We only create/include one submission file within the Transmission (Request file). If the file is rejected, you must download the error file and fix the errors before creating another original electronic file.

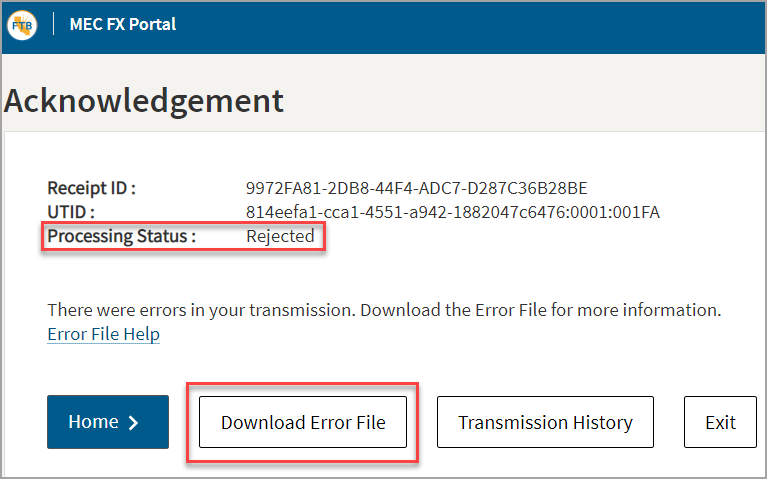

Example of a file rejection:

If the original file is Accepted, but with record-level errors, you must download the resulting error file from the MEC FX Portal website and use that to create your correction file. To create the correction file, do the following:

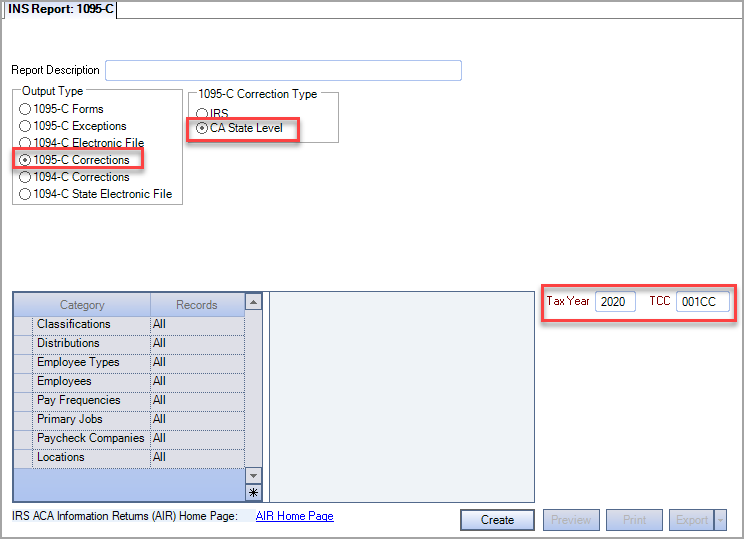

In the INS: Employee 1095-C Report window, do the following:

- Select the 1095-C Corrections output type.

- Select CA State Level as the correction type.

- Enter 2020 for the tax year.

- Enter the CA-TCC that was assigned to you in the TCC field.

- Click Create.

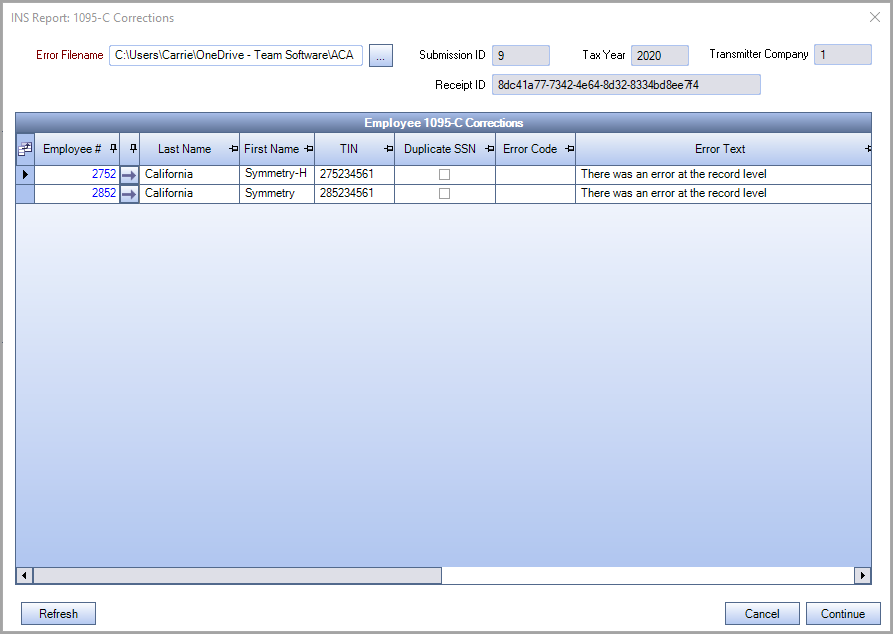

The INS Report 1095-C Corrections window opens. Select the Error file that you downloaded from the MEC FX Portal website. If a matching original file is found in the system (based on the Submission ID in the Error file), the following information is populated/displayed:

- Submission ID–from the original file

- Tax Year–from the original file

- Transmitter Company–from the original file

- Receipt ID–generated by the MEC FX Portal

- A row for each employee record with an error in the original file

Note: An error message displays if the Submission ID and Tax Year do not match or are not found in the database

If you haven't already corrected the employee information, you can drill-down to the employee 1095-C record and make the necessary corrections. Or you can Cancel out, make the corrections, and then start the process again. Once all employee records are corrected, click Continue and select the location to save the file.

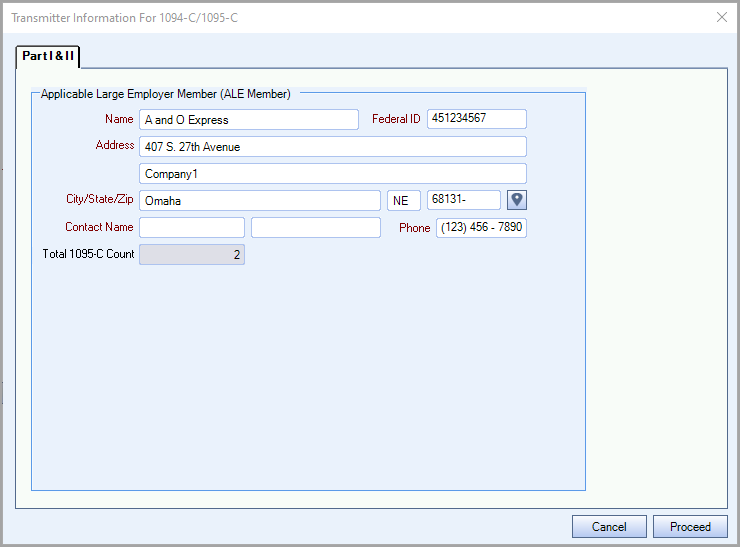

The Transmitter Information For 1094-C/1095-C window is displayed.

Complete the information and click Proceed. The Manifest and Request files are created. Submit to the MEC FX Portal website for acceptance.