployment tax act | |

| JEDD | Joint Economic Development District/Joint Economic Development Zone (JEDZ) | Ohio |

| LST | Local services tax | Pennsylvania |

| Medicare | Medicare | |

| MHT | Mental health tax | Kentucky |

| OLF | Occupational license fee | Kentucky |

| OLTS | Occupational license tax for schools | Kentucky |

| POP | Employer percentage of payroll | |

| School | School district tax | |

| SDI | State disability insurance | |

| SIT | State income tax | |

| SUI | State unemployment insurance | |

| SUTA | State unemployment tax act | |

| SUTA_SC | State unemployment tax act surcharge | |

| Transit | Employer transportation tax | Oregon |

| WC | Worker's compensation |

The fields displayed/available on the Rates tab are based on the Tax Type and State Code values. The table below outlines the appropriate field requirements for each Tax Type.

| Government Type | Tax Type | Tax Rates By Window | Employee Hourly Rate | Employee Override Rate | Override Wage Base | Employer Rate/Hourly Rate | Employer Override Rate | Exempt | Notes |

|---|---|---|---|---|---|---|---|---|---|

| Federal | FIT | N/A | Set on Employee Master File. Employee only. |

||||||

| FICA | FICA | N/A | Set on Employee Master File. If employee is, then employer is as well. |

||||||

| Medicare | Medicare | N/A | Set on Employee Master File. If employee is, then employer is as well. |

||||||

| State | SIT | N/A |

Set on Employee Master File. Employee only. |

|

|||||

| FUTA | FUTA | Yes | N/A | N/A | N/A | Required | N/A | N/A | |

| State UC | SUTA | Yes | N/A | N/A | Optional | Required | N/A | N/A | The Override Wage Base is optional. Note - certain states may not allow the wage base to be overridden based on set rules. |

| City | City | N/A |

Set on Employee Master File. Employee only (limitations based on state). |

|

|||||

| County/School District | County, School, etc. | N/A |

Set on Employee Master File. Employee only (limitations based on state). |

|

|||||

| Disability/AK | SUI | Yes | N/A | Optional | Optional | N/A | N/A |

Set on Employee Master File. Employee only. |

The Override Wage Base is required if there is an Employee Override Rate set and vice Versa. |

| Disability/CA | SDI | Yes | N/A | Optional | Optional | N/A | N/A |

Set on Employee Master File. Employee only. |

The Override Wage Base is required if there is an Employee Override Rate set and vice versa. |

| Disability/DC | FLI | Yes | N/A | N/A | N/A | N/A | N/A | N/A | |

| Disability/HI | SDI | Yes | N/A | Optional (used only if Premium Cost is set). | Premium Cost (not required). | N/A |

Set on Employee Master File. Employee only. |

|

|

| Disability/MA |

EMAC |

Yes | N/A | N/A | Optional | N/A | Optional |

Yes Employer only. |

EMACS is ending on 12/31/19 |

| Disability/MA | FLI | Yes | N/A | N/A | N/A | Optional - Employer Elected Family Leave Percentage. | N/A | Yes Employer can be exempt if they have less than 25 employees. Employee set on Employee Master File. |

The Employer Elected Medical Leave Percentage, if entered, must be greater than 60% since the employer is already required to pay 60% of the tax. |

| Disability/MA | FLI | Yes | N/A | N/A | N/A | Optional - Employer Elected Family Leave Percentage. | N/A | Employee - set on Employee Master File | By default, this is all employee paid. However, the employer can opt to pay a portion or all by entering an Employer Elected Family Leave Percentage. |

| Disability/NJ | FLI | Yes | N/A | Optional | Optional | N/A | N/A |

Set on Employee Master File. Employee only. |

Private Plan number can also be entered here, but is not required. |

| Disability/NJ | ER_SDI | Yes | N/A | N/A | N/A | Required | N/A | If employee is, then employer is set too. | Has Private Plan option. If selected, field values are removed, and the employer is marked as exempt. Private Plan Number can also be entered her, but is not required. |

| Disability/NJ | SDI | Yes | N/A | Optional | Optional |

N/A |

N/A |

Set on Employee Master File. If employee is set, then employer is set too. |

The Override Wage Base is required if there is an Employee Override Rate set and vice versa. |

| Disability/NJ | SUI | Yes | N/A | N/A | N/A | N/A | N/A |

Set on Employee Master File. Employee only. |

|

| Disability/NJ | SUTA_SC | Yes | N/A | N/A | N/A | N/A | Optional |

Yes. Employer only. |

|

| Disability/NM | WC | Yes | N/A | N/A | N/A | N/A | N/A | Set on Employee Master File. | |

| Disability/NM | EHT | Yes | N/A | N/A | N/A | N/A | N/A |

Yes. Employer only. |

|

| Disability/NY | SDI | Yes | N/A | Optional | N/A | N/A | N/A |

Set on Employee Master File. Employee only. |

|

| Disability/NY | FLI | Yes | N/A | Optional | Optional | N/A | N/A |

Set on Employee Master File. Employee only. |

|

| Disability/OR | WC | Yes | N/A | N/A | N/A | N/A | N/A |

Set on Employee Master File. If employee, then add employer too. |

|

| Disability/PA | SUI | Yes | N/A | Optional | N/A | N/A | N/A |

Set on Employee Master File. Employee only. |

|

| Disability/PR | SDI | Yes | N/A | Optional | Optional | N/A | Optional |

Set on Employee Master File. If employee, then add employer too. |

|

| Disability/RI | SDI | Yes | N/A | Optional | Optional | N/A | N/A |

Set on Employee Master File. Employee only. |

|

| Disability/WA | SDI (L&I) | Yes | Required | N/A | N/A | Required | N/A |

Set on Employee Master File. If employee, then add employer too. |

The Employee and employer hourly rates are entered as amounts and not percentages. |

| Disability/WA | FLI | Yes | N/A | N/A | N/A | N/A | Optional - employer elected percentage. | Yes Employer can be exempt if less than 50 employees. Employee – set on Employee Master File. |

