The system calculates Budgeted Taxes and Insurance at the same time it generates Daily Labor budgets for a Job. For more information, see Calculating Daily Budgets. The calculation is based on the daily labor budget of a Job, multiplied by the percentage rate in the Taxes and Insurance Type for the Job. The budget is going to be different for each month based on the number of working days for the job in the month.

In order to understand the calculation of the dollar amount of the budget, we will take a closer look at how the budget is calculated for one month. The budget is going to be different for each month based on the number of working days for the job in the month.

The last line in the table below represents the number of working days in the month for each day of the week. Note, Friday has 4 working days instead of 5 because January 1st is considered a holiday by this Job and Holiday hours are not budgeted for this Job.

| July 2009 | ||||||

|---|---|---|---|---|---|---|

|

Sunday |

Monday |

Tuesday |

Wednesday |

Thursday |

Friday |

Saturday |

|

1 |

2 |

3 |

4 |

|||

|

5 |

6 |

7 |

8 |

9 |

10 |

11 |

|

12 |

13 |

14 |

15 |

16 |

17 |

18 |

|

19 |

20 |

21 |

22 |

23 |

24 |

25 |

|

26 |

27 |

28 |

29 |

30 |

31 |

|

|

5 |

4 |

4 |

5 |

5 |

5 |

5 |

Example:

Day Custodian - # of Mondays in the Period X Rate of Pay X Budgeted Hours

4 Mondays X $6.50 X 35 Budgeted Hours = $910.00

|

January 2010 |

|||||||

|---|---|---|---|---|---|---|---|

|

Hours |

Sunday |

Monday |

Tuesday |

Wednesday |

Thursday |

Friday |

Saturday |

|

Day |

910.00 |

910.00 |

910.00 |

910.00 |

910.00 |

||

|

Night Custodian |

300.00 |

750.00 |

750.00 |

750.00 |

750.00 |

750.00 |

300.00 |

|

Supervisory |

340.00 |

272.00 |

272.00 |

272.00 |

272.00 |

272.00 |

340.00 |

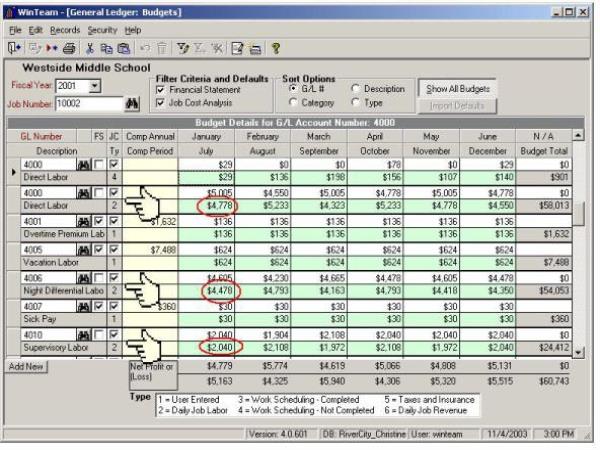

Here is an example of the calculated labor budget for January 2010, as seen in the General Ledger Budgets screen.

You must press the Show All Budgets button to view the monthly budgets.

The Total labor cost for our example of the three Hours Descriptions are designated with Type 2.

The total labor budget for Job 10002 for the month of January 2010 is $11432.00.

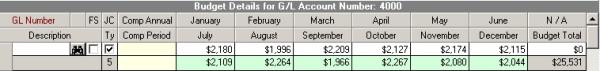

The Taxes and Insurance amount is calculated by taking the total labor dollars times the Taxes and Insurance rate for this job.

The system calculates the total labor dollars as Type 2 (Daily Job Labor) + 3 (Work Scheduling – Completed) + 4 (Work Scheduling – Not Completed). S

Total Labor Dollars X Tax and Insurance Rate = Calculated Taxes and Insurance

| Total Labor Dollars | Tax and Insurance Rate | Calculated Taxes and Insurance |

|---|---|---|

| $11432.00 | 18.45% | $2109.20 |

The system actually stores the above information by each individual day of the month. It then adds the appropriate days together to come up with the calculated total for the month. The amount of the budgeted calculated Taxes and Insurance would be the amount shown on the Job Cost Report and On Screen Job Cost.

If you scroll to the top of the GL Budgets, you will see a Type 5 (Taxes and Insurance) line.

For customers using the Payroll Tax Allocation program, the Payroll Taxes and Insurance are broke out by each tax code and are recalculated every time budgets are calculated or recalculated.