Use this procedure if you make changes to your Tax and Insurance Rates AND you want to include the updated rates in previously calculated budgets and employer payroll portions.

You may want to review the following information before recalculating:

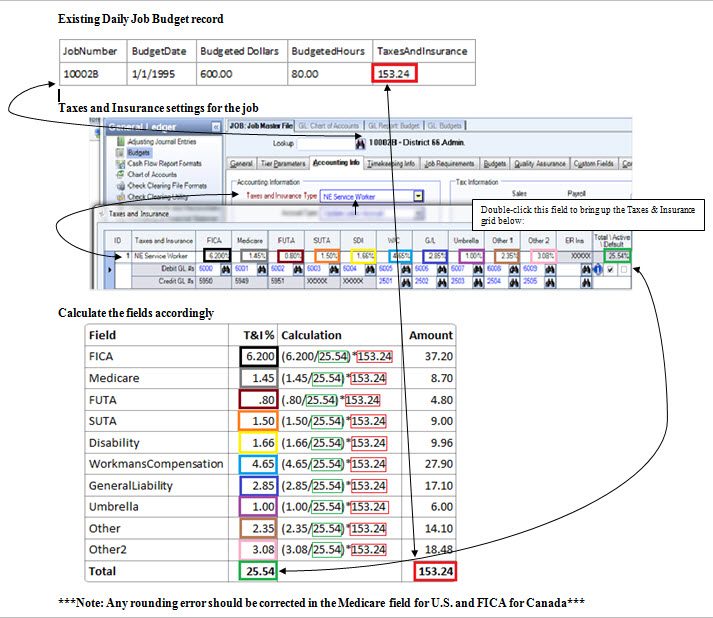

There may, at some point, be a need to recalculate the Taxes and Insurance budget amount for a Job. The main reason for recalculating would be updates to the Taxes and Insurance rates.

These amounts are figured at the time Daily Budgets are calculated for a Job. Since changing a rate in the Payroll Tax and Insurance screen DOES NOT automatically change the tax and insurance dollars stored for each day, you will need to use the Daily Budgets Adjustments program to correct things such as this.

If you are using the Tax Allocation program, the Payroll Taxes and Insurance details are recalculated every time daily job budgets are calculated or recalculated.

- From the Job Costing Menu, click Job Daily Budget Adjustments.

- Select Taxes and Insurance as the Adjustment Type.

- In the Dates Category, enter the date range to be adjusted.

- Click OK.

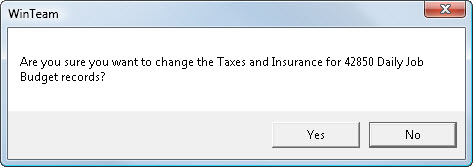

The system identifies the records that need adjustments and displays a message similar to this:

- Click No to leave the budget records as is.

Select Yes to clear the budgets for the Job. If you select Yes the system begins clearing the budgets and displays this message when complete.

- Click Ok.

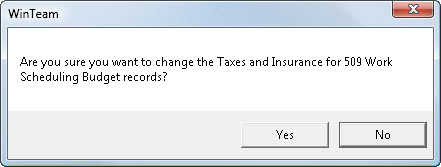

- The system then identifies the Work Scheduling budget records that need adjustments and displays a message similar to this:

- Click No to leave the work scheduling budgets as is.

Click Yes to change the work scheduling budget records. If you select Yes the system updates the budgets and displays this message when complete.

- Click OK.

- Click Cancel to close the Job Daily Budget Adjustments screen.

Example: Example of Daily Job Budget record recalculated when using the Tax Allocation program.