If the Employer Elected Percentage is set, then that percentage of the employee portion will be paid by the employer. |

| Disability/WY | WC | Yes | N/A | N/A | N/A | Required | N/A |

Yes. Employer only. |

|

|

City DE (Business License Fee) CO (OPT) |

EHT | Yes | N/A | N/A | N/A | N/A | N/A |

Yes. Employer only |

|

|

City NY (counties) MO (St. Louis) NJ (Newark) PA (Pittsburgh) |

POP | Yes | N/A | N/A | N/A | N/A | N/A |

Yes. Employer only |

Only Subject and Gross Wages are returned. No taxes are calculated. |

- Government Type – Indicates the original WinTeam value.

- Tax Type – Indicates the updated Tax Engine value.

- Tax Rates window – Indicates if this Tax Type uses the Tax Rates window to setup additional information.

- Yes - Additional setup may be needed

- N/A - No setup is required/used (the updated tax engine has all needed information for the tax)

- Employee Hourly Rate – Indicates if the hourly rate for the employee portion of tax must be set (This only applies to Washington L&I and is required).

- Employee Override Rate – Indicates if an override rate can be used for the employee portion of the tax instead of using the default agency values. The Override Wage Base must also be set if the Employee Override Rate is set and vice versa.

- Override Wage Base – Indicates if an override wage base can be used for the employer/employee portion of the tax instead of using the default agency values. The Override Wage Base should be equal to or less than the agency/jurisdiction required amount.

- Employer Rate/Hourly Rate – Indicates if this is a required field for taxes that are employer paid. For Washington L&I, this is an hourly rate instead of a percentage.

-

Premium Cost – Optional, applicable only to HI SDI.

-

Employer Elected Family/Medical Leave Percentage – Optional, applicable only to MA PFML.

-

Employer Elected Percentage – Optional, applicable only to WA PFML.

- Employer Override Rate – Indicates if an override rate can be used for the employer portion of the tax instead of using the default agency values.

- Exempt – Indicates if the employee or employer can be exempt from this tax and where it is setup. Employee exemption is set on the Employee Master File and the employer exemption is set on the Tax Rates window.

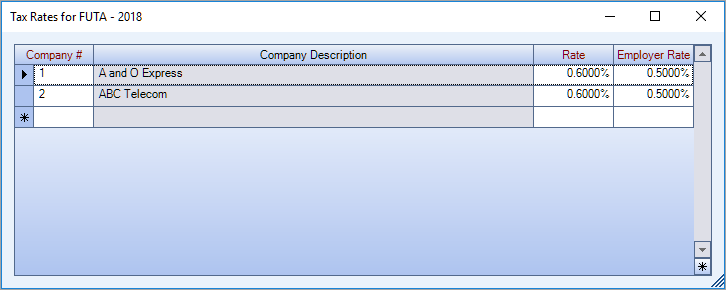

For FUTA (Government Type and Tax Type of FUTA) there is a Rate field (used by the original tax engine), and an Employer Rate field (used by the updated tax engine). These values are percentages.

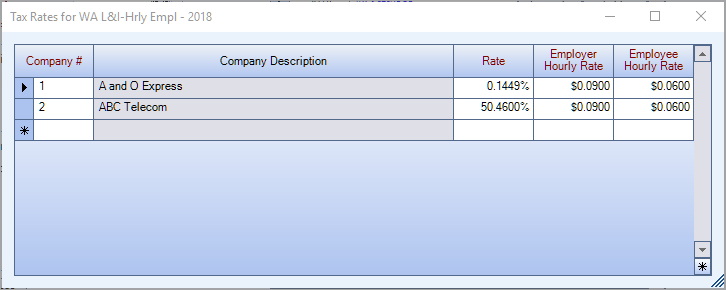

For WA L&I (Government Type of Disability, and Tax Type of SDI), there is an Employer Hourly Rate and an Employee Hourly Rate field in the Tax Rate by company grid. These values are dollar amounts.

As you are working through assigning and validating taxes the following information is helpful to verify if the tax should be on the Employee Master File or Job Master File.

Is the tax a resident based tax (where employee lives)?

- Taxes are assigned on the Employee Master File

- Tax mapping validation is performed on the Employee Master File

- Based on the Tax Type, the employee may or may not be marked as exempt

Is the tax based on where the employee works?

- Taxes are displayed in the Tax Codes window when the button is clicked on the Job Master File

- Tax mapping validation is performed on the Job Master File or the Job Taxes Validation window

- An employee cannot be marked as exempt